American Salars acquires lithium project in Canada’s Quebec

Canadian lithium junior American Salars (CNSX: USLI) (OTC: USLIF) has announced the acquisition of the Lac Simard South lithium project in Quebec, marking a significant step in the company’s expansion into the lithium market.

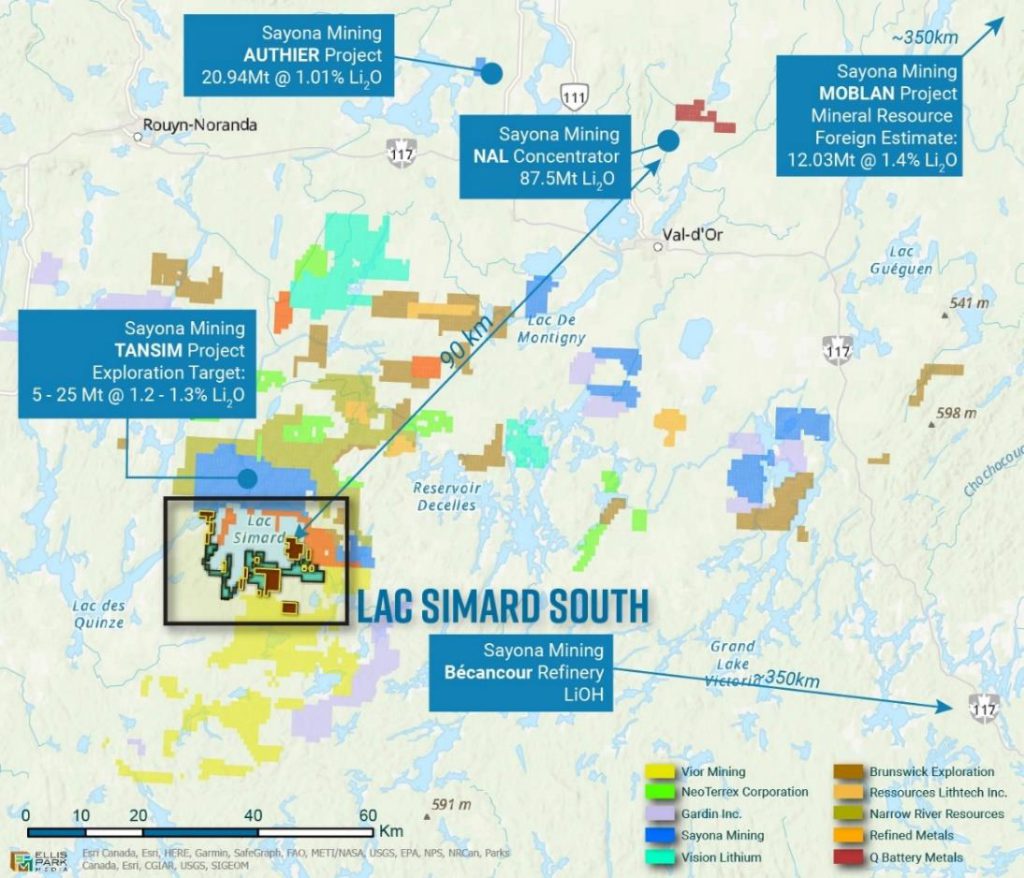

The deal grants American Salars a 100% interest in the mineral claims associated with the project, which consists of around 3,672ha covering 64 claim blocks.

Lac Simard South is close to several of Sayona Mining’s (ASX: SVA) lithium projects, which together have an indicated resource of 111 million tonnes grading 1.14% lithium, the province’s largest resource.

The Vancouver-based developer said it plans for a comprehensive work program to identify and test areas of immediate interest, though its primary focus is Argentina.

“This is the company’s first re-entry point into Quebec with the intention of building a strategic portfolio of hard rock lithium projects to compliment our lithium brine assets,” chief executive and director Nick Horsley said in the statement.

Prices for lithium, a crucial component of the batteries that power electric vehicles (EVs), have slumped over 80% since the start of last year on oversupply and weaker-than-expected EV demand.

Yet, analysts and sectorial actors trust that lithium’s long-term outlook will justify efforts. At the very least, they say, it will encourage more merger and acquisition (M&A) interest, as companies look for deeper-pocketed backers to ride out the downturn. As cases in point, they quote Codelco’s purchase of Australia's Lithium Power International and Rio Tinto’s recent $6.7 billion acquisition of U.S.-based Arcadium Lithium.

“The company’s long-term belief in a lithium price rebound is steadfast and now is the time to build a multi-jurisdictional lithium company,” Horsley noted.

Shares in the company jumped 25% on the announcement to close Wednesday at C$0.13 each, which leaves it with a market capitalization of C$3.87 million (US$2.78 million).

Comments