Canada’s capex raising credentials remain a siren call for mine developers

For more than a century, Canada has been the global leader in capital formation for the mineral exploration and development industry. However, in the wake of modern demand for niche technology minerals, a general underperformance in mining equities and dwindling investor interest, the mining finance sector needs to innovate to help keep its participants engaged and keep them from considering listings elsewhere.

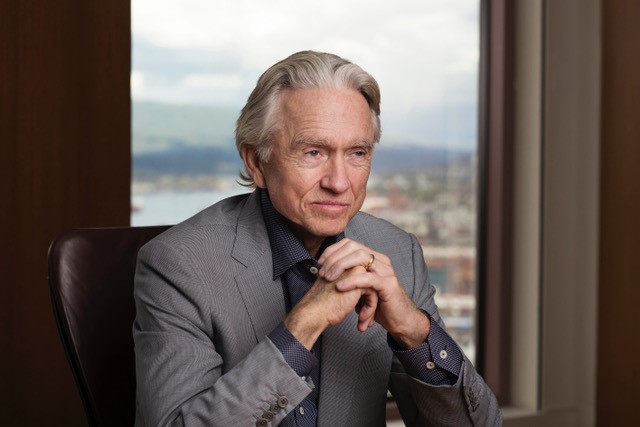

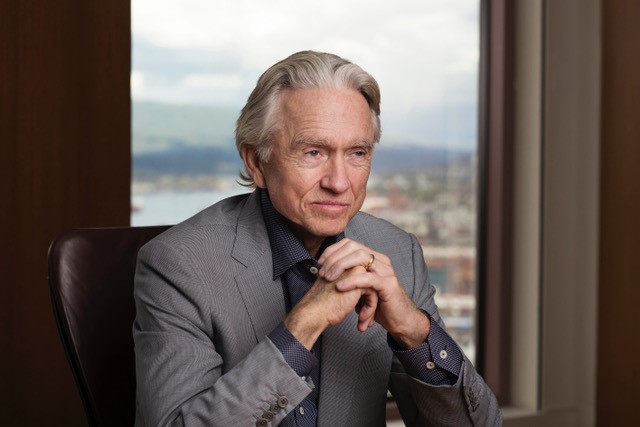

During The Northern Miner's recent Global Mining Symposium, industry veteran Ian Telfer said Canada had a strong track record of conducting mine finance based on a proud history of discovery success. It had prompted investors to develop a penchant for high-risk investments.

"This really started with some of the bigger deposits found 100 years ago in Kirkland Lake and in parts of British Columbia that showed the world that Canada had the resources and the expertise to develop these deposits and create value for shareholders and employees," he said.

"And from then it went on to become very much a Vancouver-based junior market that was very successful in the 1960s and 70s, and 80s and 90s, raising money for junior companies. And it was this willingness to put up money at high risk that differentiated Canada as a source for funding."

Telfer added that events such as the Bre-X scandal of the 1990s helped refine the market by improving regulations forcing the companies to become more responsible. "Corporate governance is a much bigger issue now, and so, I hope that Bre-X-type scandals are behind us," said Telfer.

Comments