F3 Uranium closes $20M placement to advance work at PLN

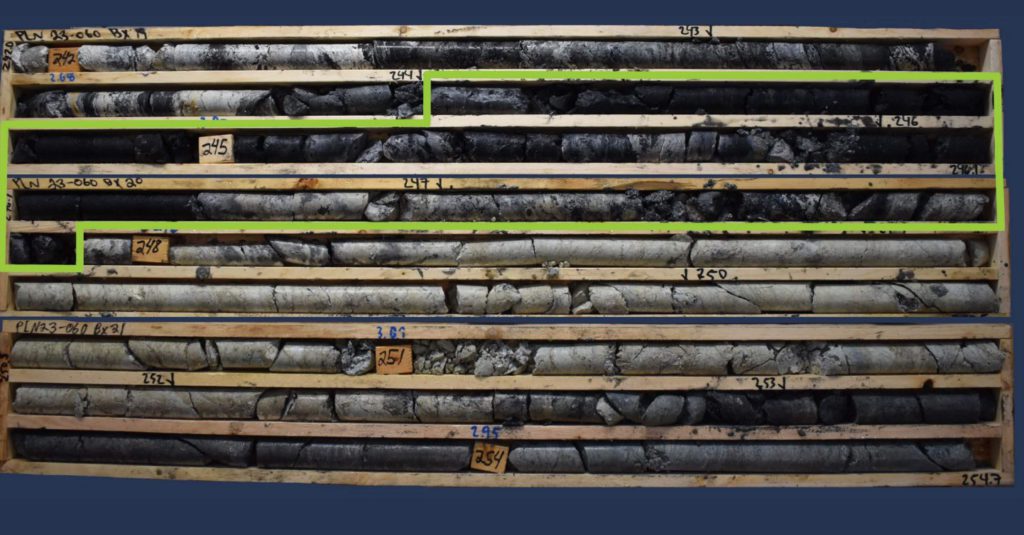

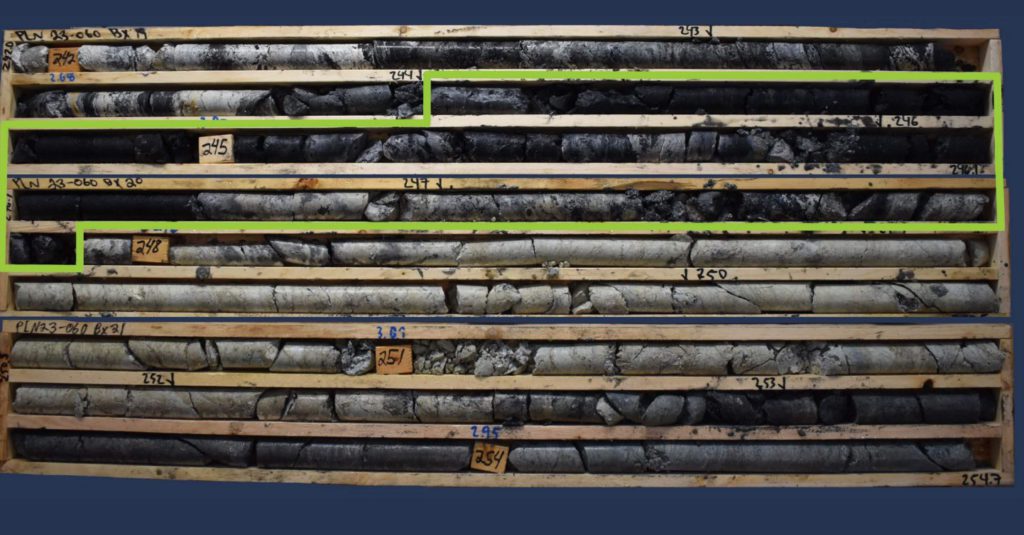

F3 Uranium (TSXV: FUU; OTCQB: FUUFF) closed the oversubscribed private placement of flow-through units, raising a total of $20 million. The funds will be used for exploration in the Athabasca Basin, including the PLN uranium project.

The company issued approximately 41.2 million flow-through units at a cost of $0.485 per unit. Each unit consists of one common shares of F3 issued as a flow-through share and one-half of one share purchase warrant. Each whole warrant will allow the holder to purchase a further common share at a price of $0.485 each.

F3 will pay a cash commission of 2.5% plus issue additional warrants equal to 5.5% of the private placement. The lead underwriter was Red Cloud Securities.

More information on F3’s projects can be found here and at www.F3Uranium.com.

Comments