NEW YORK CITY –

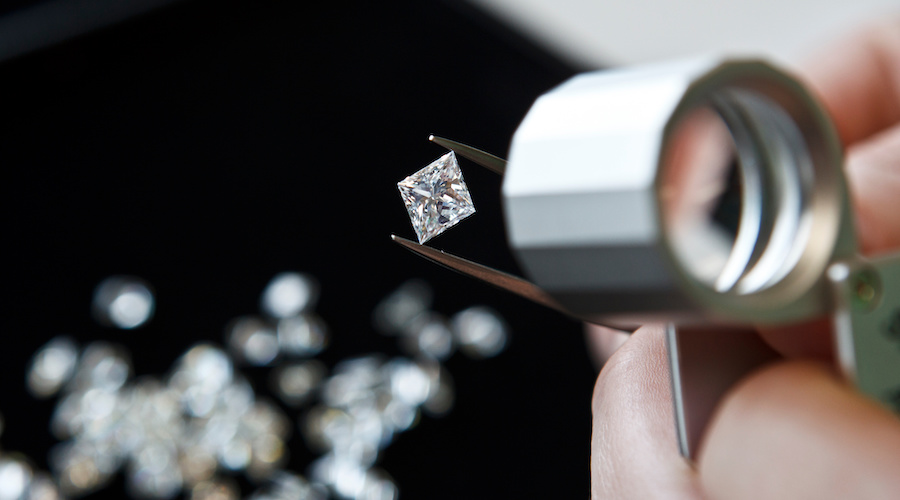

Rapaport published a report stating that diamond markets are under pressure as profit margins have tightened and the trade war with China has fueled uncertainty.

The international firm revealed that the RapNet Diamond Index, known as RAPI, for 1-carat diamonds fell 0.7% in May and is down 1.7% since the beginning of the year.

RAPI is the average asking price in hundred $/carat of the 10% best priced diamonds, for each of the top 25 quality round diamonds offered for sale on the Rapaport Diamond Trading Network.

Stones weighing 3 carats saw the most dramatic change, with a 4% drop in May and a 9.8% drop since the beginning of the year.

To try to boost sales, polished suppliers are offering technology and source verification as a value added service

Diamonds of 0.30 carats sunk by 3.7% in May and 9.4% since the start of the year, while 0.50-carat rocks fell 1.7% last month and 2.9% year to date.

"There is good demand for 0.60- to 1.99-carat, F-J, VS2-I1 diamonds. Buyers are insisting on well-cut stones. Polished below 0.50 carats is slow due to excess supply, weak Chinese demand and tight Indian liquidity," the report reads.

According to Rapaport, this state of affairs has pushed cutters to operate at lower capacity as they try to reduce inflated inventory, while manufacturers are rejecting high priced rough stones that have made polished production unprofitable.

"De Beers and Alrosa are carefully managing production and price levels amid this year’s slow rough demand," the document states.

In the view of the firm's chairman, Martin Rapaport, if the trade does not change its business practices and adapt to new realities, the diamond industry will suffer "extreme financial and regulatory disruption."

This story first appeared on www.Mining.com.

Comments