De Beers aims to rebrand as top jewellery group

De Beers, the world’s largest diamond producer by value that parent company Anglo American has put up for sale, has launched a wide-ranging, five-year strategy to reposition itself in the market as the top jewellery group.

The miner already sells diamond jewellery in retail stores worldwide through its boutiques, but chief executive Al Cook intends to increase the number of outlets in order to compete with profitable luxury brands such as Tiffany and Cartier.

“If I look at the future of diamonds, it is way beyond mining,” Cook told the Financial Times. “I’m really excited by the idea that we can really deploy our full strategy all the way to creating the world’s greatest jewellery maison [house], which would not be a natural part of a mining company.”

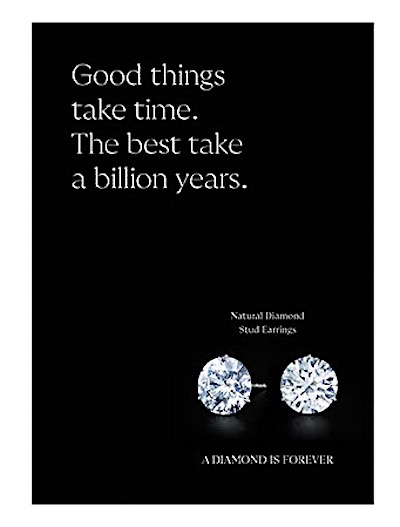

De Beers has a history of driving increased demand for mined diamonds and its “Origins” strategy seeks to do exactly that, with an emphasis on appealing to a new generation of consumers.

The plan will involve revitalizing category marketing to boost interest for diamonds, as well as utilizing innovative methods to maximize reach and impact, the company said.

De Beers, which coined the slogan “Diamonds are Forever”, is also ditching man-made stones. This means it would end a six-year experiment to sell lab-grown diamond jewellery through its own brand, Lightbox, created in 2018.

While the miner is not halting the sale of its Lightbox stones right away, it will begin thinking of what to do with the unit once it depletes current inventory, which will take about a year.

Collaborating with retailers will be crucial to this new approach, De Beers said. The successful Seize the Day pilot campaign, launched in September 2023, proved this point as it received support from over 22,000 retail stores.

De Beers next step is to develop strategic partnerships with major retailers, such as the collaboration with Signet Jewelers in the United States, and a partnership with Chow Tai Fook in China.

De Beers already owns the Forevermark diamond brand, which it is sold through more than 2,400 jewellery retail stores. De Beers has also launched dedicated outlets in 16 different markets, including one on Madison Avenue in New York City and in the Houston Galleria. It also has the De Beers Jewellers website.

Diamond miners large and small have faced challenges in the past two years as a result of increasing consumer preference for cheaper, lab-grown diamonds, along with instability in the global economy.

Consumer demand for diamonds was off in both China and the US last year, which accounts for about half of the global diamond jewellery market, according to the World Diamond Council.

De Beers in January made one of the steepest cuts to its diamond prices in years, lowering them about 10%, in an attempt to revive sales after the market ground to a halt. Market insiders said at the time the diamond miner had made even bigger price reductions for some larger stones, with one category being lowered 25%.

It also took measures regarding output. In April, it revised down its full-year production forecast to 26 million to 29 million carats from the previously guided 29 million to 32 million. The company, which in February announced a $1.6 billion writedown, also lifted expected average costs to $90 per carat, from $80.

De Beers is targeting annual core profit of $1.5 billion by 2028. Last year, the business made just $72 million, though traditionally its profits have ranged between $500 million and $1.5 billion as the diamond industry swings from boom to bust.

The diamond miner seems ready to fly alone as it did for 124 of its 136 years of existence. Anglo American only acquired a 85% stake in De Beers in 2011. The government of Botswana holds the remaining shares.

Comments