Strolling down Ontario’s Electric Avenue

The global demand for lithium is projected to reach 1.5 million tonnes of lithium carbonate equivalent (LCE) by 2025 and over three million tonnes by 2030. As the world moves away from fossil fuels, the world needs a stable supply of quality lithium to achieve a low-carbon future, and Canada needs lithium (among other critical minerals) to achieve its net-zero target.

In 2022, the government of Ontario announced its first critical minerals strategy, aiming to secure the province’s position as a global leader of responsibly sourced critical minerals, including lithium. The provincial government plan is to work alongside all stakeholders including the federal government, the mining sector, manufacturing Indigenous Peoples, and local communities.

The strategy involves six pillars, or areas of government action, including the following:

- i enhancing geoscience information and supporting critical minerals exploration;

- ii growing domestic processing and creating resilient supply chains;

- iii improving Ontario’s regulatory framework;

- iv investing in innovation, research, and development;

- v building economic development opportunities with Indigenous partners; and

- vi growing labour supply and developing a skilled labour force.

The northern Ontario mining industry is destined to play an important role in the province’s critical minerals strategy as a supplier of nickel, cobalt, and lithium to southern Ontario’s auto industry.

Several lithium junior miners operate in a different space than precious and base metal exploration companies, and their work led to the emerging premium lithium mineral district located in Ontario being dubbed the “Electric Avenue.” The area contains some of North America’s highest-grade lithium-bearing rocks.

Pegmatites form thick seams called dikes that intrude into other

rocks and can measure anywhere from a few centimeters to

hundreds of meters. Within Pegmatites is a lithium-bearing

mineral known as Spodumene.

Lithium mining technology

The two common methods for mining lithium are brine extraction (predominantly in South America, and it is water-intensive) and hard rock mining of spodumene, with subsequent lithium chemical conversion. Spodumene is a mineral that contains lithium. It is a proven source material for lithium chemicals and subsequent battery production. Hard rock/spodumene is usually extracted via conventional mining techniques. Blocks of mineralized pegmatite are then crushed, and sent to dense media separation and flotation tanks, where ore minerals are separated. Water and gravity are the primary means to separate the spodumene to form a “spodumene concentrate,” which is sent to chemical plants (lithium conversion plants) for conversion to lithium chemicals.

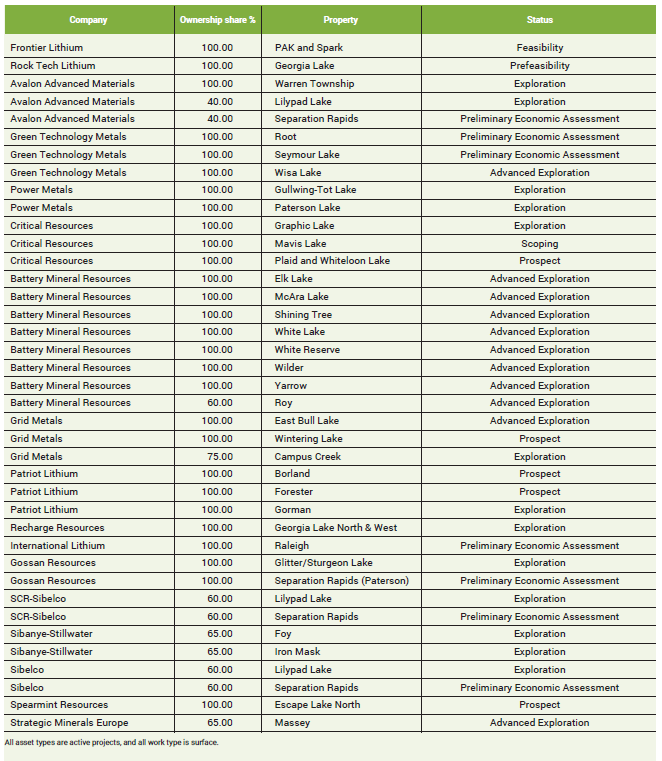

Table 1. Current lithium projects in Ontario, ownership, and status of the project.

