Climate targets threatened by lack of mining investment: McKinsey

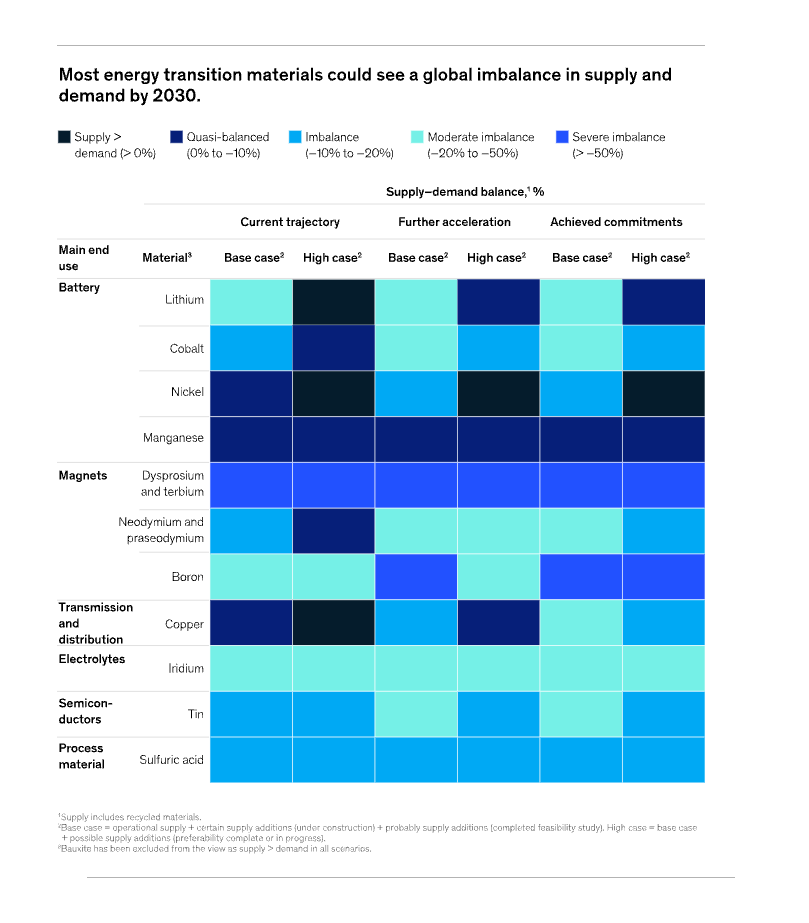

Soaring demand for metals and minerals needed to achieve a 45% reduction in global emissions by 2030, paired with low commodity prices driving investors and mining firms to cut spending are set to cause major shortages of key elements for the world’s energy transition, a new report shows.

According to consultancy McKinsey & Company, looming supply gaps for rare earths, lithium, nickel, graphite, cobalt, boron and copper could lead to higher prices and market volatility, hindering emissions goals.

To keep global warming to no more than 1.5°C, as set up by the Paris Agreement in 2015, emissions need to be reduced by 45% by 2030 and reach net zero by 2050.

The analysis, published on Wednesday, forecasts shortages of 20% to 50% across some rare-earth metals and minerals essential for renewables, power grids and EV batteries. The message is as clear it is old: the world needs mining.

It is anticipated that EV batteries and chargers alone may consume over 50% of all available cobalt and rare-earth elements and 36% of nickel resources by 2030.

The number of the roughly 500 cobalt, copper, lithium and nickel mines operating today will need to increase by as much as 76% to almost 900 in order to meet demand for batteries, the analysts wrote.

McKinsey’s report highlights that recycling could only account for 10% of supply for minerals such as copper, lithium, and nickel by 2040 and potential substitute materials are still nascent.

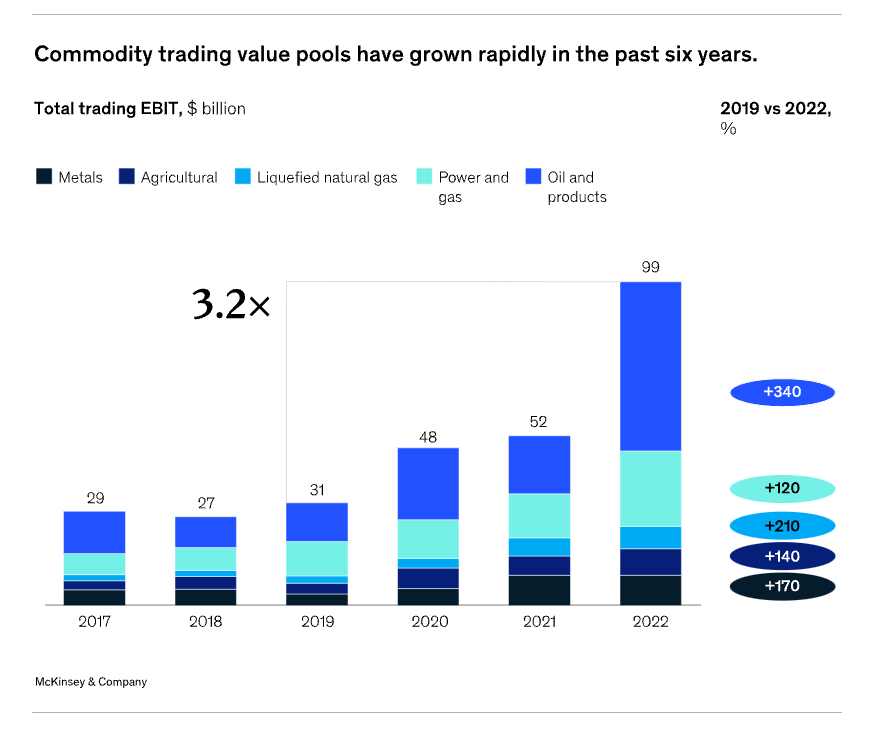

The consultancy also reveals how increasing demand for those materials is creating a trading opportunity, with a more than 170% growth in commodity trading value pools for metals in just three years.

“Our analysis shows commodity trading pools have nearly doubled year over year, reaching nearly $100 billion in 2022 and metals and minerals will make up an increasing share of the value pool in the coming years,” Roland Rechtsteiner, partner at McKinsey, said.

Yet investors are currently reducing funding for new mining projects due to low commodities prices and long lead times for new mines, exacerbating supply chain shortages for green technologies, he noted.

One of the reasons that could explain this trend, associate partner at McKinsey Spencer Holmes said, is several proposed mines involve new technologies or inexperienced companies. There also are environmental, social, governance (ESG) and permitting barriers, he said.

McKinsey suggests three paths to help companies shore up their positions and find new opportunities.

Large energy firms could help address the renewable supply chain shortage at source by expanding into metals and minerals.

Traders could accelerate development by pre-financing junior mines and helping producers gain access to markets.

Metals and minerals producers, in turn, could encourage long-term supply deals to pre-finance projects.

McKinsey’s analysis echoes a growing list of reports highlighting the need for increased investment in critical minerals and in technologies that allow the recovery of commodities from existing products, such as recycling.

THIS ARTICLE WAS ORIGINALLY PUBLISHED ON MINING.COM

Comments