Battery pack prices fall but commodity boom may drive them back up – report

A new report by BloombergNEF shows that lithium-ion battery pack prices fell 6% from 2020 to 2021 and 89% in real terms to $132/kWh from the $1,200 per kilowatt-hour registered in 2010.

“Continuing cost reductions bode well for the future of electric vehicles, which rely on lithium-ion technology. However, the impact of rising commodity prices and increased costs for key materials such as electrolytes has put pressure on the industry in the second half of the year,” the dossier reads.

According to BNEF, the prices registered this year are an average across multiple battery end-uses, including different types of electric vehicles, buses and stationary storage projects.

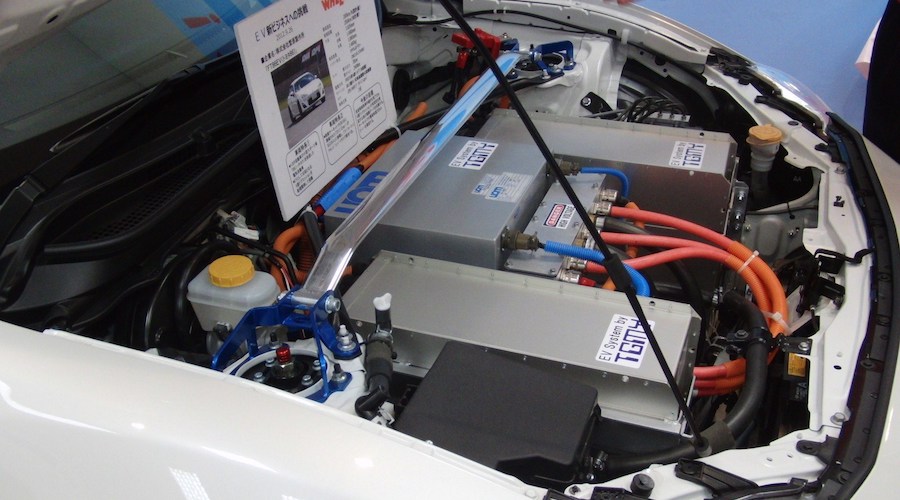

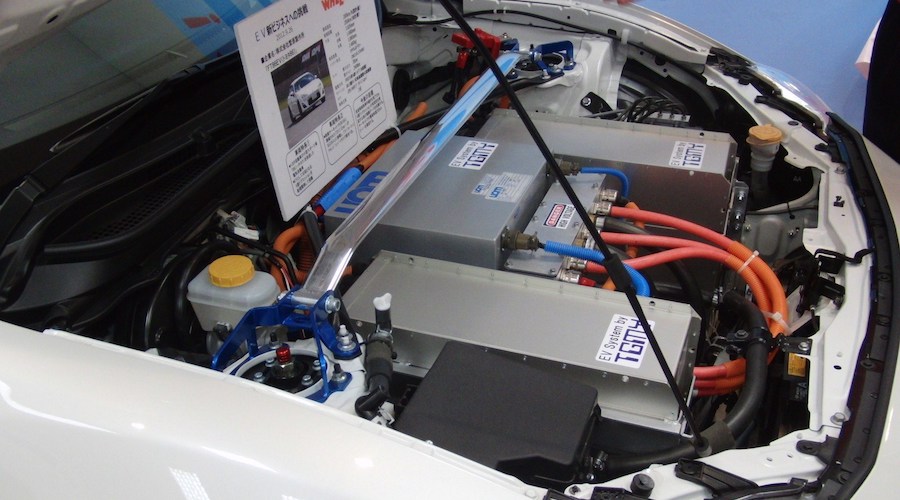

“For battery electric vehicle (BEV) packs, in particular, prices were $118/kWh on a volume-weighted average basis in 2021. At the cell level, average BEV prices were just $97/kWh,” the document states. “This indicates that on average, cells account for 82% of the total pack price. Over the past two years, the cell-to-pack cost ratio has diverged from the traditional 70:30 split, a result of changes to pack design, such as the introduction of cell-to-pack designs.”

The analyst’s data show that on a regional basis, battery pack prices were the cheapest in China, at $111/kWh. Packs in the US and Europe, on the other hand, were 40% and 60% higher, respectively.

In the view of BNEF’s experts, higher prices reflect the relative immaturity of the western markets, the diverse range of applications and, for the higher end of the range, low volume and bespoke orders.

Despite the regional differences, the reality is that prices kept falling in 2021. The researcher identified that one of the reasons behind the drop has been the increased adoption of the low-cost lithium-iron-phosphate (LFP) cathode chemistry, and the reduced interest of OEMs in the expensive cobalt in nickel-base cathodes.

“On average, LFP cells were almost 30% cheaper than NMC cells in 2021,” the report reads. “However, even low-cost chemistries like LFP, which is particularly exposed to lithium carbonate prices, have felt the bite of rising costs throughout the supply chain. Since September, Chinese producers have raised LFP prices by between 10-20%.”

Given this state of affairs and based on historical trends, BNEF’s 2021 Battery Price Survey predicts that by 2024 average pack prices should be below $100/kWh.

For the London-based firm, it is at around this price point that automakers should be able to produce and sell mass-market EVs at the same price and with the same margin as internal combustion vehicles in some markets. The prediction assumes no subsidies are available and acknowledges that actual pricing strategies will vary by automaker and geography.

In the near term, however, BNEF expects higher raw material prices to impact average pack prices, which could rise to $135/kWh in 2022 in nominal terms. If there aren’t any other improvements that can mitigate this impact, the analyst believes that the point at which prices fall below $100/kWh could be pushed back by two years, a development that would impact EV affordability or manufacturers’ margins and could hurt the economics of energy storage projects.

“Although battery prices fell overall across 2021, in the second half of the year prices have been rising. We estimate that on average the price of an NMC (811) cell is $10/kWh higher in the fourth quarter than it was in the first three months of the year, with prices now closing in on $110/kWh,” James Frith, lead author of the report, said in a media statement. “This creates a tough environment for automakers, particularly those in Europe, which have to increase EV sales in order to meet average fleet emissions standards. These automakers may now have to make a choice between reducing their margins or passing costs on, at the risk of putting consumers off purchasing an EV.”

Prices for lithium have risen this year as a result of constraints within global supply chains, rising demand in China and Europe and the recent production curbs in China. Yet, BNEF expects these issues to be resolved by Q1 2022, which should help ease lithium prices.

“The path to achieving $100/kWh is clear, although the timing now looks more uncertain,” the dossier states.

This article first appeared on www.Mining.com.

Comments