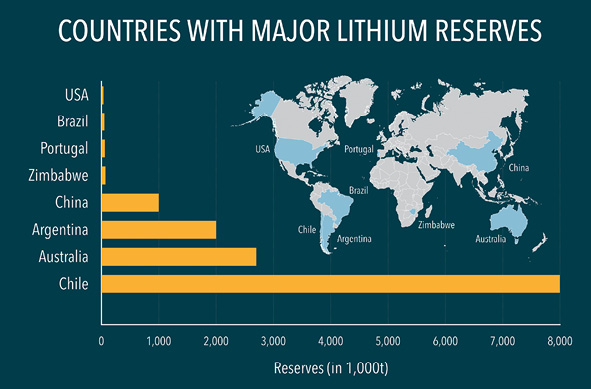

So far, northern Ontario has not seen any mining of lithium, but deposits of lithium bearing pegmatites in the northwest are now being targeted by several exploration companies. As a result, northwestern Ontario is now a rapidly emerging lithium exploration powerhouse, with an ongoing land acquisition fever by several junior mining companies. Ontario could soon emerge as a big player in lithium production, which could help reduce the global lithium market’s volatility, caused by the dependence on current leading suppliers, such as the “lithium triangle” stretching across Bolivia, Argentina, and Chile (recently, Indigenous communities in northern Chile agreed to lift roadblocks that have restricted access to the country’s giant lithium operations), and Australia, China, and Nevada in the U.S.

Sadly, none of the properties in Ontario is currently in the production stage or even close. Table 1 shows two properties (PAK and Georgia Lake) in feasibility and prefeasibility stages, respectively, 10 properties in advanced exploration, nine in exploration, five in preliminary economic assessment (PEA) or scoping, and finally, four prospects: Plaid and Whiteloon Lake, Wintering Lake, Borland, and Forester, with the last two 100-owned by Patriot Lithium.

The companies

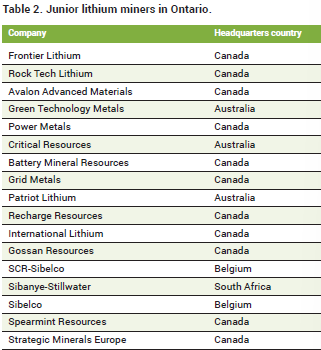

The properties are mostly owned by Canadian companies: 11 out of 17 companies have headquarters in Canada, as shown in Table 2. These Canadian companies own 24 properties in total, with Battery Mineral Resources owning or co-owning eight properties, all of them in advanced exploration. Australia-based miners also have sound presence on the list in Table 2, with three companies: Green Technology Metals, Critical Resources, and Patriot Lithium. The Aussies combined own nine properties at 100%, including only one property in advanced exploration (Wisa Lake, owned by Green Technology Metals). Finally, there are two companies from Belgium and one from South Africa.

Ontario’s rise as a lithium powerhouse could stabilize current market volatility.

The province’s push to develop “Electric Avenue” aligns with

the global market’s increasing demand for battery metals,

essential for electric vehicles (EVs) and renewable energy storage.

Frontier Lithium is an exploration and development mining company with headquarters and assets in northern Ontario, a tier-one mining jurisdiction. The company’s PAK project represents the largest proven land position in the new, premium lithium mineral district, with a high-grade, large tonnage, and pure lithium resource. Strategically located near the United States border, Frontier is developing the first fully integrated lithium mining-and-processing operation in Ontario with an aim to become a significant supplier of spodumene concentrates and battery-grade lithium hydroxide to the growing electric vehicle and energy storage markets across North America.

Recently, Frontier has commenced a preliminary economic assessment study targeting the manufacturing of battery quality lithium hydroxide in the Great Lakes region to support electric vehicle and battery supply chains in North America. Frontier maintains a tight share structure with management ownership approximately 30% of the company.

Rock Tech is another Canadian cleantech company with a mission to produce lithium chemicals for EV batteries. The company aims to serve automotive customers with high-quality lithium hydroxide made in Germany.

