LAS VEGAS –

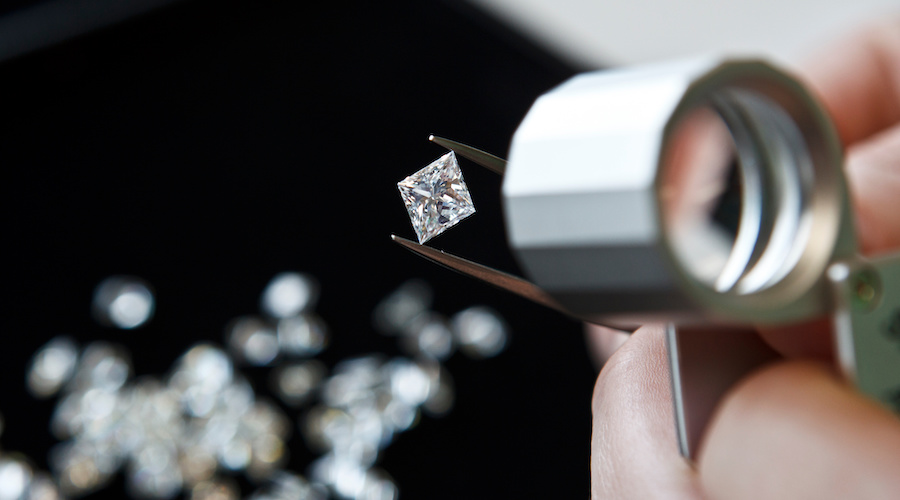

Rapaport published a report stating that the escalation of the U.S.-China trade war, the protests in Hong Kong, and the depreciation of the yuan, paired with dealers taking their summer vacations, greatly impacted the diamond market in August.

According to Rapaport, diamond prices continued to soften, with the RapNet Diamond Index or RAPI for 1-carat gems down 0.4% during the month, 4.3% year-to-date and 6% year-on-year.

RAPI is the average asking price in hundred $/carat of the 10% best priced diamonds, for each of the top 25 quality round diamonds offered for sale on the Rapaport Diamond Trading Network.

For 3-carat diamonds, the RAPI is down 2.1% in August, 15.3% year-to-date, and 18.4% year-on-year.

For 0.50-carat gems, the RAPI went down 0.9% in August, 7.6% year-to-date, and 10.3% year-on-year.

Finally, Rapaport reports that the RAPI for 0.30-carat rocks fell 0.5% in August, 15 % year-to-date, and 21.8% year-on-year.

The international firm said it doesn’t expect sales to improve in September.

“Expectations are low for the Hong Kong fair, which begins on September 16. Suppliers are anticipating weak buyer attendance as demonstrations continue to affect commerce in the city,” the report reads. “Luxury shoppers were put off by the protests as well as the 4% depreciation of the yuan against the dollar in August. The devalued yuan puts additional pressure on diamond prices for local importers.”

Rapaport suggests that the drop in Chinese demand has made it difficult for diamond manufacturers to rebalance their inventory since sales have fallen more than supply in certain categories.

“Manufacturers refused about 50% of De Beers’ supply in August as the miner adopted a more flexible sales policy amid the difficult market conditions.”

For the second month in a row, the diamond market analyst proposed the idea of bringing rough diamond prices down to restore manufacturing profitability.

“Rough sales are expected to be small again in September, with manufacturers limiting their purchases until after Diwali, which begins October 27,” the dossier states. “Inventory levels should go down as U.S. jewelers stock up for the holiday season. The challenge then will be to buy only profitable rough so as to ensure a more viable trade in 2020.”

This story first appeared on www.Mining.com.

Comments