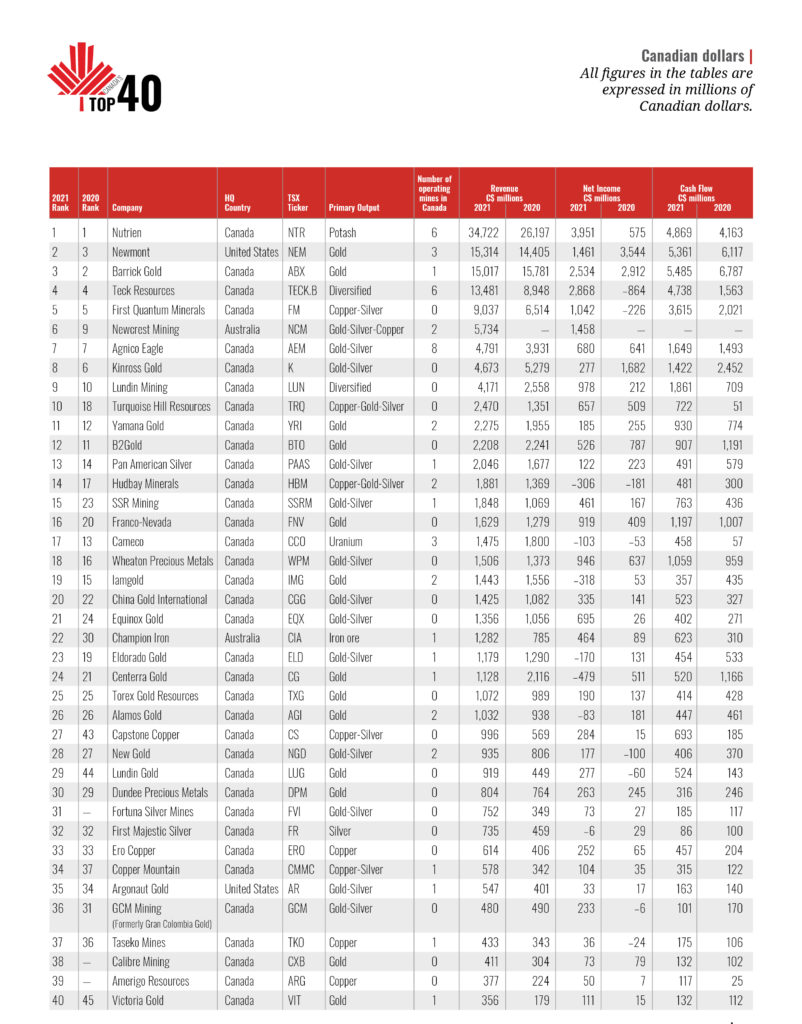

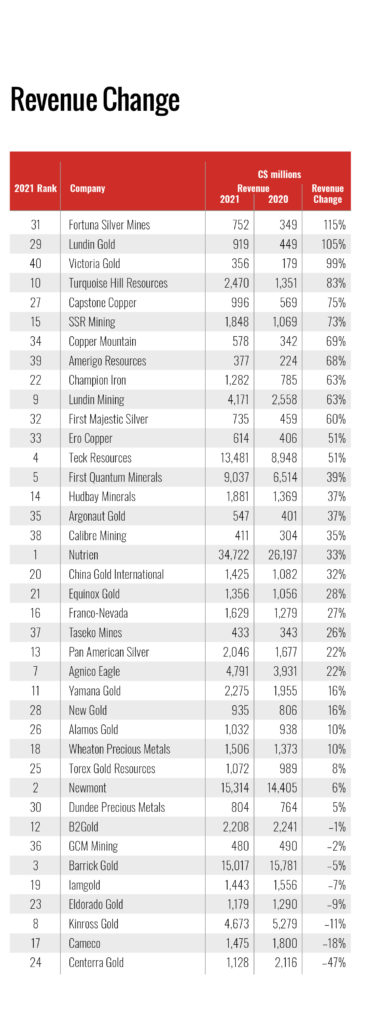

Top 40 revenues top $143 billion: $19 billion up from last year

Nutrien continues to top the list for another year

Although businesses were still trying to adjust to the global Covid-19 pandemic, the mining sector continued to handle the pandemic effectively in 2021. Mining was designated an essential service during the pandemic, thus most mining activities continued while following provincial health regulations.

