The Top 40 can begin to breathe: 2017 edition

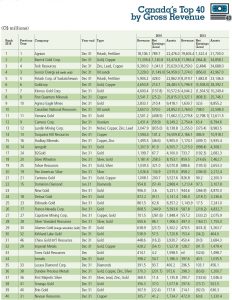

Although the economic outlook for Canadian miners brightened somewhat over the last year, this is still a difficult time to be profitable. A look at the current Top 40 ranking by gross revenue (all tables follow text) indicates that the biggest companies remain big, and there was little change from a year earlier.

Agrium again heads the list with gross revenue of $18.1 billion. The fertilizer producer rose to the top of the 2010 list – to the surprise of CMJ editors – and has pretty much stayed there. We shouldn’t be surprised though. A look through the previous 10 years shows Agrium climbing steadily through the ranks and always in the top 10.

With the merger of Agrium and Potash Corporation of Saskatchewan under the Nutrien name, Canada’s potash and fertilizer behemoth can be expected to top next year’s list, too. This year, PotashCorp had revenue of a $5.9 billion and ranked No. 5 in the Top 40 for the third year in a row.

The world’s largest gold producer, Barrick Gold, took the No. 2 slot with revenue of $11.3 billion. The company recovered 5.5 million oz. of gold, although the total has declined steadily from 7.2 million oz. in 2013. This is also the first time Barrick has recorded net earnings – $1.1 billion – in several years.

Teck Resources and Suncor Energy swapped places this year to round out the top five. Teck enjoyed revenue of $9.3 billion, sitting at No. 3. Suncor grossed revenue from its oil sands operations of $7.2 billion, making it No. 4.

The remainder of the top 10 contains only one new company – Canadian Natural Resources – that is now producing steadily from its Horizon oil sands project. Horizon is undergoing an expansion to 250,000 bbl/day of synthetic crude oil, so readers can expect to find CNRL near the top of the rankings next year. (Unless the oil price plummets.) Backing up a bit, in the No. 6 spot is Goldcorp, another of the world’s largest gold mining companies. It recorded revenues of $4.7 billion in 2016 and finished the year in the black. A very close No. 7 is Kinross Gold with revenue of $4.6 billion. Both held the same spots a year ago.

Again in the No. 8 spot is copper producer First Quantum Minerals. The company’s revenue was $3.5 billion, up a tidy $200 million from 2015. On the horizon is the Cobre Panama mine slated for commissioning in 2018 with annual copper production of roughly 300,000 to 350,000 tonnes. First Quantum owns 80% of the project and will benefit from the new source of revenue.

Watching Agnico Eagle rise through the ranking over the years has been satisfying. The company is up another notch this year to the No. 9 slot. The gold producer had 2016 revenue of $2.8 billion. Production from its 50% of the Canadian Malartic gold mine is a boon, as will be production from the Meliadine gold mine scheduled for startup in 2019.

The other half of the Canadian Malartic mine is owned by Yamana Gold, which had revenue of $2.5 billion, giving it the No. 11 spot. The company’s other producing mines are in South America, and it can look forward to initial gold production from the Cerro Moro gold-silver mine in 2018 at an annual rate of 150,000 oz.

It is with sadness that we note Dominion Diamond, No. 22 this year and No. 15 a year earlier, is going to be sold to a private group of companies in the United States. When that happens, the owner of Canada’s first diamond mine, Ekati, will no longer be eligible for our list (see page 26).

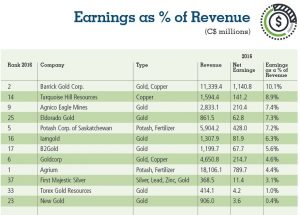

There’s money in gold

Overall, a quick glance at the primary output of the Top 40 seems to indicate that it is a good time to be a gold producer. Those that are on the list had more positive net earnings in 2016 than a year earlier. Barrick, Goldcorp, Agnico Eagle, Iamgold, B2Gold, New Gold, Eldorado Gold, Kirkland Lake, Torex, Semafo, Terango, Centerra, and Tahoe all registered black ink in the earnings column. Franco-Nevada, the gold streaming company, also finished in the black. Where a producer had a gold mine made little difference – one high grader in Canada or several scattered around the globe.

The gold price did not rise during 2016, but most of the gold producers either trimmed corporate debt or capital spending to conserve cash. Both strategies seem to have had beneficial effects.

Primary silver producers also did well. Streaming company Silver Wheaton, Silver Standard and First Majestic finished with positive net earnings. Their revenues were also up between about 20% and almost 40%.

Copper producers were some in the black and some in the red. Those that eked out positive earnings – Turquoise Hill, Nevsun and Imperial Metals – were outnumbered by those who didn’t, whether they were pure copper plays or had gold and/or other base metals as by-products.

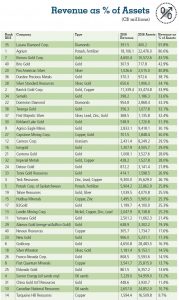

Another measure to examine is the amount of gross revenue measured against a company’s assets. Once again, the primary gold producers peppered the list with that calculation between 11% and 29%. The measure might not mean much as nearly half of the Top 10 are primary gold producers.

It was difficult to compare year-over-year net earnings because there were only four companies out of the 40 that registered earnings in both 2016 and 2015. There were three gold producers – Eldorado, Centerra and Semafo – and one silver streaming company – Silver Wheaton.

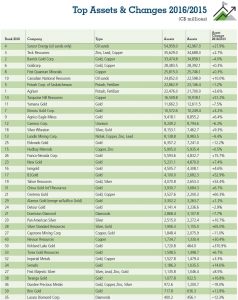

To shift gears and consider the size of Top 40 companies’ assets, those at the top of the list are producers of almost all commodities produced in Canada. Suncor Energy with its oil sands assets worth $55 billion tops the list, followed by base metal producer Teck Resources with $35.6 billion. The gold producer with the most assets is Barrick ($33.5 billion), followed closely by Goldcorp ($28.4 billion).

Only uranium (Cameco with $8.3 billion), nickel (Lundin Mining with $8.1 billion), and diamonds (Dominion Diamond with $2.9 billion) were not part of the largest 10 asset holders group.

The Runners-up

We have also listed 15 runners-up to the Top 40. Again, gold producers are over represented. There is Banro No. 41, Golden Star No. 42, Primero No. 43, Klondex No. 47, Guyana Goldfields No. 50, Gran Colombia No. 52, Aura Minerals No. 54, and Argonaut Gold No. 55. Two of those – Klondex and Guyana Goldfields are newcomers to the list. Perhaps they will continue to rise through the ranks a year from now. Copper Mountain and Taseko, both copper producers, also made the runners-up list.

We at CMJ are proud of all the Top 40 Canadian miners. Congratulations to all, and we look forward to seeing what changes next year as mergers and sales are completed.

Comments