Recently, Rock Tech Lithium announced that it is undertaking a non-brokered offering of approximately 7.7 million units of the company at C$1.30 per unit to raise aggregate gross proceeds of C$10 million ($7.3m). Half of the gross proceeds (C$5 million) are intended to finance the continued exploration and development of Rock Tech’s Georgia Lake lithium project in Ontario, including exploration drilling programs and planned consolidation of adjacent properties.

Georgia Lake is a key part of Rock Tech’s integrated strategy. The project contains over 40% of the published Mineral Resources in the Thunder Bay District and the newly added Boston Lake mining claims offer another opportunity to further expand. In the last few months, the Georgia Lake project has advanced significantly.

So far, no lithium refineries exist in Canada to convert lithium oxide into an upgraded battery-grade material called lithium hydroxide, companies like Avalon Advanced Materials are working to bridge that gap and become mid-stream processors. The company’s 100%-owned Separation Rapids property is approximately 70 km by road north of Kenora, Ont. The property consists of 19 mineral claims and one mining lease covering a combined area of approximately 4,414 hectares in the Paterson Lake area, Kenora Mining Division, all of which are 100%-owned by Avalon. It is worth noting that Separation Rapids lithium project has the potential to produce high purity lithium compounds for two distinct markets: a specialty mineral product for high strength glass-ceramics and lithium battery materials, notably lithium hydroxide.

The Separation Rapids’ Big Whopper pegmatite deposit is one of the largest “complex-type” lithium-cesium-tantalum (LCT) pegmatite deposits in the world, unusual in its enrichment in the rare, high purity lithium alumino-silicate mineral petalite. Petalite is the preferred lithium mineral feedstock for several high strength glass-ceramic products for technical reasons, including its low level of impurities.

Last June, another junior player, Maverick Capital, announced that it has entered into a definitive mineral property acquisition agreement, pursuant to which it proposes to acquire the Northwind Lake property, a lithium pegmatite exploration project located in the Electric Avenue lithium district, located approximately 10 km north-northwest of the Frontier Lithium PAK lithium deposit in the Red Lake mining division in Ontario.

The Aussies are here!

The recent expansion of Patriot Lithium’s footprint (Patriot Lithium fully owns Gorman and recently added two other prospects: Borland and Forester) and the ongoing development of Frontier Lithium’s PAK project are expected to inspire further investments and exploration within the corridor.

Earlier in Jan. 2024, Patriot Lithium secured rights over an additional 536 km2 in one of the largest and highest-grade lithium deposits in North America: the Electric Avenue. Patriot Lithium’s portfolio in Ontario comprises multiple highly prospective hard rock lithium projects.

Including Patriot’s Gorman project, the Aussie miner will own the largest claim in the “Electric Avenue,” with a regional claim package exceeding 890 km2.

Managing director, Nicholas Vickery, said that adding the Berens and Borland areas positioned Patriot as a major player in “one of the most exciting lithium regions in the world.”

In 2022, Australian Critical Resources secured 1,200 more hectares in Ontario’s “Electric Avenue” to expand its Plaid lithium project.

An aggressive works program is already well underway to identify drilling targets in the region, with pegmatite mineralisation observed across Plaid and Whiteloon Lake projects. The mapped pegmatites follow the same northwest/southeast trend of Frontier Lithium’s PAK, Spark, and Bolt battery mineral deposits.

Finally, another Australia-based junior miner, Green Technology Metals, hopes to begin producing lithium from its 100%-owned Seymour project near Armstrong, 250-km northeast of Thunder Bay, by the first quarter of 2024. The property has an estimated resource of 9.9 million tonnes of lithium oxide grading 1.04%. Other lithium properties in its portfolio include Root, 300-km northwest of Thunder Bay, and Wisa, 100-km east of Fort Frances.

UPDATES ON SOME LITHIUM PROPERTIES

Frontier Lithium’s PAK

The PAK lithium deposit contains some of North America’s largest and highest-grade lithium-bearing pegmatites in the form of a rare low-iron spodumene and is the largest in Ontario by size. The deposit is located 175 km north of Red Lake, Ont. The deposit has a strike length of 500 metres and a depth of 300 metres with a true width varying between 10 metres and 125 metres.

