BHP to spend up to $14 billion in Chilean copper expansion

BHP (ASX: BHP) has outlined its ambitious plans to boost copper production in Chile, aiming to increase output by 430,000 to 540,000 tonnes per annum (tpa) based on its current operations, but the world’s largest miner is also looking into new projects.

Speaking to investors and journalists gathered in a Chile tour this week, BHP’s Brandon Craig, President Minerals Americas, said the company’s long-term production is projected to stabilize at around 1.4 million tonnes per annum (Mtpa), a modest increase of 100,000 tonnes from current levels.

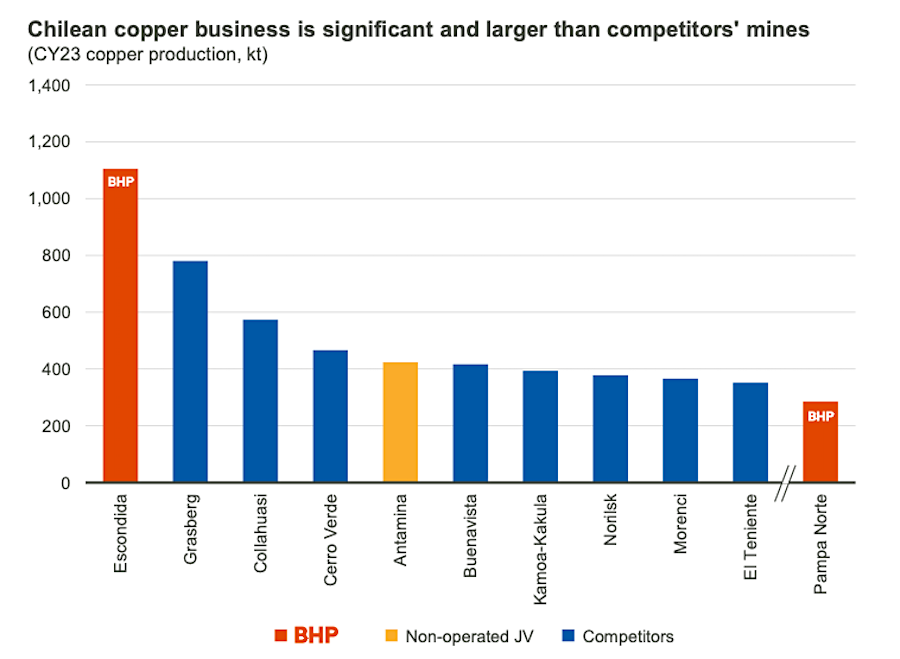

BHP, which owns and operates the giant Escondida copper mine in Chile, said the company will need to invest between $10 and $14 billion at a capital intensity of $23,000 per tonne of copper equivalent (CuEq) to achieve its growth plans.

At Escondida, the world’s largest copper mine, BHP plans to invest between $7.3 billion and $9.8 billion in new projects starting from 2028. These initiatives aim to offset ore grade declines and the upcoming closure of the Los Colorados plant.

One BHP’s major projects is the construction of a new concentrator, which is expected to produce between 220,000 and 260,000 tonnes per annum from 2031/32, with an estimated capital expenditure of $4.4 billion to $5.9 billion. The The company is also planning an expansion at Laguna Seca, which aims to boost production by 50,000 to 70,000 tpa from 2030/31, requiring an investment of $2 billion to $2.6 billion.

New planned leaching facilities are anticipated to contribute an additional 35,000 to 55,000 tpa from 2030/32 onwards, with a projected capital expenditure of $0.9 billion to $1.3 billion.

BHP, which has operated in Chile for over 30 years, said the Los Colorados facility will continue operating until fiscal year 2029, sustaining output of 130-145ktpa before its scheduled shutdown.

The mining giant is also allocating $2.8-3.9 billion for Pampa Norte, a division that includes two main copper mines — Spence and Cerro Colorado — where BHP wants to increase production by 125-155ktpa. A significant portion of this will come from restarting the Cerro Colorado mine, utilizing supergene leaching to deliver 85-100ktpa.

BMO metals and mining analyst Alexander Pearce, said that the total copper BHP plans to add with the projects outlined is probably higher than what the market expected. “Capex intensity, however, is lower than some feared, and much of this is in effect sustaining capital to offset grade decline,” he wrote on wrote on a note to investors on Tuesday.

