VANCOUVER — In early May, Goldcorp announced a $520-million, all-share bid for explorer Kaminak Gold and its feasibility-stage Coffee project in the Yukon. Subsequent filings have revealed there were two other potential bidders for the multi-million ounce gold asset, and that Goldcorp had to sweeten its offer to secure the deal.

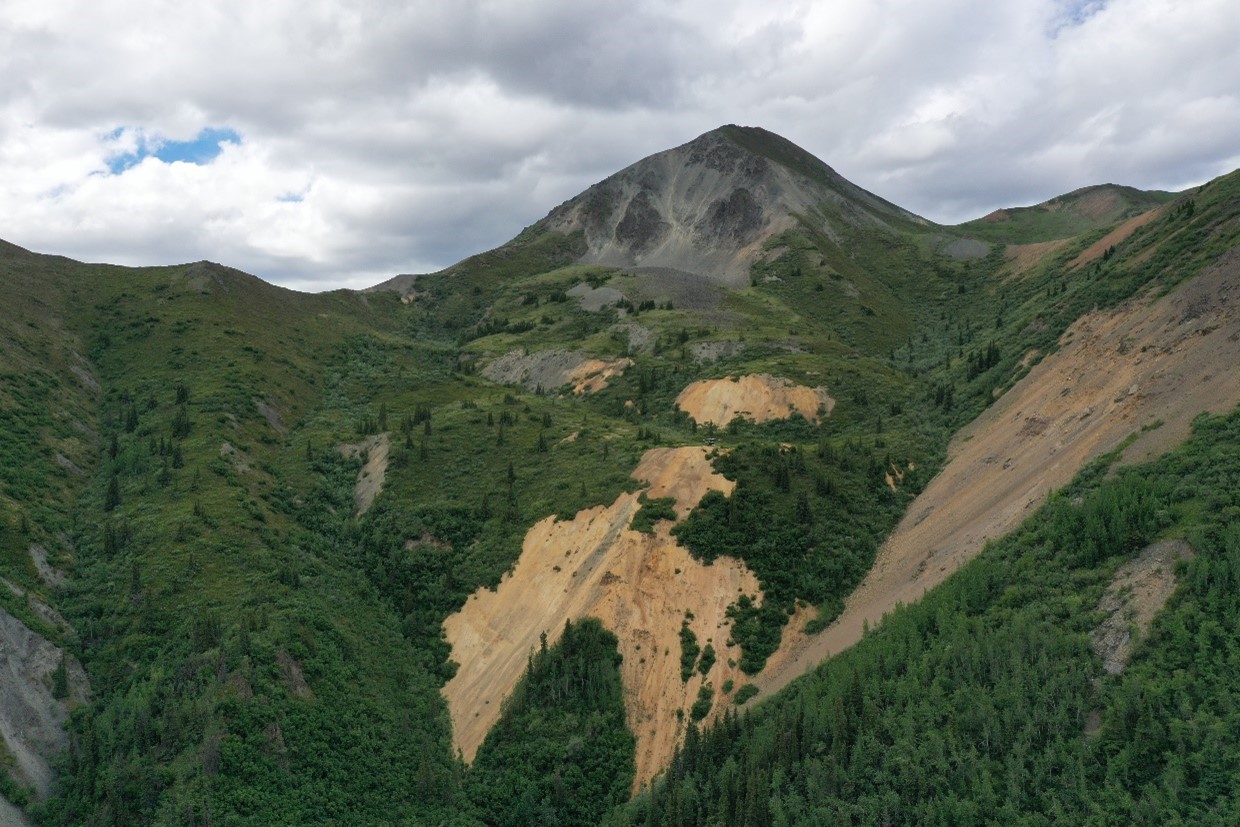

On June 13, Kaminak released a management circular that outlines the bid process for Coffee, which hosts 52.4 million indicated tonnes grading 1.68 grams gold for 2.8 million contained oz., and 43 million inferred tonnes of 1.52 grams gold for 2.08 million contained oz.

Interest in Kaminak began heating up following the release of an updated feasibility study (FS) on the project in January, which outlined a heap-leach operation focused on around 2.2 million oz. of gold-oxide reserves that carried a US$455 million after-tax net present value at a 5% discount rate and a 37% internal rate of return.

The first interested bidder came forward in March to “informally” inquire about a transaction. These preliminary discussions and diligence reportedly continued through April, when Goldcorp delivered its initial non-binding transaction proposal.

After reviewing the terms Kaminak management determined the “proposal was not sufficiently compelling to enter into exclusive discussions,” but the company would “work with Goldcorp to help complete its due diligence if [it] was prepared to consider delivering more value.”

Roughly two weeks after Goldcorp’s first offer a third company entered the fray and requested a site visit to Coffee in order to “pursue a transaction.” Kaminak subsequently heard the first interested bidder intended to offer a proposal, while Goldcorp indicated it would deliver a “revised” offer by early May.

On May 6, Kaminak received the new proposal from Goldcorp and an offer from the first interested party. There is no further mention of the third company.

On the afternoon of May 8, Kaminak and Goldcorp agreed to enter into exclusive negotiations on the basis that, among other things, the consideration would be increased to $2.70 per share. Directors, officers and shareholders of Kaminak representing roughly 27.5% of its outstanding shares have subsequently agreed to vote in favour of the arrangement, which is expected to close no later than August 15. Goldcorp retains the right to match any superior offer and is entitled to a $20.3 million break fee.

The multiple offer situation hints at the lack of attractive development projects in North America, with newly-appointed Goldcorp president and CEO indicating during marketing presentations in early June that “there is a lack of opportunity given a focus on investing in politically safe jurisdictions.”

BMO Research indicated in a June 8 note that it viewed Goldcorp’s message to investors as quite clear: “expect future acquisitions.”

Goldcorp has traded within a 52-week window of $13.55 and $25.35, and closed at $22.81 per share at the time of writing. The company maintains 832 million shares outstanding for a $19.05 billion press-time market capitalization.

Meanwhile, Kaminak has gained nearly 50% or 80¢ following news of the transaction en route to a $2.46 per share close. The company has 186 million shares outstanding for $459.4 million market capitalization.

Comments