The project is 100%-owned by Frontier Lithium, a Sudbury based, publicly listed, junior mining company with the largest land position in the Great Lakes region of northern Ontario known as the Electric Avenue. The Project has significant upside exploration potential.

- The total resource (measured, indicated, and inferred) of the PAK deposit is 9.3 million tonnes grading 2.06% lithium oxide (Li2O). The deposit remains open at depth and along strike. The inferred resource is 2.8 million tonnes at 2.22% Li2O.

- Spark deposit is estimated to contain 14.4 million indicated tonnes at 1.40% Li2O and 18.1 million inferred tonnes at 1.37% Li2O.

- The Channel sampling in the two other pegmatite occurrences in the area (Bold and Pennock) returned grades of 1.51% and 1.96% Li2O, respectively.

The project encompasses close to 27,000 hectares and covers 65 km of the avenue’s length and remains largely unexplored. Since 2013, Frontier has delineated two premium spodumene-bearing lithium deposits (PAK and Spark), located 2.3 km apart. The project exploration continues through two other spodumene-bearing discoveries: the Bolt pegmatite (located between the PAK and Spark deposits), as well as the Pennock pegmatite (a further 30 km northwest of PAK deposit within the project claims just east of the Manitoba border). A 2023 pre-feasibility study: “National Instrument 43-101 (NI 43-101) Technical Report PFS PAK Lithium Project,” authored by BBA E&C Inc., delivered a 24-year project life, at a post-tax NPV (8%) of US$1.74 billion and internal rate of return of 24.1% as per the press release disseminated on May 31, 2023.

Georgia Lake

The mine site is Located 160 km northeast of Thunder Bay. Georgia Lake is planned as an open-pit and underground mining project, anchored by indicated mineral resources of 10.6 million tonnes grading 0.88% Li2O and inferred resources of 4.2 million tonnes grading at 1% Li2O.

The history of Georgia Lake: Several operators worked on different targets in the 1950s to discover strategic metals. A comprehensive drilling program was carried out in 1 955 and 1956, investigating the spodumene pegmatites after these had been discovered during prospecting work, seeking a potential source of the lithium mineral.

In November 2022, Rock Tech announced the results of a pre-feasibility study (PFS) completed for its 100% owned Georgia Lake spodumene project located in the Thunder Bay mining district of Ontario. The PFS strengthens previous engineering studies and supports an open pit and underground mine operation and the construction of a 1,000,000 t/y spodumene concentrator. The positive results indicate a pre-tax internal return rate of 47.8% and a pre-tax net present value of US$ 223 million for the Georgia Lake project.

According to prefeasibility study, the project has an after-tax net present value of $146 million (at a discount rate of 8%) and an internal rate of return of 36%. The mine would cost $192.2 million to build, with sustaining capital costs of $98.5 million including closure after a nine-year mine life.

In May 2023, Rock Tech announced the expansion of its exploration potential in the Thunder Bay by entering into an option agreement to acquire a 100% undivided interest in the Boston Lake claims. Adding to the company’s Georgia Lake project, these claims will expand Rock Tech’s footprint in a region that is already well-known to the company.

“The Georgia Lake project contains over 50% of the published mineral resources in the Thunder Bay district and the Boston Lake mining claims offer an exciting opportunity to expand our exploration footprint,” said Robert Macdonald, general manager at Rock Tech’s mining entity.

The company asserted that the agreement and the Georgia Lake project demonstrate Rock Tech’s continued growth in the market. To further support this development, CIBC, a longstanding participant in the mining industry, is serving as Rock Tech’s strategic advisor that will help selecting a strategic partner to jointly advance Georgia Lake project by managing the process intended to identify partners for the development and further exploration of the mine project.

Moreover, after reaching a high level of engineering maturity for its Guben Converter in Germany, Rock Tech is now implementing its strategic vision to build several lithium converters in Canada. The company has decided to accelerate the planning for its Canadian converter, aiming for a start of production in 2027. Rock Tech has also relocated its Canadian headquarters to Toronto.

