Supply-demand balance, technology, and circular economy in emerging ecosystems

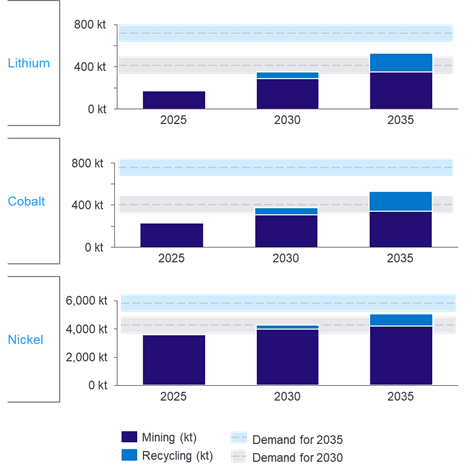

Currently, the demand for battery metals is mostly driven by EV OEMs and green energy producers with both sectors expected to grow double digits within the next decades. For instance, our research showed that of Canadians looking to purchase a vehicle in 2022, nearly half were considering an EV; that is up 11% from 2021. In addition, green energy producers are creating increasing demand for reliable energy storage solutions to ensure the stability of the grid. This demand will, in turn, translate to the demand for batteries and for battery metals. With that, mining volumes will need to grow by approximately 15% per year for lithium and 5% per year for cobalt and nickel. Figure 1 illustrates the potential balance of supply and demand for battery metals over the next decade.

Model source: Hauke Simon, senior manager in EY Berlin and Patrick Kreidi, manager EY Montreal.

Anticipate changes that could fluctuate demand

It is important to note that this supply and demand gap is highly sensitive to various factors, such as future growth in EVs and green energy, depth of recyclability of retired batteries, potential local regulations that may have a sizable impact on concentrated mining and smelting, and shifts in battery technologies. Not surprisingly, even a small shift in EV sales could influence demand for all three metals. However, larger swings are also possible. Regulators could catalyze or slow down adoption by providing incentives, the cost of EV ownership may fluctuate, or customer behaviour could pivot.

Technological changes could also impact the metals supply and demand balance significantly. Cobalt-free technologies (for example, LFP batteries) are expected to be gaining market share. The current 70:30 split between NCM and LFP is forecasted to move towards a more even 50:50 distribution within the next decade. If this shift towards LFP or hard electrolyte cobalt-free technology speeds up, this could eliminate expected shortages of cobalt and nickel in 2035 and onward. Similarly, an increase in battery lifespan could lead to a tighter market as fewer retired batteries would be available for recycling.

All these factors reinforce the importance for ecosystem players to regularly monitor the market, forecast future demand and make necessary adjustments to their strategies, if needed.

Do not overlook the circular economy

Retaining and reusing battery minerals at the end of the battery’s life seems like a no brainer, opening an opportunity of new commercial models for battery disposal. While Canada’s track record for such an opportunity is slim, electric vehicles could change that. Their batteries are too toxic, too large and too valuable to simply throw away. The global EV revolution has brought about a new recycling industry that hopes to capitalize on this future waste problem and help solve a looming minerals shortage.

Traditionally, mining operations follow a linear process of take (mine), make (process), and dispose. Recycling in a circular economy rounds off this process to instead take, make, use, and recycle/reuse. In other words, ore is mined and processed, but opportunities to create by-products from waste that can be used within mining or in other industries are an integral part of the process. Many markets are exploring circular economic principles to increase mineral and metal self-sufficiency.

We have seen Glencore make headway with its smelting and refining assets that allow a wide range of recyclable materials to be processed, especially end-of-life electronics, batteries, and battery metals.

The circular economy offers opportunities for mining and metals companies to take ownership of their products throughout their lifecycle, finding ways to unlock new value. For example, a company that mines battery minerals can also play a role in ensuring they are retained and reused at the end of the battery’s life. Stewardship of minerals throughout their lifecycle can be an excellent differentiator for companies, particularly while recycling continues to develop.

As industry players navigate the everchanging battery metal world and brace for the technology evolution, they must ensure that the circular economy is leveraged to the utmost.

Dzmitry Bianko is an EY-Parthenon strategy partner and the chemicals leader for Canada. For more information visit www.ey.com/en_ca/mining-metals.

Comments