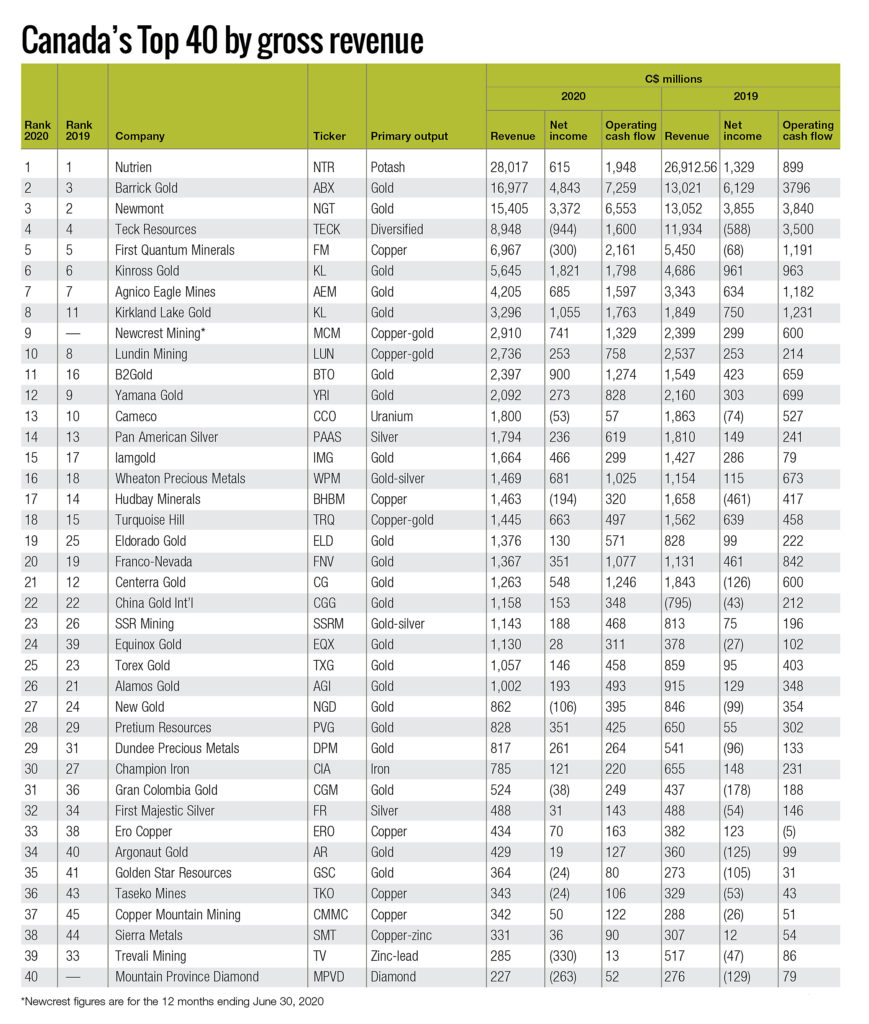

Ranking Canada’s top 40 miners: 2021 edition

Revenue of the top 40 climbs to $125B

The Canadian mining industry counted much success in 2020 despite a year that saw shutdowns due to the Covid-19 pandemic. Concerned about the health of its workforce and local communities, in many cases miners chose to temporarily suspend operations rather than risk spreading the virus. Temporary shutdowns continued throughout the year at individual sites as outbreaks occurred, but the industry as a whole weathered the interruptions and adopted new safety protocols without major production losses.

Long-time readers of CMJ’s Top 40 Canadian mining companies will not be surprised to note that once again potash producer Nutrien has taken the top spot with revenues of $28 billion. It was also the No. 1 revenue generator in last year’s list and in the previous year. Created in 2018, Nutrien combined the assets of both Agrium and Potash Corp. of Saskatchewan, both of which had dominated our list for a decade. (See last year’s Top 40 here.)

Being a potash producer may lack the prestige of being a gold producer, but we expect potash dominance to continue. There are 7.7 billion people – all of whom need to eat – living on our finite planet. Moreover, the amount of arable land is shrinking due to rising sea levels, warming climate and urbanization. As the population continues to grow, potash will remain a key means to getting the most food from our farmlands.