Mavis Lake

Australian miner, Critical Resources is developing critical metals projects in Canada. The company holds a suite of lithium prospects across Ontario, including Mavis Lake, Graphic Lake, Plaid, and Whiteloon Lake.

The company’s primary objective is the rapid development of its flagship Mavis Lake lithium project. The Mavis Lake Project area includes the primary claims area that was acquired by Critical Resources in January 2023 and new claims that were acquired in late 2023.

This major lithium project is located approximately 19 km east-northeast of Dryden in northwestern Ont., providing a logistics and support base for a low-cost operation during the exploration and development efforts, supported by local resources such as hospitals, airport, and a high quality, clean hydropower produced by Ontario Power Generation and delivered to the community through a robust distribution network managed by Hydro One Networks.

Critical Resources holds 1,097 individual claims that form a single, contiguous block covering approximately 22,984 hectares of land, with a geological setting, highly prospective for lithium. The First Nations in the area are Wabigoon Lake Ojibway Nation, Eagle Lake First Nation, Naotkamegwanning (Whitefish) Nation, Lac Seul First Nation, and Metis Nation of Ontario.

Critical Resources completed over 19,500 meters of drilling in 2022 that delivered some of the highest lithium assay results reported by any Australian hard-rock lithium company.

Mavis Lake has a mineral resource estimate of 8 million tonnes at 1.07% Li2O and has near-term development potential. Critical Resources has completed over 30,000 metres of drilling at Mavis Lake and continues exploration and drilling to increase the resource base. The company has also commenced technical studies and environmental monitoring programs that will lead to the transition from exploration to development.

Finally, the project has immediate road accessibility to Trans-Canada Highway 17 and the rail network that stretches across Canada and has links to the northern U.S., providing inbound and outbound logistics routes for major equipment, mining fleet, and other product logistics. Utilizing the deep-water port and shipping lanes from the nearby port of Thunder Bay will help to reach any number of downstream customers and will make it a part of a supply chain that supports the North American and European Electric Vehicle industry.

Graphic Lake

Another project that is 100%-owned by Critical Resources. Located 55 km south-east of Kenora, Ont., Graphic Lake is situated in the Sioux Lookout Domain of the Wabigoon Terrane in north-west Ontario. The property hosts a pegmatite swarm trending NE/SW, over an estimated strike of 5.5 km controlled by the foliation of the metasedimentary host rock. These pegmatites exhibit elevated levels of Rare-Earth-Elements (REE) consistent with LCT pegmatites. LCT pegmatites account for roughly one quarter of all lithium production, most of the tantalum production and all caesium production globally.

Access to the property is favourable along gravel/dirt roads trending east/west from Highway 71. Further infrastructure to site such as electricity is also favourable with powerlines present across the property.

Seymour Lake, Root, and Wisa Lake

Australia-based company Green Technology Metals’ flagship Seymour project is located near the township of Armstrong and approximately 230 km north of the city and port of Thunder Bay. Seymour is rapidly moving from exploration to development to be construction ready by 2024. The project covers the Archean Green Stone belt, highly prospective for LCT pegmatites and hosts a mineral resource of 9.9 Mt at 1.04% Li20.

The project remains largely underexplored with focus on accelerated drilling and development activities on the Aubry deposits in the Southern Seymour tenement area to fast-track the project into production.

The Gorman project

In addition to their lithium properties in Quebec, Patriot Lithium’s Gorman project (506 km2) covers 72 multi-cell mining claims for a total area of approximately 320 km2. The Electric Avenue lithium district contains several LCT pegmatites over a total strike length of at least 60 km with potential for additional discoveries along strike to the NW and SE. Patriot’s Gorman project is located approximately 60 to 65 km to the NW of Frontier Lithium’s PAK, Spark, and Bolt LCT pegmatites and about 39 km from Frontier Lithium’s Pennock Lake LCT pegmatite. Additional LCT and rare metals pegmatites, recently identified by Midex Resources occur within 2.5 to 23 km of PAT’s Gorman project.

Comments