BHP projects copper demand to rise by 1 million tonnes annually until 2035

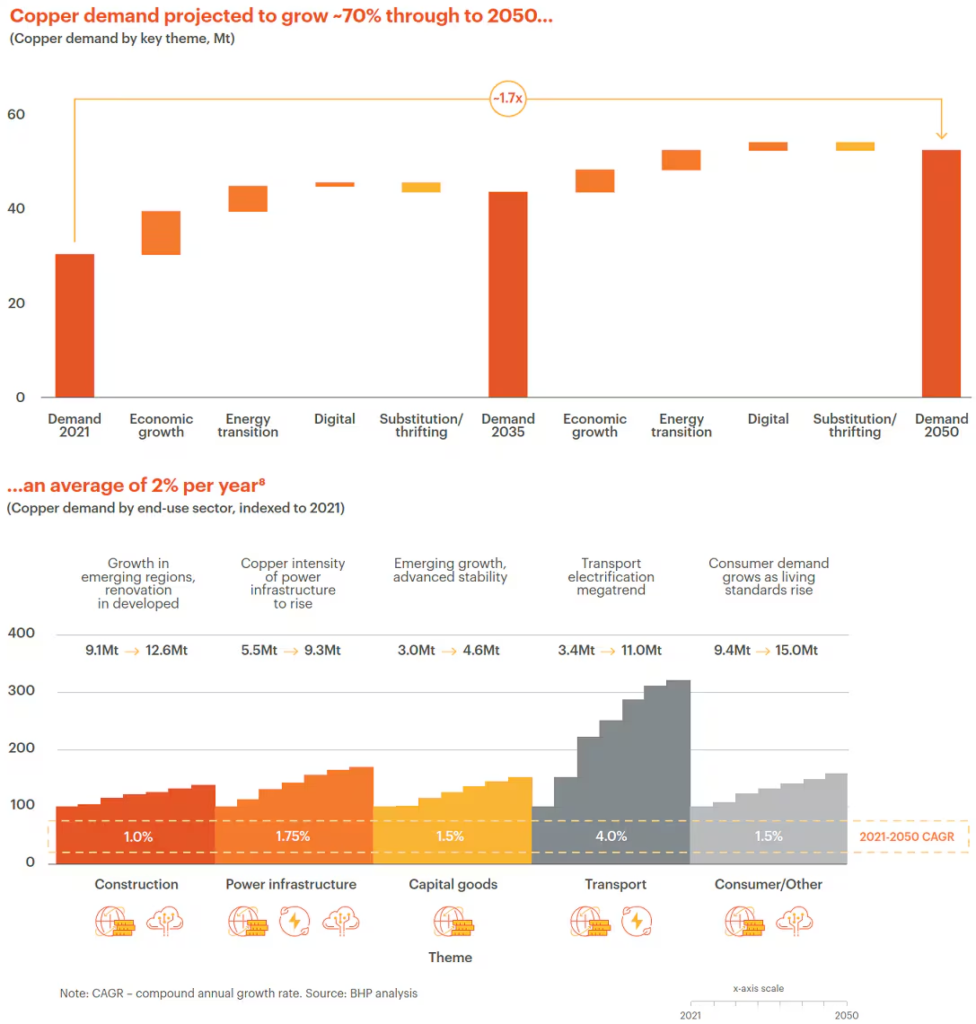

BHP (ASX, NYSE: BHP) projects that global copper consumption will increase by an additional 1 million tonnes annually, on average, until 2035. This is largely due to the adoption of copper-intensive technologies, doubling the growth rate seen over the past 15 years.

In a report released on Monday, the mining giant noted that global copper demand has historically grown at a compound annual rate of 3.1% over the last 75 years. However, the growth rate slowed to 1.9% in the 15 years leading up to 2021.

“Looking ahead to 2035, we anticipate this growth rate to rise again to 2.6% annually,” the report stated.

In 2023, total copper demand reached 31 million tonnes, comprising 25 million tonnes of copper cathode and 6 million tonnes of copper scrap.

“As we look towards 2050, we foresee global copper demand increasing by 70% to reach 50 million tonnes annually. This will be driven by copper’s role in both current and emerging technologies, as well as the world’s decarbonization goals,” said BHP’s Chief Commercial Officer Rag Udd.

The company expects that by 2050, the energy transition sector will represent 23% of copper demand, up from the current 7%. The digital sector, which includes data centers, 5G, artificial intelligence, the internet of things, and blockchain, is projected to account for 6% of copper demand, up from 1% today.

“As the energy transition unfolds, we anticipate the roll-out of EVs to lift the transport sector’s share of total copper demand from around 11% in 2021, to over 20% by 2040. We expect global electricity consumption for data centers to rise from around 2% of global demand today, to 9% by 2050, with copper demand in data centers increasing six-fold by 2050,” said the miner.

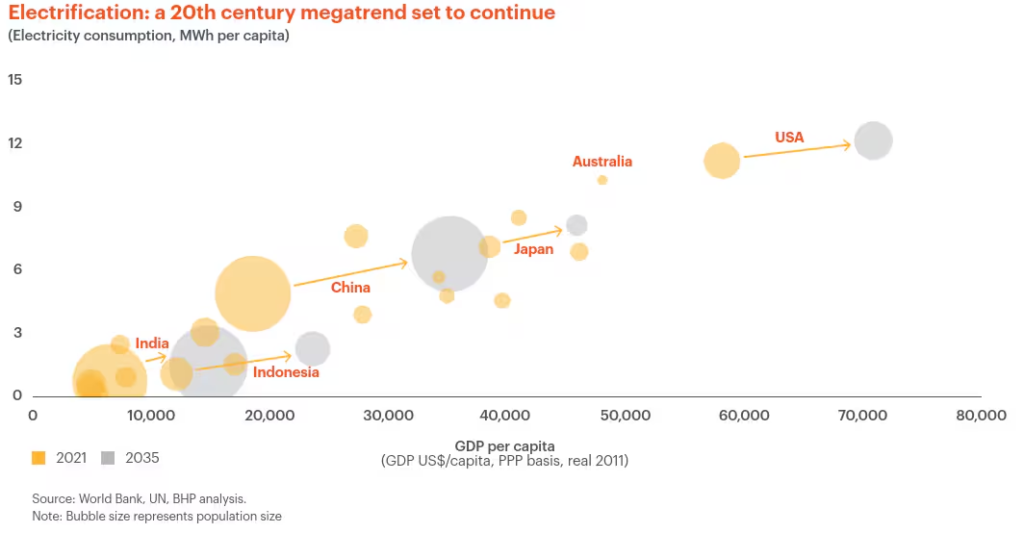

While China’s copper demand is expected to continue growing, it will do so at a slower pace, as the country’s copper consumption per capita remains about half that of developed nations. India is also expected to see increasing demand.

“India’s electricity consumption per capita currently stands at around one-seventh of Japan’s and one-fifth of China’s, and we expect its copper demand to grow five-fold over its pre-Covid volumes in the coming decades as electricity is made more accessible,”

On the supply side, copper mining faces challenges due to rising costs and declining ore grades.

“We estimate that the average copper mine grade has decreased by approximately 40% since 1991. We expect between one-third and one-half of global copper supply to face grade decline and aging challenges in the next decade,” BHP said.

The company estimates that $250 billion in investment will be required over the next decade to address the widening gap between copper supply and demand.

Comments