Welcome to the battery issue

When it began last March, the Covid-19 pandemic derailed all of our lives. But one thing it didn’t derail is the global shift toward electrification.

In fact, Benchmark Mineral Intelligence, which closely follows demand and supply in the lithium-ion battery supply chain, says that its demand forecast for battery metals is higher now than it was pre-pandemic, thanks to stimulus spending that’s been directed towards supporting electrification, clean energy and electric vehicles.

“The stimulus efforts that were put into place coming out of the pandemic mean the longer-term trajectory for the market has actually strengthened over the past twelve months,” said Andy Miller, product director of Benchmark Minerals Intelligence at this year’s virtual Prospectors and Developers Association of Canada convention.

While there was a marginal dip in 2020 battery materials demand as measured against the pre-pandemic forecasts, Miller says a rebound that started in mid-2020 with demand from China has spread to include the rest of the world, particularly the European Union.

“This diversification of demand is really going to be a story for the coming decade,” he predicted.

There are, of course, several potential flies in the ointment on the road to decarbonization – availability of materials being one of the primary challenges.

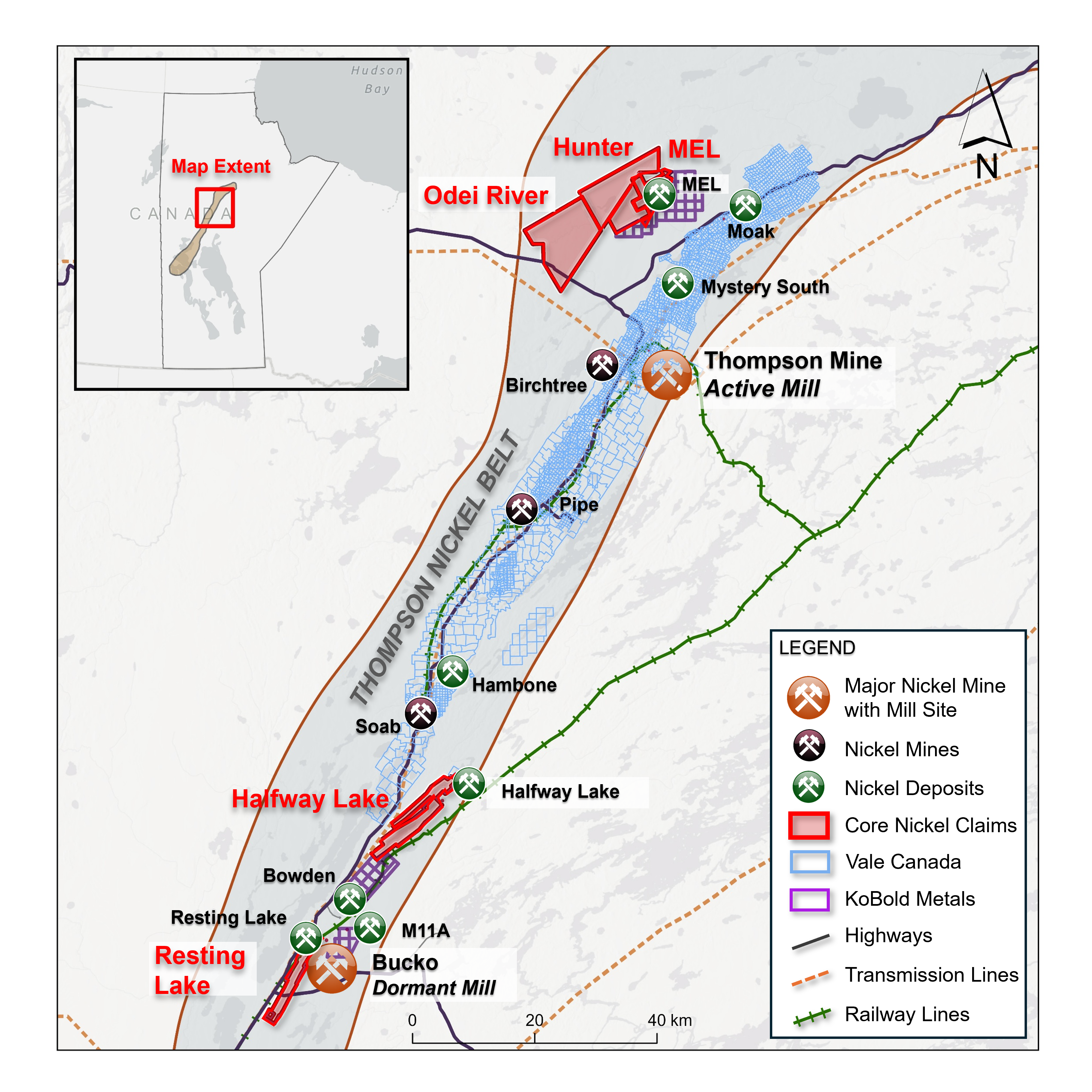

Benchmark estimates that massive investment is needed in order to meet projected demand in 2030 – upwards of US$39 billion worth for nickel (US$50 billion for nickel and cobalt combined), US$24 billion for lithium, and US$13 billion for natural flake graphite.

Manufacturers and other downstream participants in the supply chain – who normally vastly underestimate the time for mine supply to respond to demand – are waking up to the issue.

“You’re seeing a lot more companies downstream, whether it be at the OEM level or the battery producer level, taking serious steps to secure their supply chains upstream because they’re aware of the impending shortages in these markets,” Miller said.

In this issue of CMJ, Frik Els, executive editor of MINING.COM, lays out quite nicely the challenge ahead for just one EV manufacturer – Tesla – as it plans to ramp up production over the next nine years (page 20).

We also look at BEV demand from operating mines – some of which supply battery minerals. As miners accelerate their transition away from diesel, mining OEMs report that the interest in and demand for BEVs has only grown during the pandemic. They report that this interest is not only global, but it also includes both large and smaller miners. For a rundown of some of their new battery equipment offerings, see page 27.

How does Canada fit into the picture? Skarn Associates’ analysis of Canada’s mining sector shows we have a unique advantage in terms of low carbon intensity mineral production (page 16). CMJ and Mining Intelligence also take a look at some of the biggest undeveloped battery minerals projects in Canada on page 23.

Comments