Chile to negotiate with lithium partners on case by case basis — minister

A decision by Chile, the world’s no. 2 lithium producer, to tighten control over the key battery metal sector has triggered speculation on what the announced state-led public-private model will look like and how it may affect the global industry.

To address market rumours and clarify aspects of the strategy described by some as “vague”, MINING.COM spoke with Chile’s mining minister Marcela Hernando, who noted the country had announced a strategy, rather than a policy.

“It will become a public policy when it has legitimacy and it is supported by all the political forces of the country,” Hernando said.

Reaching the point of public policy, which includes the creation of a national lithium company (Enal), could take years.

President Gabriel Boric has, in the interim, enlisted two other state-owned companies — Codelco, the world’s largest copper producer, and state miner Enami — to determine how the private-public partnerships will operate.

Codelco will be initially in charge of negotiating for the state a stake in Albemarle’s and SQM’s operations. Enami, in turn, will sign up partners for new contracts. Their roles will be eventually undertaken by a national lithium company.

The Chilean state has always played a major role in the mining industry. A 1979 law declared lithium to be a strategic resource, stipulating that its development was the exclusive prerogative of the nation.

Only SQM and Albemarle are currently licensed to produce lithium in the country, and in only one salt flat — the Atacama. The government wants to expand production both in Atacama and in any or all of the other 18 salt flats that have been identified.

The minister explained that the government will only seek control of the operation — via different mechanisms, not just majority participation — in projects that are considered strategic.

Currently, the only strategic lithium area is the Atacama salt flat, Hernando said. In the others, each company will negotiate with representatives of either Enami or Codelco. The result of such negotiations will be presented to a committee integrated by the ministers of mining, finance, economy and environment, the vice presidency of the development office — Corfo — and the country’s President.

Hernando said the new lithium strategy contemplates three options of public-private partnership.

In the first one, Codelco or Enami would conduct prospecting and then negotiate the terms of development with interested parties.

The second modality will see the state partnering with a private company for the exploration stage and will negotiate the next phase with that particular company.

The last option is for the government to grant exploration licences directly to private companies and evaluate results they present.

“Our strategy seeks to help the country create an ecosystem in which more value is added to its lithium industry, especially around issues [such] as technology transfer and worker training,” Hernando said.

According to official figures, around 50 interested parties, including companies and countries, have already approached Chilean authorities to express their interest in participating in the lithium business — including China and Canada.

The country’s Minister of Economy, Nicolás Grau, told MINING.COM that Chile’s lithium policy does not give preference to any country. Rather, it opens the possibility of exploring new salt flats to any interested company.

“The conversations we have had in recent weeks make us think that when the exploration permits begin to be tendered, offers will come from companies from a variety of countries. We want to promote that diversity,” Grau said.

The minister noted that potential partners have applauded the government’s initiative as its sets up a mechanism for their entry into the Chilean lithium market, which did not exist until the policy announcement in late April.

“Something that has been highlighted is that the environmental requirements the government is putting in place are in line with the growing demands of buyers and society in general,” Grau said.

“This will give projects developed in Chile better prospects in terms of social license and acceptance of their production in international markets,” he noted.

The government will create a public research institute to develop new refining technologies, and institute lithium waste and battery recycling.

While Boric’s plan relies on the wide scale deployment of direct lithium extraction (DLE) technologies, both ministers said the state will not impose technological choices on private companies.

“Rather, we will regulate to achieve desired outcomes having into account the surrounding biodiversity,” Hernando said.

The long-term plan is to consolidate areas of oversight currently held by different public institutions, with some authorizing sales quotas and water use, under the mandates of a state-run lithium company.

While some experts reacted negatively to Chile’s new strategy, the majority of those interviewed said the announcement brings an end to a long period of uncertainty for the sector.

Strategic lawyer and business advisor at Canada’s McCarthy Tétrault, Shawn Doyle, considers the policy a rather positive turn of events for private capital keen to invest in the battery metal.

“It must be remembered that, as a result of policy paralysis, Chile has been effectively closed to new private investment in lithium for decades,” Doyle said.

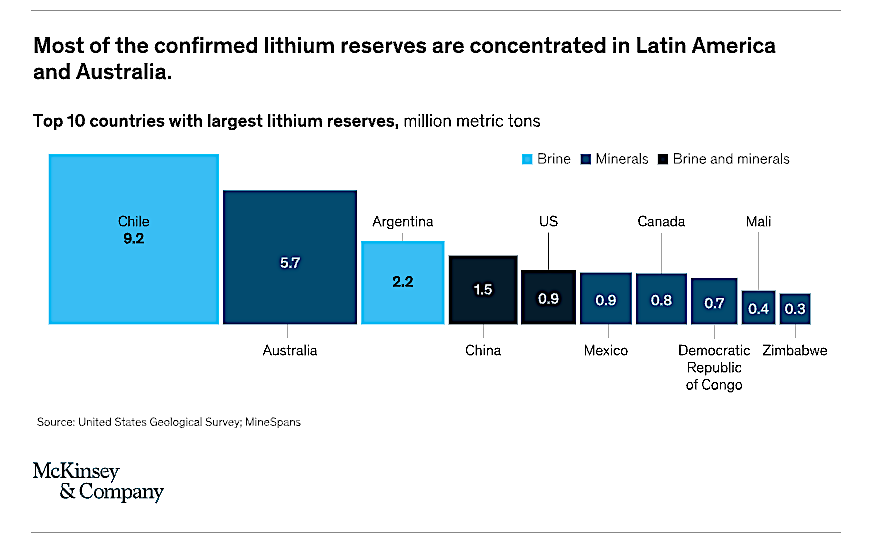

Analysts from Fastmarkets believe that, if Chile fails to capitalize on the lithium boom, it would fall from the world’s second-largest lithium producer last year to fourth in 2030 after China, Australia and Argentina. They forecast the country’s share of production would shrink from almost a third to 12%.

Global demand for lithium, according to the government’s projections, will quadruple by 2030, reaching 1.8 million tonnes. Available supply by then is expected to sit at 1.5 million tonnes.

The country’s strategic Atacama region, which is also home to vast copper mines, supplies nearly one-quarter of the globe’s lithium.

World output of lithium carbonate equivalent (LCE) was 737,000 tonnes in 2022. It is estimated to reach 964,000 tonnes this year and 1,167,000 tonnes in 2024, according to the Resources and Energy Quarterly Report by the Australian Department of Industry, Science and Resources in March.

Comments