Why Northern Ontario remains mining central: Investment, innovation fuel growth in Sudbury-North Bay mining cluster

This year’s annual U-Haul Growth Index, which tracks the net gain of one-way U-Haul trucks arriving in a Canadian city, ranked North Bay, Ont., as the country’s leading growth city for the second year in a row with Sudbury following close behind in third place. Covid-19 and skyrocketing housing prices in the Greater Toronto Area certainly had something to do with it, but both cities owe much of their appeal to the economic impact of northeastern Ontario’s mining cluster.

Vale and Glencore’s Sudbury Integrated Nickel Operations (SINO) are both in the midst of major new mine developments, gold and nickel prices are high, drills are turning and new mines are ramping up across northern Ontario, suppliers are on a roll and Sudbury in particular has emerged as one of the country’s most important hubs for mining-related research and innovation.

SINO is advancing its $1.3 billion Onaping Depth project and is in the midst of sinking an internal shaft to a depth of 2.6 km from surface. Scheduled to begin producing ore in 2024 with mine completion projected for 2025, Onaping Depth will also serve as a showcase for leading edge technologies, including mine-wide LTE communications, teleremote and autonomous equipment operation, and the deployment of battery electric vehicles.

“Onaping Depth is a step change into a depth we haven’t mined previously,” said Glencore vice-president Peter Xavier. “It unlocks that opportunity going forward which is where our future lies given that all of the near-surface deposits in the Sudbury Basin have been mined out. It opens another horizon of exploration opportunities for us.”

Advances in geotechnical understanding, seismic monitoring, predictive modelling and new technologies like battery electric equipment “have given us confidence that we can safely mine at those depths,” he added.

An extension of Nickel Rim South that overlaps Vale’s Victoria property will be in position for project approval as a joint venture by the end of 2023, while Moose Lake, another orebody at depth is close enough to Glencore’s Fraser mine to leverage existing infrastructure. Yet another opportunity at depth is Norman West, described by Xavier as “one of the largest undeveloped orebodies in Sudbury.”

Vale turns page on tough year

Meanwhile, Vale is in the final stages of completing its $900-million Copper Cliff South project with plans for first ore production later this year.

“It’s going to be a significant mine in our portfolio and we will be relying on it heavily for the long term,” said Gord Gilpin, head of the company’s Ontario operations. The Copper Cliff operation, like all of Vale’s other four mines in the Sudbury Basin, is equipped with mine-wide LTE and is trialling electric vehicles.

“LTE enables us to see into our operations in real time, which will help us with decision-making, quicker understanding of where we have problems and how to best go about solving them,” said Gilpin, who assumed his current role in January.

The year 2021 was challenging for Vale with production disrupted by a two-month strike, the ongoing pandemic and the shutdown of Totten mine in September, when a scoop bucket being sent underground detached and blocked the mine shaft, trapping 39 miners for three days. (All were safely rescued.) However, Gilpin is optimistic about 2022 with Totten back in production as of mid-to-late February, Copper Cliff South expected to begin producing ore in the second half of the year, and nickel prices in favourable territory.

At its Garson mine, Vale is also trialling Komatsu’s MC51 Dynacut mechanical cutter and assessing its potential to replace traditional drill and blast technology in hard rock mines.

“It’s an exciting project and from a high level, we see promise there. But the equipment is complex, and it’s going to take more work and testing to get to a point where we are able to draw some serious conclusions,” Gilpin said.

Thriving mining supply sector

Meanwhile, the mining supply sector in Sudbury and North Bay is firing on all cylinders. MineConnect, an association of mining suppliers in northern Ontario, has more than doubled its membership to 209 companies since 2018, and in December, opened an office in Elko, Nev., to better serve the mines in this important export market. Strategic Development Officer Sheena Hansen has been hired to manage the office and work with the first 10 northern Ontario suppliers to enrol in the program.

Credit: Alex Hall/Glencore

“It was a no-brainer to select Nevada because a number of our suppliers have established relations in this market,” said MineConnect executive director Marla Tremblay. “Every time we survey our members and ask what markets they’re interested in, the Nevada market always tops the list.”

The cluster’s appeal as a location for mining supply companies was confirmed by Epiroc’s opening of a 22,000-sq.-ft., state-of-the art component remanufacturing centre in Sudbury last year. The new facility will recycle powertrain components for underground equipment from Chile, Mexico, the U.S. and Canada. According to reman centre plant manager Brian Bernier, Sudbury is an ideal location because of its “skilled talent pool of qualified technicians and generations of Sudburians who have worked in the mines.”

North Bay, home to Redpath, Cementation, Foraco, Boart Longyear, Miller Technology and a number of other mining suppliers, welcomed the addition of Norgalv, a $21-million, state-of-the-art galvanizing plant at the city’s Airport Industrial Business Park. North Bay was selected by the plant’s South African investors as an ideal location to serve the region’s mining suppliers and steel fabricators, which had to rely on shipping product to southern Ontario in the absence of a northern Ontario galvanizing plant.

