Canadian group led by Lassonde plans to buy Teck’s coal mines

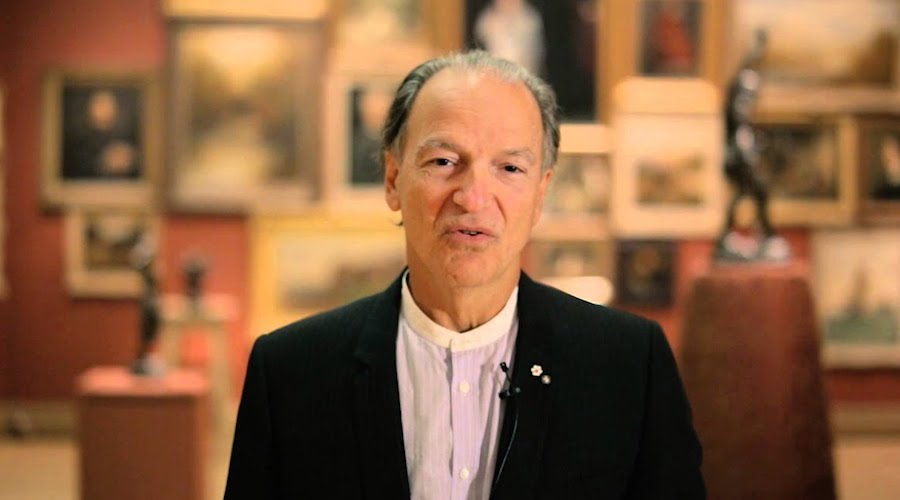

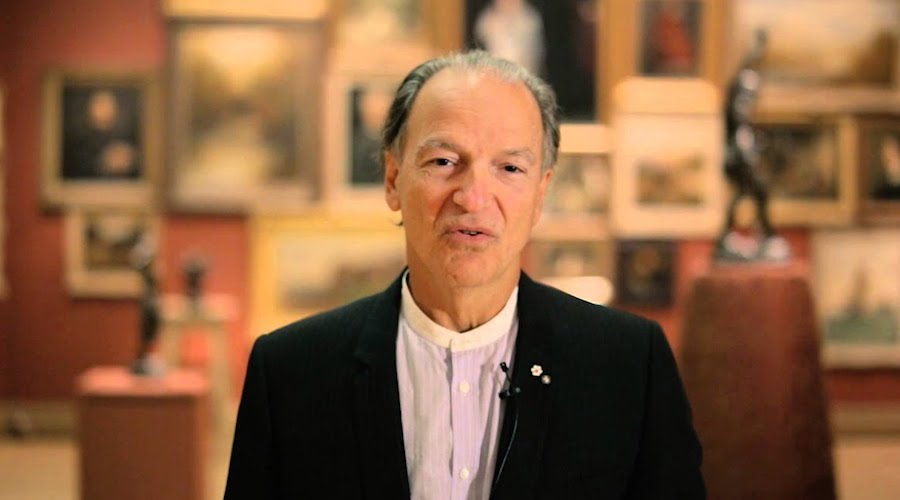

Shares in Teck Resources (TSX:TECK.A, TECK.B; NYSE:TECK), Canada’s largest diversified miner, jumped on Tuesday on news that a consortium led by mining veteran Pierre Lassonde had proposed to buy the company's coal operations.

The move, reported by the Globe and Mail, could prevent Glencore from acquiring the Vancouver-based mining giant, which in April rejected an unsolicited takeover offer of $23 billion from the Swiss miner and commodities trader.

Glencore has made it clear it would not back down and said it remained interested after Teck’s restructuring proposal was taken off the table.

"Teck wants to move forward, we've been told very definitively," Lassonde told the paper. "For them, it's a question of consulting their bankers and consulting other groups. We're told that they want to get something done between eight to 12 weeks.”

New York-traded shares of Teck were up 4.2% midday at $46.65 each. Class B shares climbed 5.5% to C$62.5, while Class A were changing hands at C$103.67 each or 5.4% higher.

The Canadian businessman and philanthropist will need the backing of Teck's existing coal joint venture steelmaking partners, Japan’s Nippon Steel and South Korea's Posco, for his proposal to succeed.

In the interview with the Globe, Lassonde said he was optimistic that both companies would back his proposal.

The possibility of Teck being swallowed by Glencore has become a broader political issue.

The Federal government has expressed that any takeover offer for Teck will have to go through a “rigorous process” to win government approval.

Other than Prime Minister Justin Trudeau, Finance Minister Chrystia Freeland, Industry Minister François-Philippe Champagne, Natural Resources Minster Jonathan Wilkinson and British Columbia Premier David Eby have all weighed on the issue.

Large-scale mining takeovers are a sensitive topic in Canada since a wave of acquisitions more than 15 years ago eliminated many of the sector’s biggest players, including nickel miner Inco and aluminum producer Alcan.

When BHP attempted to buy of Potash Corp. of Saskatchewan in 2010, the government of then-Prime Minister Stephen Harper blocked the deal on the grounds that it would not be of “net benefit” to the country.

(With files from Bloomberg and Reuters)

Comments