VANCOUVER - Peregrine Diamonds Ltd. is pleased to announce that it has entered into an arrangement agreement with De Beers Canada Inc. under which De Beers will acquire all of the Company’s outstanding common shares for $0.24 per share in cash or a total equity value of approximately $107 million pursuant to a plan of arrangement under the Canada Business Corporations Act. The transaction represents a 50% premium to Peregrine’s share price of $0.16 on July 18, 2018, and a premium of 44.5% to the volume weighted average price of the shares for the 20-trading days ended July 18, 2018.

[caption id="attachment_1003724070" align="alignnone" width="490"]

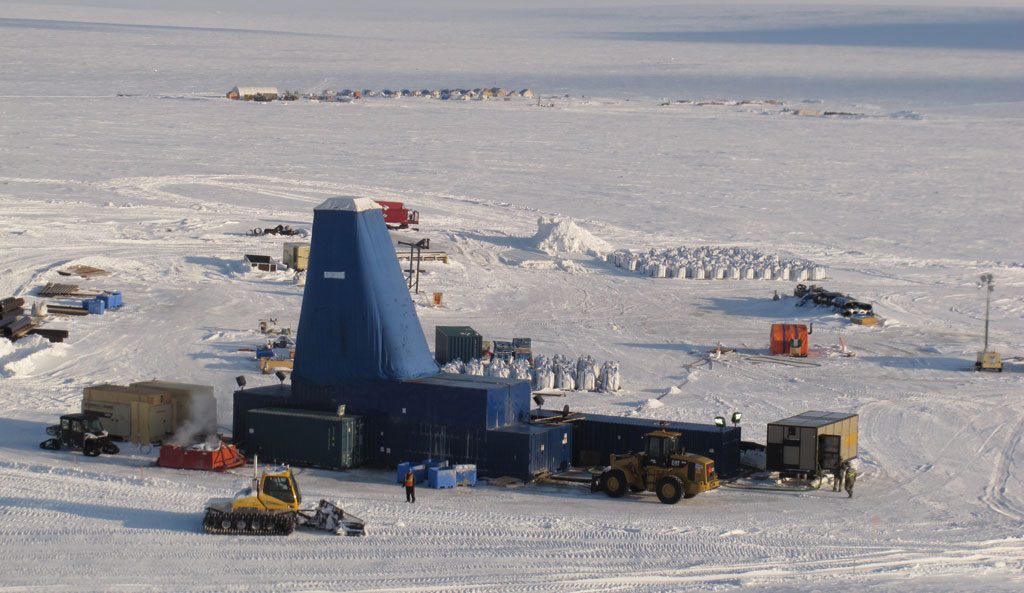

A large-diameter rig on site in 2015 during the CH-7 kimberlite bulk sample at Peregrine Diamonds’ Chidliak diamond project on Baffin Island in Nunavut. Credit: Peregrine Diamonds.[/caption]

The Board of Directors of Peregrine, after consultation with financial and legal advisors, and based on the recommendation of a special committee of the Board consisting of three independent directors, has unanimously determined that the Arrangement is in the best interests of the Company, has approved the Arrangement Agreement and the Arrangement and recommends that Peregrine’s shareholders, as well as its option holders and warrant holders, vote in favour of the Arrangement. All directors and officers of the Company as well as Messrs. Eric Friedland and Robert Friedland, the Company’s two major shareholders who collectively control 42.8% of the issued and outstanding common shares (and 42.2% of the issued outstanding common shares, options and warrants), have entered into voting and support agreements to vote their common shares in support of the Arrangement.

Benefits to Peregrine’s Shareholders:

- Immediate and attractive premium of approximately 50% to spot and 44.5% based on the 20-day VWAP.

- All cash offer that is not subject to a financing condition.

- Secures immediate value appreciation, eliminating technical and financial risks and the burden of future dilution involved in advancing the Chidliak project as a standalone publicly-traded company.

Eric Friedland, Peregrine’s Founder and Executive Chairman, commented: “The De Beers Canada offer delivers immediate liquidity to Peregrine’s shareholders at an attractive premium that recognizes the current value of Chidliak and provides shareholders certainty through an all-cash offer. Further, it eliminates the substantial equity dilution, and project and market risks to advance Chidliak to bankable feasibility and, if warranted, to commercial production. This offer is the result of a comprehensive review process of our options to advance Chidliak towards development. The Board unanimously agrees that this offer represents the best path forward available to Peregrine’s shareholders and recommends that shareholders vote in favour of this transaction.”

Kim Truter, CEO, De Beers Canada, said; “The Peregrine team has done outstanding work progressing the Chidliak project, demonstrating its quality and high potential. With our extensive De Beers Group operating experience in similar Canadian arctic environments and employing innovative mining methods, we believe we are very well positioned to develop this resource further. We are delighted to be extending our business presence in Canada to the Nunavut Territory and look forward to working with all community and government partners as we progress the project.”

Tom Peregoodoff, Peregrine’s President and CEO, added; “It is very gratifying to see that the work accomplished by the team at Peregrine is being recognised by De Beers. We have consistently stated that Chidliak holds significant diamond mine development potential and this transaction is an excellent outcome for the Company’s stakeholders, including shareholders, community members and the territory of Nunavut. The transaction ensures the next steps in mine development are taken by a world-class operator with recognized arctic mine development and operational experience, and ensures stakeholders will benefit from responsible development of this rare and unique diamond resource.”

For more information visit www.peregrinediamonds.com or www.debeersgroup.com.

A large-diameter rig on site in 2015 during the CH-7 kimberlite bulk sample at Peregrine Diamonds’ Chidliak diamond project on Baffin Island in Nunavut. Credit: Peregrine Diamonds.[/caption]

The Board of Directors of Peregrine, after consultation with financial and legal advisors, and based on the recommendation of a special committee of the Board consisting of three independent directors, has unanimously determined that the Arrangement is in the best interests of the Company, has approved the Arrangement Agreement and the Arrangement and recommends that Peregrine’s shareholders, as well as its option holders and warrant holders, vote in favour of the Arrangement. All directors and officers of the Company as well as Messrs. Eric Friedland and Robert Friedland, the Company’s two major shareholders who collectively control 42.8% of the issued and outstanding common shares (and 42.2% of the issued outstanding common shares, options and warrants), have entered into voting and support agreements to vote their common shares in support of the Arrangement.

Benefits to Peregrine’s Shareholders:

A large-diameter rig on site in 2015 during the CH-7 kimberlite bulk sample at Peregrine Diamonds’ Chidliak diamond project on Baffin Island in Nunavut. Credit: Peregrine Diamonds.[/caption]

The Board of Directors of Peregrine, after consultation with financial and legal advisors, and based on the recommendation of a special committee of the Board consisting of three independent directors, has unanimously determined that the Arrangement is in the best interests of the Company, has approved the Arrangement Agreement and the Arrangement and recommends that Peregrine’s shareholders, as well as its option holders and warrant holders, vote in favour of the Arrangement. All directors and officers of the Company as well as Messrs. Eric Friedland and Robert Friedland, the Company’s two major shareholders who collectively control 42.8% of the issued and outstanding common shares (and 42.2% of the issued outstanding common shares, options and warrants), have entered into voting and support agreements to vote their common shares in support of the Arrangement.

Benefits to Peregrine’s Shareholders:

Comments