“It’s great to see something like this in the north,” said Roy Slack, former president of Cementation and past president of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM). “North Bay is an integral component of the northern Ontario hub supplying the global mining industry and Norgalv is a welcome addition as there are many applications for galvanizing in the mining industry.

“Cementation has a lot of work on the order book and the drilling industry is hiring, which is always a good sign,” added Slack.

Innovation ecosystem

The cluster has also evolved as one of Canada’s most important hubs for innovation and prototyping. In July, for example, the Centre for Excellence in Mining Innovation (CEMI) received a $40-million allocation from Industry Canada’s Strategic Innovation Fund to establish the Mining Innovation Commercialization Accelerator Network (MICA). Headquartered and managed from Sudbury, MICA is tasked with identifying and commercializing made-in-Canada solutions for the mining industry by working with the Bradshaw Research Initiative for Minerals and Mining in British Columbia, InnoTech Alberta, Saskatchewan Polytechnic, MaRS, le Groupe MISA in Quebec and the College of the North Atlantic in Newfoundland.

MICA is in the process of onboarding companies interested in participating in the five-year project and was scheduled to issue a call for proposals in February for projects able to improve productivity, reduce greenhouse gas emissions, mitigate environmental risk and advance the development of smart, autonomous mining systems, said Charles Nyabeze, CEMI’s vice-president of business development and commercialization.

NORCAT, the only innovation centre in the world with its own underground mine, cut the ribbon on a new 15,000-sq.-ft. surface building with meeting rooms, offices, and men’s and women’s dry facilities for companies using the mine to develop, test and showcase emerging mining technologies.

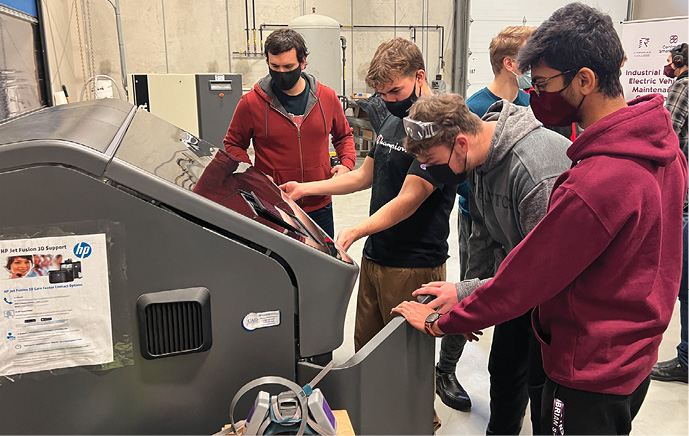

Credit: Cambrian College

From Sept. 26-29, the expanded complex will host the world’s first technology exhibition in an underground mine. “We will be inviting emerging technology companies from around the world to install their solutions at the NORCAT Underground Mine so they can connect with delegates from global mining companies and enable transactions to get done,” said NORCAT CEO Don Duval.

NORCAT also operates its Open Innovation Platform, a portal designed to expedite technology adoption in the mining industry by connecting the builders and buyers of technology, said Duval. The initiative began with NORCAT posting some of Vale’s challenges and opportunities and inviting technology companies to propose solutions using new or existing products. With two years under its belt, NORCAT has refined the program and is expanding it to include the global mining community.

Also focused on mining innovation in Sudbury is Cambrian College’s Centre for Smart Mining, a technology access centre funded by the Natural Sciences and Engineering Research Council of Canada. “The Centre for Smart Mining serves mining technology companies with ideas they’d like to see go into the mining industry,” said Centre for Smart Mining manager Stephen Gravel. “Typically, they don’t have their own R&D capabilities, so they use our teams of faculty, students and researchers to respond to the technology needs their customers are expressing.”

The centre typically averages between 15 and 20 projects per year and boasts a so-called “maker’s space on steroids” with big water jet cutters, five axis CNC machines, large volume 3-D printers and a fully equipped electronics shop for prototyping purposes.

Laurentian University, Sudbury’s other post-secondary institution, plays a critical role in the region’s mining cluster as one of Canada’s pre-eminent academic institutions with its geology and mining engineering programs. Unfortunately, in February 2021, the university filed for insolvency under the Companies Creditors’ Arrangement Act, which led to the dismissal of 100 professors and dozens of programs. The Harquail School of Earth Sciences and the Bharti School of Engineering’s Department of Mining Engineering both lost several faculty members, forcing remaining professors to increase their teaching load.

While there are still some concerns about the impact on the university’s reputation, strong demand for geologists and mining engineers is expected to keep enrolment close to historical levels.

“The mining sector has traditionally been, and certainly will continue to be, a significant area of focus for us,” said Laurentian University president Dr. Robert Haché. “We take great pride in the work we’ve done in this space and continue to view the mining industry as an integral part of what makes Laurentian unique.”

Norm Tollinsky is a freelance journalist and former editor of Sudbury Mining Solutions Journal.

Comments