CRU unveils top 10 sustainability predictions for commodities in 2024

Global mining and metals sector consultancy CRU has released its top 10 sustainability predictions for commodity markets in 2024, covering topics that were already hot this year. These include reporting standards, nature conservation, climate action, carbon pricing and critical raw materials.

Here is a summary of what CRU analysts expect for 2024:

1. Reporting: As reporting pressures increase, companies need to prepare for a range of new and expanded reporting requirements both in scope and quantity.

CRU warns that standards are increasingly overlapping, which mean that transition planning is critical to navigate policy uncertainty and liability risk.

There are increasingly significant risks for organizations or supply chains that operate across multiple jurisdictions. For policy makers, the more standards diverge, the more they could raise costs and create reporting fatigue, the analysts say.

2. Biodiversity pledges gain traction: Businesses will increasingly need to begin to monitor and prepare for legislation on nature and biodiversity.

The Taskforce on Nature-related Financial Disclosures (TNFD), a market-led, science-based and government-backed initiative, published its final recommendation in September. The aim of this non-legally binding framework is to provide organizations with the structure to integrate science-based targets for nature into decision-making.

3. Polarized views on need and speed of climate action: Businesses will face increased scrutiny and risk as the effects of climate change intensify, CRU says. However, the speed of required action is not set. Political resolve will ebb and flow even if the trend is clear.

In some countries, like the US, the outcome of scheduled elections will matter significantly for environmental policy, the analysts said. Irrespective of the outcome, they note, some parts of the Inflation Reduction Act (IRA) will be harder to unwind than others.

4. Incentivizing emission reductions: All commodity markets will be transformed by the spread of higher carbon prices. Understanding carbon pricing is and will continue to be vital as its role in driving emission cuts will grow internationally.

5. The race for critical raw materials will intensify: Critical mineral baskets are dynamic across both regions and time. For example, the US Energy Department ranks copper as “not critical” for the short term and “near critical” for the medium term, as demand from electrification and renewable energy sectors grows faster than supply.

6. Greater focus on Scope 3 emissions: Indirect emissions through the value chain, or Scope 3 emissions, will be the subject of increased attention from regulators, investors and consumers in 2024. CRU believes that companies will need to measure, report and reduce their Scope 3 emissions to maintain their social license to operate and access capital markets.

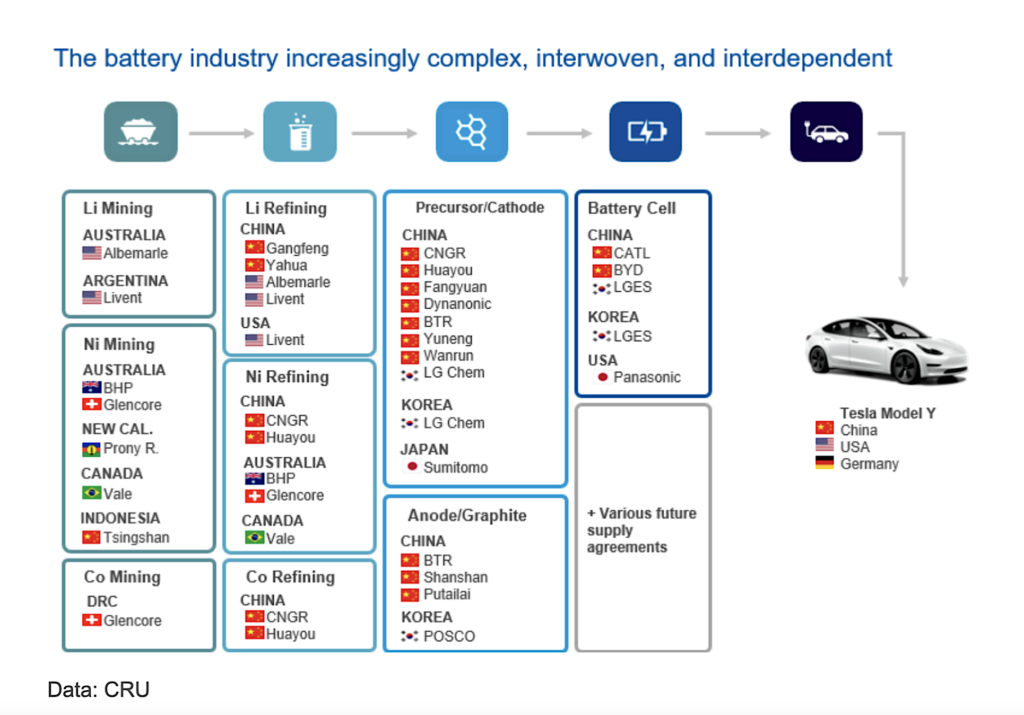

7. Supply chains are changing: Supply chains are in a period of significant change, with regionalization growing as a trend. Europe and the North American market are good examples of this phenomenon. As supply chain sustainability and resilience come under greater scrutiny, there is likely to be a shift towards greater self-sufficiency, and diversification, CRU says. This could create new opportunities for local suppliers and manufacturers but may also lead to higher costs and reduced efficiency.

8. Electric vehicle sales continue to grow: During 2023, EV sales grew less than expected, but proved resilient against macroeconomic headwinds in all markets. Globally, just over 12% of light vehicle sales in 2023 were battery electric vehicles (BEVs). CRU expects this share to jump to over 16% next year. By 2025, one in five new car sales will be BEVs and the consultancy forecasts penetration rates approaching 50% in 2030.

9. Renewable capacity grows, energy storage receives more attention: This year saw a notable increase in renewable energy installations, with over 500 GWs of solar and wind capacity installed, with huge increases in Chinese deployment of solar. CRU forecasts 2024 will see double digit percentage growth on this. However, in some regions, such as Europe, planning laws, labour shortages, higher financing costs are holding back deployment.

10. Continued excitement surrounding new technologies: The interest in low-carbon technologies will will keep increasing, with green hydrogen and ammonia, carbon capture and storage (CCS) and small modular reactors (SMRs) likely to receive much of the market’s attention in 2024.

CRU believes, despite technological improvements and falling costs, there is not a panacea to solve decarbonization. These technologies will, nearly always, require significant policy support or high carbon prices to be cost competitive compared to traditional, fossil alternatives.

The EU, Japan and Australia are just three regions where policymakers are pushing green hydrogen production by offering financial incentives. Many solutions still need to be proven at commercial levels.

THIS ARTICLE WAS ORIGINALLY POSTED ON MINING.COM

Comments