The mining sector still struggled with some unfortunate events in 2021. At the recommendation of health officials, Cameco revised its protocols to include the temporary closure of all common spaces at the Cigar Lake camp but continued to operate safely.

It is true that miners faced a huge challenge in the last two years, including the costs of pandemic protocols and temporary suspensions, but strong commodities prices were a good compensation, especially for gold and copper miners, who make up the vast majority of our Top 40. Also, the good news is that mining employment has increased since June 2020. In May 2021, employment was 28,800 in the western provinces of Canada (up almost 9%, year-over-year).

According to a recent survey by Fraser Institute, only Australians enjoy higher labour productivity growth, and living standards than Canadians due largely to improvements in their mining and energy sector. The Fraser Institute’s annual survey of mining and exploration companies indicated that the top jurisdiction in the world for investment based on the Investment Attractiveness Index is western Australia. However, Saskatchewan ranked second this year, and Canada has a total of three jurisdictions in this year’s top 10.

An overall Investment Attractiveness Index combines the Best Practices Mineral Potential index, which rates regions based on their geologic attractiveness, and the Policy Perception Index, a composite index that measures the effects of government policy on attitudes toward exploration investment.

Moreover, according to the policy perception index (PPI) of Fraser Institute, which measures the overall policy attractiveness separately, Canada had the most jurisdictions (Quebec, Saskatchewan, and Alberta) in the top 10.

Nutrien has taken the top spot again this year with revenues of $35 billion. It was also the No. 1 revenue generator for the last three years. Potash is vital for the efficient expansion of the world’s food supply with almost 95% of the world’s potash being used in farming, and since there are no known substitutes for potash, we expect Nutrien to continue to dominate our list for several years.

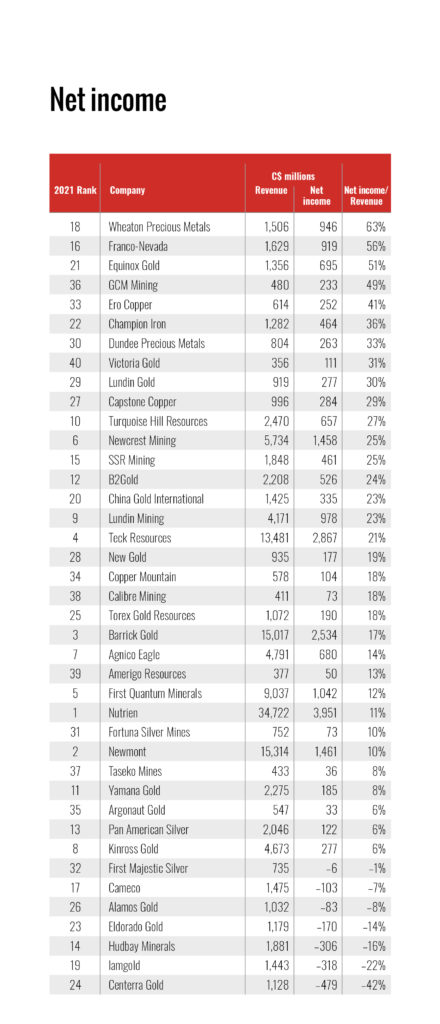

Gold and copper are joined by silver

Most of this year’s list are primary gold miners. That includes the new additions to the Top 40. There are some copper-gold miners and many gold-silver miners. Several companies moved up the list assisted by their increased silver output in 2021. Both gold and copper continued their gains overall last year. Despite the lasting impact of the Covid-19 pandemic, the average price for gold was $1,798.89 per oz. in 2021, up from $1,773.73 and $1,393.34 per oz. in 2020 and 2019, respectively.