Gold and copper dominate

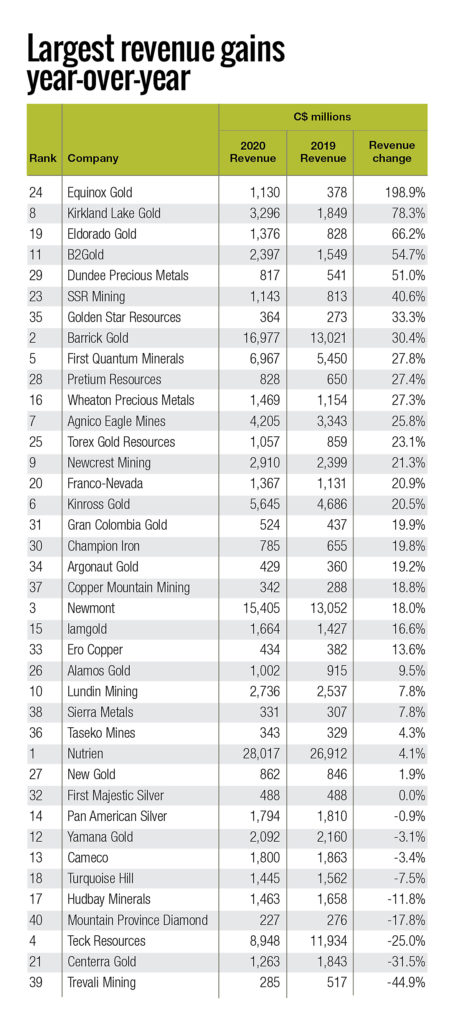

After Nutrien, the Top 40 are dominated by gold and copper miners. More than half of this year’s list – 23 companies – are primary gold miners. Three are copper-gold miners and nine primary copper miners. Together, they account for 87.5% of Canada’s biggest revenue-generating miners. Both gold and copper were winners overall last year, which saw the Covid-19 pandemic begin in earnest in March 2020. The gold price spiked above US$2,000 per oz. last August, driven by uncertainty around the pandemic and waves of stimulus spending globally. And while copper sunk to just above US$2 per lb. last March, it soared to US$3.50 by the end of the year and has hit US$4.70 in 2021 – boding well for copper miners in next year’s Top 40.

Continuing with the Top 40, gold miners occupy the next two slots on our list. Barrick Gold is No. 2 with revenues of $17 billion, and Newmont is No. 3 with $15 billion. The record high prices for the yellow metal in 2020 did not hurt either of these companies, and with prices remaining strong in 2021, both will likely be near the top of the list again next year.

The only truly diversified miner on our list is Teck Resources, holding down the No. 4 spot with $9 billion in revenues. The company reported sales last year of 277,000 tonnes of copper (with a value of $2.4 billion), 646,000 tonnes of zinc ($2.7 billion), 22 million tonnes of steelmaking coal ($3.3 billion), and 11.6 million barrels of blended bitumen (approximately $432 million). Teck is also a producer of germanium, indium, cadmium, silver, fertilizers, and industrial products.

Rounding out the 10 best revenue generators are copper and gold producers. At No. 5 is First Quantum Minerals with $7 billion from both copper and gold sales. Then come three gold producers: No. 6 is Kinross Gold with $5.6 billion; No. 7 is Agnico Eagle Mines with $4.2 billion; and No. 8 is Kirkland Lake Gold with $3.3 billion in revenues. More copper-gold producers follow: No. 9 Newcrest Mining with $2.9 billion and No. 10 Lundin Mining with $2.7 billion. All these companies maintain international operations in all corners of the globe.

While most of the other 30 miners on the list are copper and gold producers, there is also one uranium producer (Cameco at No. 13), two primary silver producers (Pan American Silver at No. 14 and First Majestic Silver at No. 32), one iron ore producer (Champion Iron at No. 30), and a diamond miner (Mountain Province Diamond at No. 40).

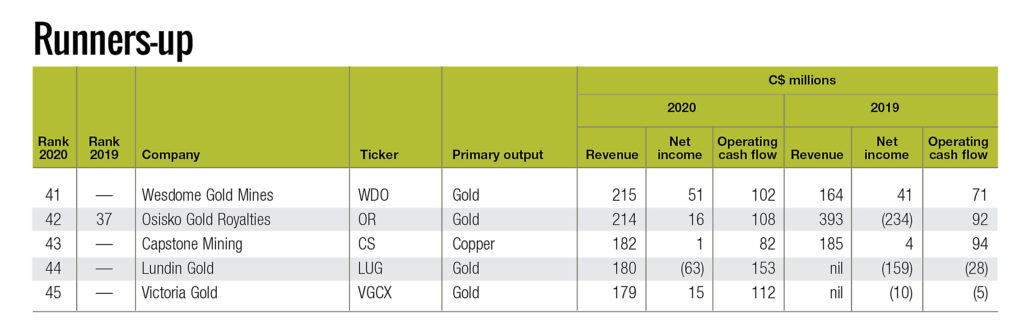

As is customary, we have also created a list of five runners-up, including new entrant Lundin Gold.

