Ventilation Vanguard: ESG integration

How asset managers influence ESG integration in mine ventilation strategies

In mining, a traditionally capital-intensive industry, there is a transformation taking place. This change is not purely driven by regulatory guidelines and public sentiment but by financial juggernauts that control the purse strings of industry. BlackRock, led by CEO Larry Fink, is at the frontline of this movement, placing a strong emphasis on ESG (environmental, social, and governance) principles. This shift towards ESG is reshaping the landscape of investment strategies in the mining sector, pushing companies to evolve and adapt to meet these new criteria.

Navigating the ESG landscape

Larry Fink’s annual letters to CEOs are more than just correspondences; they are policy-shapers. By prioritizing ESG principles in investment decisions, Fink and BlackRock are part of a larger shift in the financial industry that views sustainability as a financial necessity. This shift is clearly visible, in the actions of asset managers such as BlackRock and Vanguard who handle trillions of dollars in investment dollars. They are increasingly prioritizing ESG factors. Providing guidelines for industries and businesses to adhere to ESG standards. Failing to align with these benchmarks may result in missing out on investment opportunities.

Confronted with this reality, mining companies find themselves at a crossroads. Given the capital-intensive nature of their operations and their reliance on external funding, mining companies must demonstrate an unwavering commitment to ESG goals to secure the necessary funding.

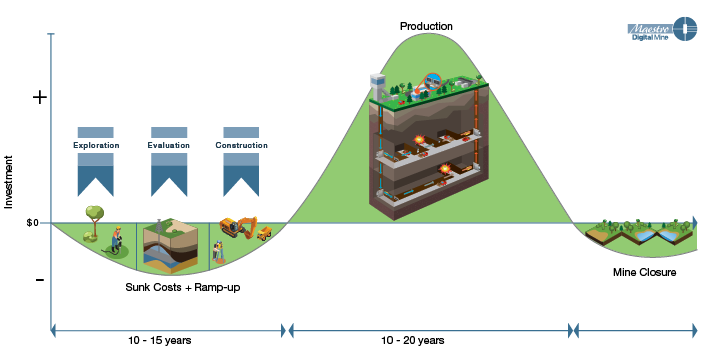

This narrative highlights a crucial fact: the inherently capital-intensive nature of the mining sector makes it particularly vulnerable to shifts in investment criteria. While other industries may have more flexibility to adapt to changing expectations, the significant upfront costs and long project timelines associated with mining mean that companies in this sector must be proactive in aligning their operations with ESG principles.

Contrasting the mining landscape with traditional industries

Examining the differences between the mining sector and traditional industries reveals the unique challenges mining companies face.

A cookie factory represents a traditional manufacturing setup. While not immune to the pressures and demands of sustainable practices, the operations and capital requirements of such a factory are distinct from those in the mining sector.

In a traditional factory, the timeline from investment to production is relatively quick. Once the required machinery and infrastructure are in place, the company can realize a return on its investment in a short span. On the other hand, the mining sector, particularly when discussing underground mines, deals with a lengthy process from exploration to production that can span decades. The extensive research, planning, and development required to establish a productive underground mine contribute to this extended lead time.

The capital investment in both industries differs as well. For a cookie factory, the primary costs, such as machinery, ingredients, and labour, though substantial, are significantly lower compared to the capital demands of mining operations. Investment in mining, particularly in the case of underground mines, includes substantial expenses covering heavy machinery, labour, and the rigorous compliance costs associated with strict environmental regulations. These costs are incurred before a single bucket of ore can be extracted, emphasizing the significant upfront investment in terms of both time and money required for mining operations.

Revenue potential and financial risks vary between the two industries as well. A cookie factory can expect a consistent revenue stream once production begins, provided there is demand for their products. On the other hand, the mining industry grapples with fluctuating mineral market values and potential uncertainties in the quantity of minerals available for extraction. This variability, coupled with the extended time required to reach the break-even point and significant upfront capital requirements, leaves the financial health of mining companies vulnerable to the influences of asset managers and their investment criteria.

These factors emphasize the unique challenges faced by the mining industry as it navigates evolving dynamics significantly influenced by asset managers’ commitment to ESG principles. Adhering to ESG standards is not only a matter of ethics; it is a financial necessity that directly affects a mining company’s ability to secure investments. An essential component of showcasing this dedication involves integrating ESG principles throughout various operational aspects, with mine ventilation emerging as a focal point.

The role of mine ventilation in ESG compliance

Ventilation, the second largest energy consumer, plays a crucial role in the mining industry, acting as a bridge between ESG concerns. It serves as a cornerstone in the industry’s efforts to achieve ESG compliance. This can be dissected into the following three key facets:

1 Environmental integrity: The primary “E” in ESG is intimately linked to mine ventilation. Efficient ventilation systems drastically reduce energy consumption, diminishing carbon emissions. Additionally, modern emissions monitoring ensures that harmful elements are effectively controlled, minimizing their release into the surrounding environment.

2 Social commitment: Ventilation systems go beyond environmental considerations. Its role is essential in safeguarding miners from toxic gases and pollutants. A robust ventilation system demonstrates a mining company’s unwavering dedication to its workforce’s well-being, thus encapsulating the “S” in ESG.

3 Governance through transparency: The aspiration of asset managers is unequivocal; investments should be ESG-compliant and transparent. Leading-edge ventilation monitoring systems offer mining operations the capacity to relay real-time data on emissions and ventilation efficiency, fostering accountability and instilling investor confidence.

As asset managers, empowered by expansive ESG-rich portfolios, redefine mining investments, mining companies must do the following:

Champion technological advancements: Committing to innovations, like instantaneous environmental tracking and AI-propelled ventilation optimization, serves a dual purpose: enhancing operational efficacy and positioning operations for capital infusion.

Seamless ESG fusion: ESG is not an isolated function. The new-age mining company seamlessly integrates ESG ethos across its operation spectrum.

Engage and enlighten: Regular dialogues with investors, underpinned by data sharing and ESG commitment demonstrations, are no longer optional but mandatory.

Larry Fink, coupled with other financial powerbrokers, have catalyzed a new chapter where capital deployment is deeply connected with ESG considerations. For miners, this is both a daunting challenge and an exciting frontier. By focusing towards ESG-aligned ventilation strategies, mining entities stand to not only attract essential capital but also pilot the industry towards a sustainable future.

Jacob Lachapelle is CEO in training at Maestro Digital Mine.

Comments