According to the Silver Institute, global demand for silver surged in 2021. The average price for silver was $25.14 per oz. in 2021, up from $20.69 and $16.22 per oz. in 2020 and 2019, respectively. Silver demand increased in all categories last year, raising the annual total to 1.05 billion oz., an impressive 19% gain over 2020. The global silver demand is forecasted to reach a record 1.112 billion oz. in 2022.

To replace or be replaced

Next, Newmont and Barrick continue to play musical chairs for another year, with Newmont retrieving the second place it lost to Barrick in last year’s list. Barrick lost second place this year by merely $300 million in total revenue with revenues of $15.3 billion for Newmont and $15 billion for Barrick Gold. Both companies are gold producers and lead the domination of gold miners on this year’s list. Barrick is expected to continue with this strong performance in the future, especially with the latest news of them being close to a final deal with Pakistan on $7 billion Reko Diq copper-gold project.

Teck Resources continues to hold steady in fourth place overall with a whopping $13.5 billion in revenues, mainly assisted by its diversified output of copper, zinc, coal, and bitumen.

Next, First Quantum Minerals was able to hold on to the fifth place with over $9 billion in total revenue from copper, gold, and silver sales. Newcrest Mining is on the list for the again this year in sixth place with $5.7 billion. In seventh place for the third year in a row is Agnico Eagle Mines with $4.8 billion and a total of 8 operating mines in Canada.

The rest of the top 10 include Kinross Gold in with $4.7 billion in total revenue and dropping two spots from last year; Lundin Mining with $4.2 billion (the only other diversified miner on the list along with Teck Resources). Finally, with $2.5 billion comes Turquoise Hill Resources with a big leap from the eighteenth spot in last year’s Top 40.

The acquisitions boost

Sixth place Newcrest Mining, with $5.7 billion moved up the list from ninth in 2020. Newcrest received a boosting shot in the arm due to its acquisition of Pretium Resources, which was No. 28 on the list of 2020. As a result, Pretium is now part of Newcrest and its revenues are included in the latter.

The Aussie miner earned a spot last year due to its 70% share and position as operator of the Red Chris copper mine in British Columbia with the bulk of its revenues coming from mines in Australia and Papua New Guinea. The acquisitions, as well as the purchase of a gold prepay, streaming facility and offtake agreement on production from Lundin Gold’s Fruta del Norte mine in Ecuador, have served as Newcrest’s entry into North America. The company listed on the TSX in October 2020, thus becoming eligible for inclusion in CMJ’s Top 40.

Despite moving up one spot to the eleventh place this year, Yamana Gold will no longer appear on future Top 40 lists. On 11 July 2022, Gold Fields announced a market update regarding its proposed acquisition of Yamana Gold, including the intention to pursue a listing of Gold Fields shares on the Toronto Stock Exchange to provide shareholders additional flexibility, subject to the completion of the transaction.

New to the top 40

Several miners made the Top 40 despite not being on last year’s list. Capstone Copper and Lundin Gold are twenty-seventh and twenty-ninth, respectively. Both benefit from the continued strength of copper and gold. Victoria Gold, in fortieth place, is another gold miner that joined the Top 40 from last year’s runners-up list.

Other newbies include Fortuna Silver Mines (silver again), Calibre Mining, and Amerigo Resources in thirty-first, thirty-eighth and thirty-ninth, respectively. Finally, Gran Colombia Gold is off the list this year as it changed name to GCM Mining Corp and appears as thirty-sixth on the list.

