Donlin Gold drilling returns 14 metres at 23.5+ g/t for partners Barrick, NovaGold

The final drill assays for 2021 continue to return high grades from the Donlin gold project 450 km northwest of Anchorage, Alaska. Five of the best intervals were:

The operating company, Donlin Gold LLC, is an equal partnership of Barrick Gold (TSX: ABX; NYSE: GOLD) and NovaGold Resources (TSX: NG; NYSE: NG). This marks the end of last year’s 79-hole, 24,264 program that produced multiple high-grade intercepts.

The excellent results of the recent program have set the foundation for the largest budget at Donlin in more than a decade. Plans call for spending US$60 million this year. The geological model and interpretation work is designed to prepare an updated feasibility study. About 34,000 metres will be drilled in and below the proposed pit as well as fieldwork and permitting for the Alaska dam safety certifications, environmental studies, and external affairs efforts.

Donlin Gold is working with Native Alaska partners Calista Corp. The Kuskokwim Corp. (TKC), and 20 communities in the Yukon-Kuskokwim (Y-K) delta. Programs in support of health and safety, environmental management, training and education, and cultural initiatives in the Y-K region are all underway.

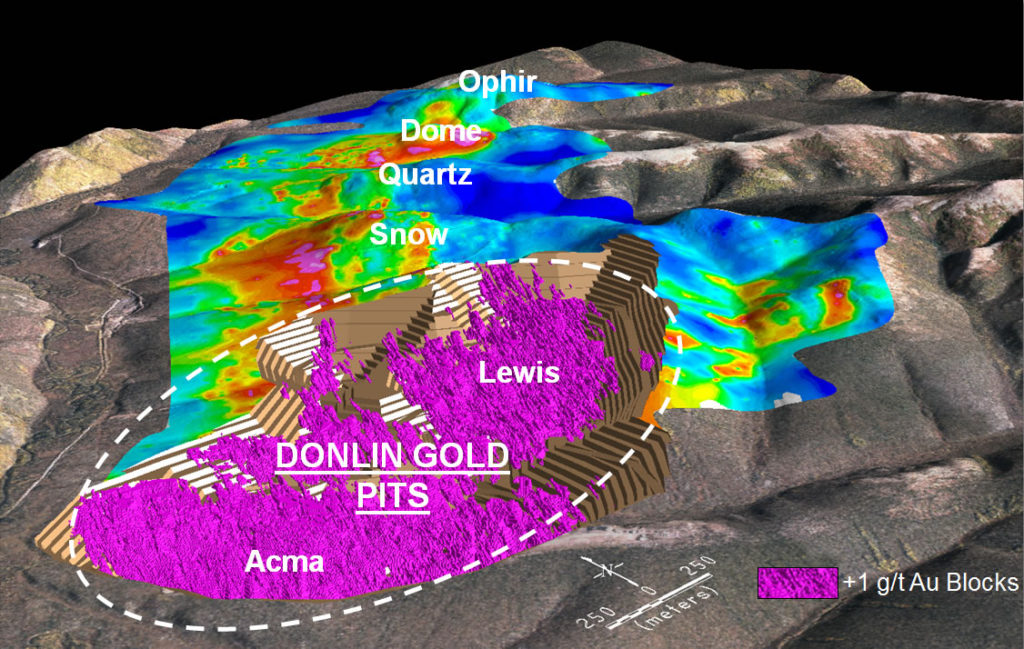

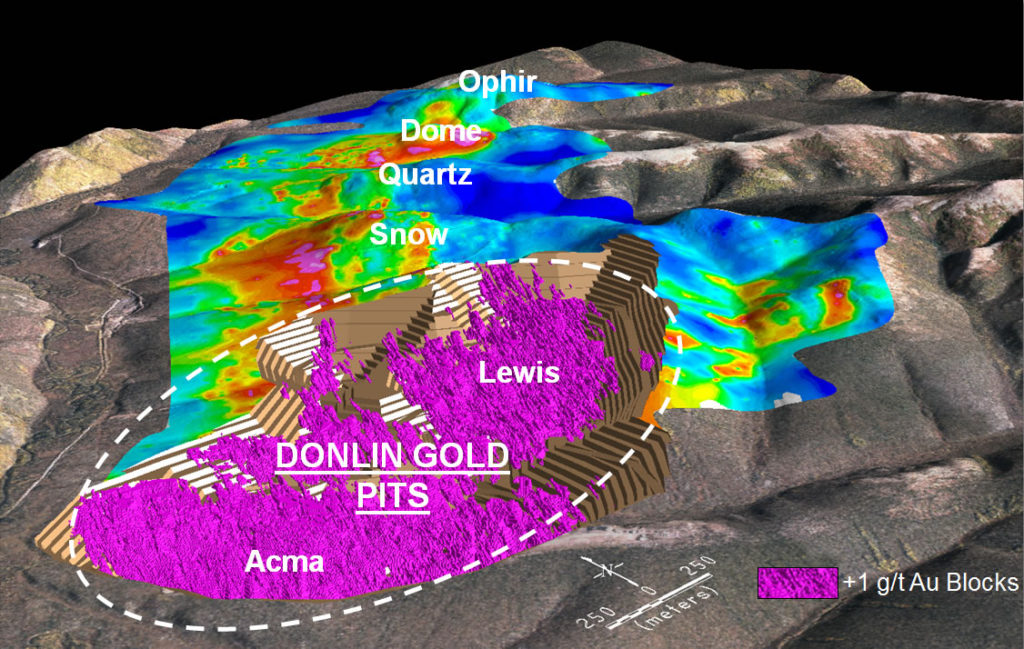

The Donlin deposit is one of the largest and highest grade undeveloped open pit gold projects. Measured and indicated resources total 541.3 million tonnes grading 2.24 g/t gold, containing 39 million oz. The inferred portion is 92.2 million tonnes at 2.02 g/t containing 6 million oz.

Assuming a gold price of US$1,200 per oz., the proven and probable reserves are 504.8 million tonnes grading 2.09 g/t gold, containing 33.8 million ounces.

The total initial capital cost estimate is US$7.4 billion followed by sustaining costs of US$1.7 billion for a mine with a life of 27 years. Over that time more than 30 million oz. gold will be recovered.

The project carries an after-tax net present value at a 5% discount of US$3 billion and an after-tax internal rate of return of 9.2%. Payback would occur after 7.3 years, and total cash flow is estimated at $13.1billion.

Barrick and NovaGold are planning a conventional open pit operation at Donlin. The mill has a planned throughput of 53,500 t/d, and the flowsheet includes semi-autogenous grinding (SAG), two-stage ball milling, flotation, pressure oxidation, cyanidation and carbon-in-leach processes. Expected gold production in the early years will be between 1.4 million and 1.6 million oz., dropping to 800,000 oz./year near the end of mining.

Donlin Gold has completed all the federal permitting requirements and continues to work with state authorities. Alaska has issued permits for air quality, wastewater discharge, pipeline and hazardous materials, fish habitat, as well as for the reclamation and closure of the site. Work continues on obtaining permits for the tailings management facility, dam safety, and environmental approval.

More information and the most recent 43-101 technical report for Donlin are posted at www.NovaGold.com.

Comments