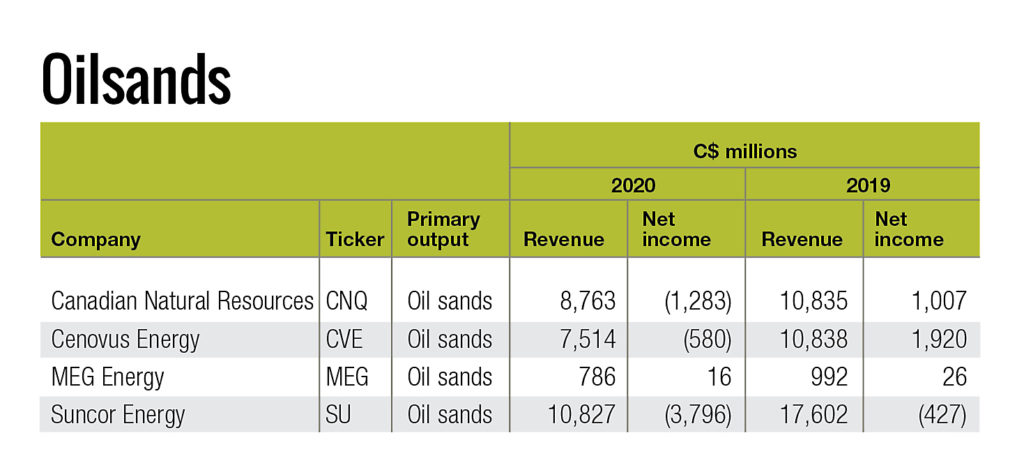

Again, this year we have segmented the oilsands miners. Their lot is not a happy one as oil prices tanked last year on collapsing demand, and continue to be under pressure with a global push away from fossil fuels and toward renewable energy. The four oilsands producers for which we could segregate Alberta production had total revenues of $27.9 billion. Despite billions in revenues, three out of four had net losses totalling $5.7 billion this year.

The Aussies are coming!

Looking to the future we see an influx of Australian miners to Canada. The potential richness of our resources makes this a country worth examining. The shift has already begun.

Newcrest Mining earned a spot at No. 9 by virtue of its 70% share and position as operator of the Red Chris copper mine in British Columbia. Undoubtedly, the bulk of its revenues come from mines in Australia and Papua New Guinea, but it is included for Red Chris and the fact that its shares now trade on the TSX.

At the risk of leaving some out, here are several other Australian companies taking a keen interest in Canada. Auteco Minerals is exploring the former Pickle Crow gold mine in northern Ontario; Santa Barbara bought out Atlantic Gold in Nova Scotia; Evolution Mining now owns the Red Lake gold operations in Ontario that are due for a renaissance, and recently bought Battle North Gold for its Bateman project; Galaxy Resources wants to mine lithium on the property it holds near James Bay in northern Quebec; Indiana Resources is 50% owner and operator of the St. Stephen nickel-copper-cobalt property in New Brunswick; Austral Gold owns the Clapperton copper-molybdenum property in British Columbia; and Sayona Mining plans to acquire North American Lithium and its Authier lithium carbonate project in Quebec. In addition, Vital Metals has high hopes for the Nechalacho rare earths project in the Northwest Territories, and Paladin Energy still holds the Michelin uranium exploration property in Labrador, although development is hampered by a ban on such projects in the province.

Several Australian companies also have interests in coal projects on the east slopes of the Rocky Mountains. They were granted leases last year when the Alberta gave the go-ahead to coal exploration and development. The province has since done an about-face, but the leases remain valid. What will ultimately happen remains unclear.

The environmental review panel for the Grassy Mountain colliery near Cranbrook, B.C., recently gave that proposal the thumbs down. The property is ultimately owned by Hancock Prospecting, headed by Australia’s richest woman, Gina Rinehart. Also in B.C. is the proposed Telkwa coal mine near the town of the same name and 90% owned by Allegiance Coal, another Australian company.

Whatever the outcomes of the individual Canadian projects in which they are interested, watch to see if more Australian companies find their way onto future Top 40 Canadian miners lists.

THE FINE PRINT

We recognize that revenues are an imperfect way of looking at companies, as they discount the value of near term expansions and development projects. Since the cutoff for our Top 40 can be close, we have also included a runners-up table to highlight other companies generating strong revenues. Please see also the criteria for our Top 40 eligibility, which is unchanged from past years.

Differences in reported revenue figures between this year and last are attributable to different exchange rates used to convert U.S. dollar figures for each year. For comparability purposes, note that cash flow from operations is calculated after changes in working capital.

Financial results are largely impacted by commodity prices and exchange rates. We use the Bank of Canada’s exchange rate when converting U.S. to Canadian dollars: for 2020 the average was US$1.00 for C$1.34. And because so many of our Top 40 miners are gold producers, for reference the average price of gold in 2020 was US$1,770 per oz., compared to US$1,393 in 2019.

HOW WE CHOOSE THE TOP 40

To be eligible for CMJ’s Top 40 Canadian miners list, companies must meet two of the following three criteria:

1 Be domiciled in Canada.

2 Trade on a Canadian stock exchange.

3 Have a significant share of an operating mine or advanced

development in Canada.

Sometimes we have been tripped up and non-Canadian miners shave slipped onto the list. However, we have put extra effort into checking the eligibility of all the miners on the current list. We remain open to the suggestions of our readers.

3 Comments

Ritchie

Watching a show Gold Rush… The American boys hire American boys to gold mine in the Yukon. Why don’t they hire Canadians or what percentage of Canadians work for foreign mining in Canada? Canadians can do what they do and maybe reclamation won’t look like a wasteland when completed. Let the Billions of dollars stay in Canada and help Canadians.

Rae Klaassen

All the information one could need with one click! Perfect

SYED BUKHARI

I AM SEEKING YOUR SUPPORT TO PROVIDE ME THE NAME OF EPC CANADIAN MINING COMPANIES WHO CAN PERFORM ENGINEERING AND CONSTRUCTION OF MINING SITES.

REGARDS,