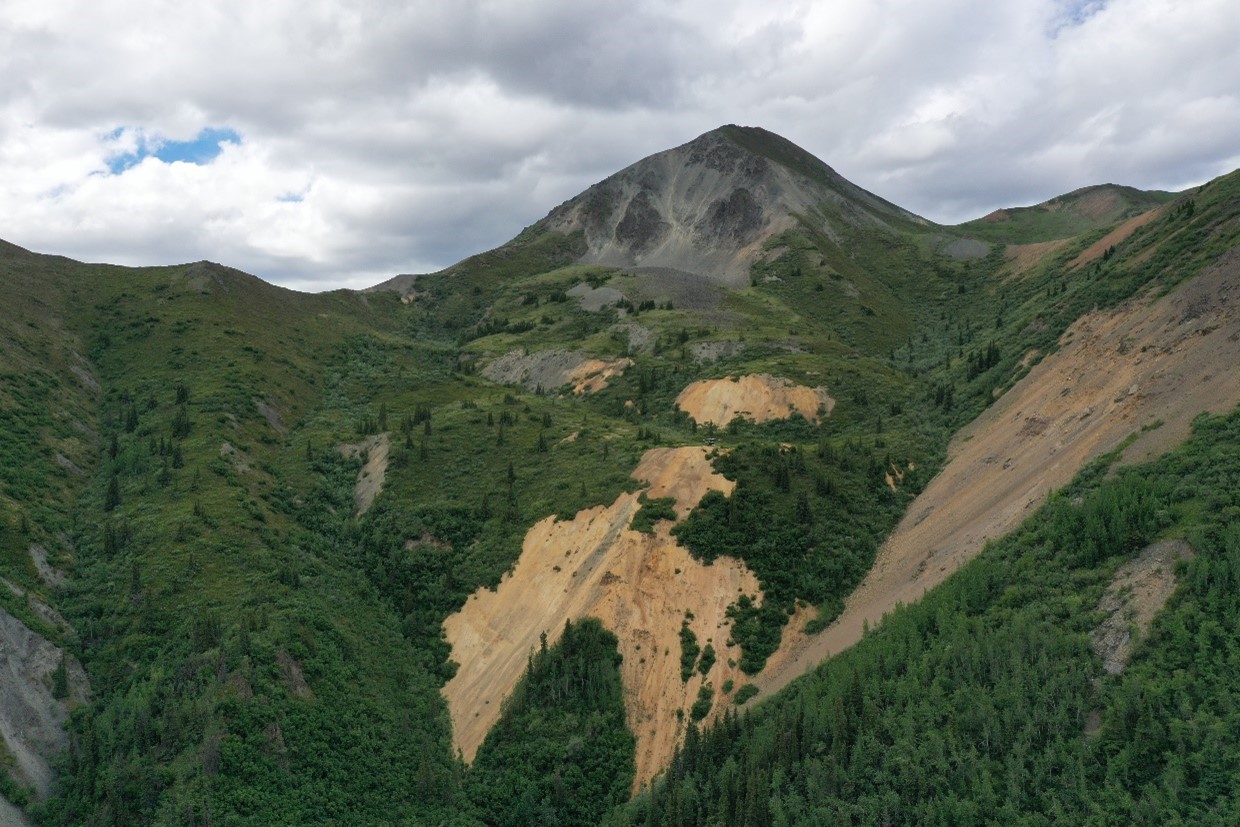

[caption id="attachment_1003741435" align="aligncenter" width="550"]

Clearwater base camp Credit: Eastmain

Clearwater base camp Credit: Eastmain[/caption]

Auryn Resources has entered into an agreement with a syndicate of underwriters, co-led by Canaccord Genuity and Beacon Securities, for a bought-deal private placement of 7.5 million subscription receipts, for gross proceeds of $22.5 million.

The subscription receipts will be exchanged for Auryn common shares as Auryn acquires Eastmain, after the spinout of Auryn’s Peruvian properties to its shareholders, as the two companies unite to create

Fury Gold Mines (for more details, see

our post on the deal announced on Jul. 30).

The subscription receipts are sold in two tranches – the first will be issued at $2 per receipt, for gross proceeds of $5 million, while the second will be issued at $3.5 per receipt. The subscription receipts will be exchanged for Auryn common and flow-through shares as Auryn acquires Eastmain.

“We are excited to welcome these new investors as new shareholders of Fury Gold and to position the company with $22.5 million to carry out its aggressive growth plans through exploration and development over the next 12 months,” Ivan Bebek, Auryn’s executive chairman and director, said in a release.

Bebek added that the combined company is looking to start a 50,000-metre drill program this fall to expand the Eau Claire deposit.

This news follows

July’s announcement of Auryn’s all-share acquisition of Eastmain Resources – the acquisition terms include a private placement financing of subscription receipts, to raise a minimum of $15 million, before closing of the transaction.

Fury Gold, a Canadian gold developer, will hold three core projects: Eau Claire in Quebec (originally held by Eastmain), as well as the Committee Bay and Homestake gold projects in Nunavut and B.C., respectively, currently held by Auryn.

The offering is scheduled to close on Sept. 24.

For more information, visit

www.Eastmain.com or

www.AurynResources.com.

Clearwater base camp Credit: Eastmain[/caption]

Auryn Resources has entered into an agreement with a syndicate of underwriters, co-led by Canaccord Genuity and Beacon Securities, for a bought-deal private placement of 7.5 million subscription receipts, for gross proceeds of $22.5 million.

The subscription receipts will be exchanged for Auryn common shares as Auryn acquires Eastmain, after the spinout of Auryn’s Peruvian properties to its shareholders, as the two companies unite to create Fury Gold Mines (for more details, see

Clearwater base camp Credit: Eastmain[/caption]

Auryn Resources has entered into an agreement with a syndicate of underwriters, co-led by Canaccord Genuity and Beacon Securities, for a bought-deal private placement of 7.5 million subscription receipts, for gross proceeds of $22.5 million.

The subscription receipts will be exchanged for Auryn common shares as Auryn acquires Eastmain, after the spinout of Auryn’s Peruvian properties to its shareholders, as the two companies unite to create Fury Gold Mines (for more details, see

Comments