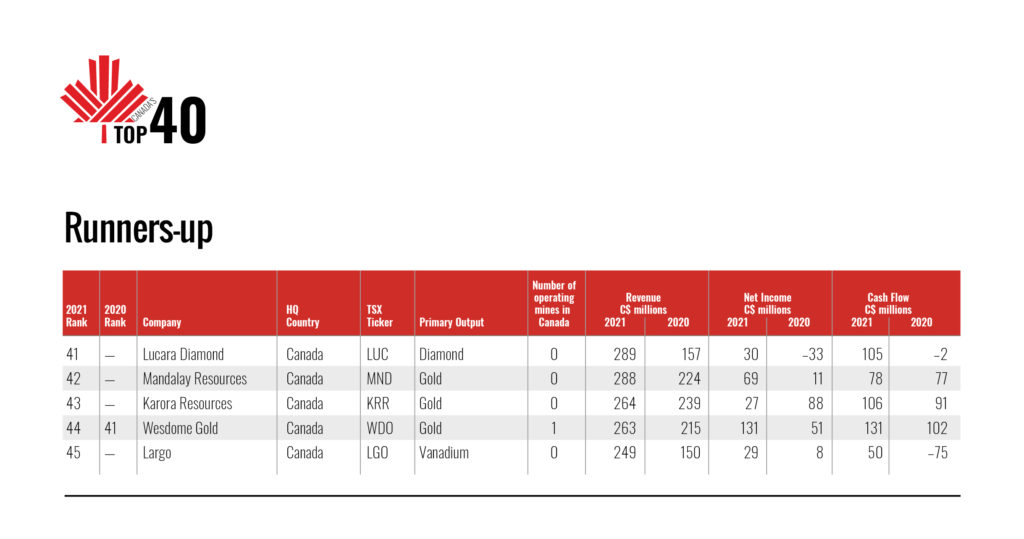

The runners-up

A list of five runners-up, including only Wesdome Gold from last year’s runners-up is below. It is worth mentioning that Wesdome Gold officially has only the Eagle River mine in production. Four new companies made it to the runners-up list for the first time: two gold miners (Mandalay Resources and Karora Resources) with the other two producing diamonds (Lucara Diamond) and vanadium (Largo).

The oilsands

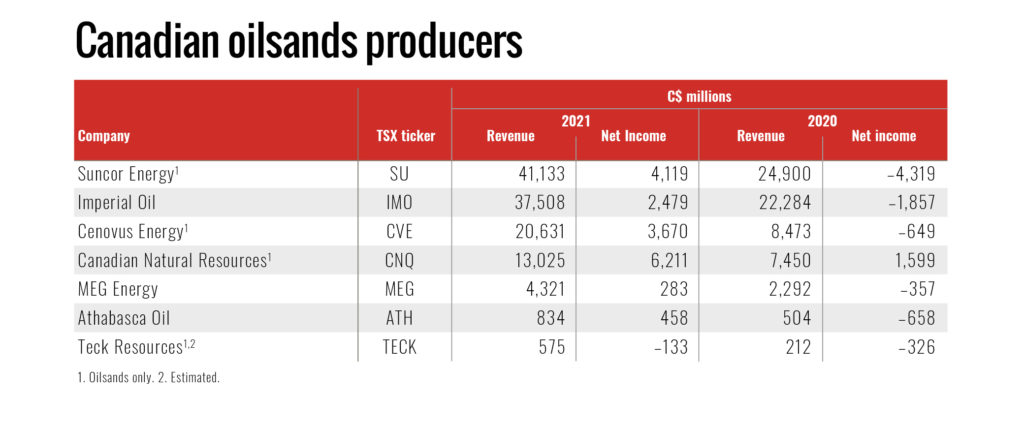

Canada’s oilsands sector is huge with revenues running into the 10s of billions. For this reason, we break their numbers out of our regular tables.

As shown in the table above, these operations saw tremendous revenue increases in 2021, compared to 2020 – generally 50% to 75% – most of which were due to improved oil prices. Part of the higher revenues was due to a 9.3% increase in production to 3.26 million bbl/day over the same time period. Or for the entire 2021-year, production totalled 517,600 m3, split roughly evenly between mined bitumen (up 7% to 253,000 m3) and steam-assisted gravity drainage (SAGD) (up 11.6% to 264,600 m3).

THE CRITERIA FOR CHOOSING THE TOP 40

To be eligible for CMJ’s Top 40 Canadian miners list, companies must meet two of the following three criteria:

1. Be domiciled in Canada.

2. Trade on a Canadian stock exchange.

3. Have a significant share of an operating mine or advanced development in Canada.

We have put extra effort into checking the eligibility of all the miners on the current list. However, we remain open to the suggestions of our readers.

Comments