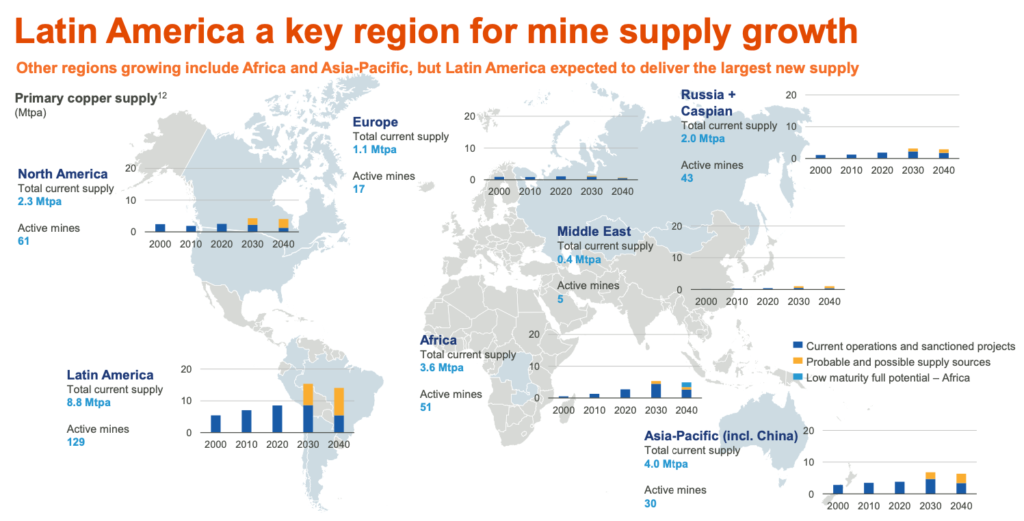

BHP expects global copper demand to continue soaring, with global copper consumption jumping by an additional 1 million tonnes a year on average, until 2035.

Market consensus points to a rise in demand for the metal of about 70% through to 2050, as a result of the global transition to renewable energy and the increasing adoption of electric vehicles (EVs). Both require substantial amounts of copper for wiring and components.

BHP projects as a result that $250 billion in investments will be necessary over the next decade to meet this demand, likely driving further mergers and acquisitions in the industry.

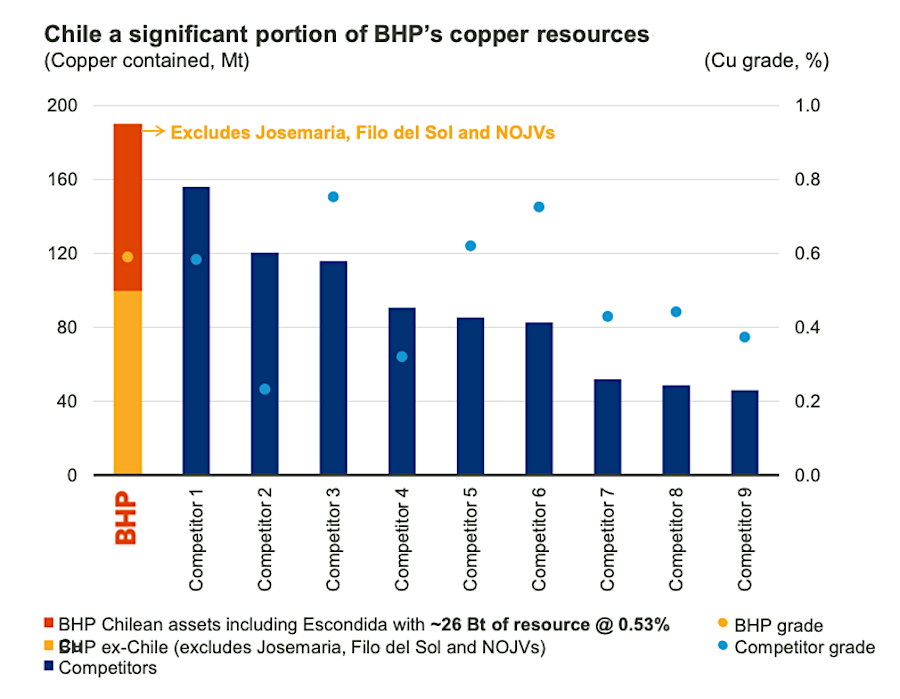

Chile is the largest copper producer globally, accounting for 28% of the world’s supply on an annual basis. BHP’s operations, particularly its Escondida mine, are crucial for the nation’s top position — it is estimated that about 27% of Chile’s copper production comes from BHP-owned mines.

Since 1990, BHP has produced an impressive 38 million tonnes of copper in the South American country, accounting for over 7% of global copper mine production.

BHP has been trying to secure new copper supply as its annual production of the metal is projected to decline by around 300,000 tonnes, reaching 1.6 million tonnes by the end of the decade.

Its operations in Chile ares also key for the nation’s economy. The company estimates that it will contribute $9.4 billion to Chile’s economy by the end of the fiscal year 2024.

Analysts suggest that acquiring Anglo American (LON: AAL), which BHP tried but failed to accomplish earlier this tear, remains the miner’s best near-term option for increasing copper production. The takeover, they argue, would enable it to benefit from operational synergies in Chile.

Under UK takeover laws, BHP has to wait at least six months before it can consider another tilt for Anglo, a period which expires at the end of this month.

The company has succeeded in securing copper assets in other South American countries, It acquired a stake in Filo Corp. (TSX: FIL) in July, partnering with Lundin Mining (TSX: LUN) in a $3 billion transaction.

Comments