Sorting through the heap

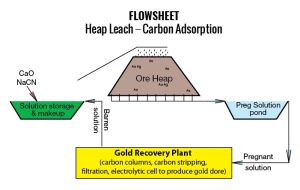

Heap leach flowsheet Credit: CostMine

The business of mining has always been a romantic dream; gold is the shiniest of them all. These are exciting times for gold producers as the gold price has increased from an average of US$1,160 per oz. in 2015 to over US$1,900 per oz. in 2020, briefly breaking above US$2,000 per oz. in early August.

The number of projects currently in the pipeline have increased by over 16% in the last five years as a direct result of the hot gold market. Worldwide, heap leaching accounts for about 46% of all gold currently produced, and the rising gold price is making heap leach projects more attractive.

A recent study by CostMine focused on the costs and challenges when developing gold heap leach projects. This study looked at 375 projects worldwide that currently recover gold from heap leach technology, or anticipate doing so, either as the sole source of gold production or combined with milling of ores by other processes. The average grade at 275 of these projects and operations ranged from 0.11 to 6.91 g/t gold, with an average of 0.7 g/t gold.

With rising gold prices, it is expected that more projects will become economic. But how does the miner or investor evaluate these projects, and what are the costs?

Cost considerations

It sounds simple: mine the ore, find a place to stack it up and then sprinkle with a cyanide solution, and recover the gold from the cyanide. Easy right? Not so fast. Every mine is different and many of these ores will require special treatment to maximize the gold recovery.

There are multiple factors that have to be addressed when evaluating a heap leach project. Some of these include the basics of extracting the ore from the mine and then determining the appropriate leaching and recovery methods.

One of the advantages of heap leaching versus conventional milling and using either carbon-in-pulp (CIP) or carbon-in-leach (CIL) for gold recovery is the lower cost. However, along with that lower cost comes a lower recovery rate. Gold recovery is also usually only about 55% to 75% compared with roughly 90% recovery in an agitated leach plant. Therefore, heap leaching shines where ores are lower grade and cannot justify the higher capital and operating costs in methods such as CIP and CIL.

Another factor to consider is the time that it takes to produce gold from a heap leach. Heap leaching can take anywhere from a couple of months to several years, compared to the 24 hours required by a conventional CIP or CIL process.

CostMine’s Gold Heap Leach Cost Estimating Guide, published this year, serves as a valuable reference to evaluate the cost, feasibility, design and operations for gold heap leach operations. The guide contains cost models of mining and processing, in addition to addressing several technical topics on gold heap leach not available elsewhere.

Example

For this article we will focus on the capital and operating costs from one of the production rates available in the Guide, using the following assumptions.

This gold heap leach project is assumed to be an 15,000 t/d open pit mine in areas of moderate relief with warm summers and snowy winters in North America.

The following construction activities are included for this example model:

Surface Mine:

• Drilling, blasting and excavating of ore, waste and overburden

• Hauling of ore by truck out of the pit and to a mill site

• Hauling of waste and overburden out of the pit and to a dump site

• Construction, installation and operation of facilities and equipment necessary for equipment maintenance and repair, electrical systems, fuel distribution, water drainage, sanitation facilities, offices, labs, powder storage, and equipment parts and supply storage

Heap Leach Pad and Pond Construction:

• Site excavation, contouring, and preparation

• Underliner and leak detection system

• Pad and pond installation using synthetic liners

• The equipment and supplies required to distribute barren solution to the heaps and to collect and return the pregnant solution

Merrill-Crowe Plant:

• Reagent delivery and preparation systems

• Pumping and piping infrastructur de–signed for caustic use

• Pressure clarification circuit

• Deaeration system

• Plate and frame filter recovery circuit

• Make-up solution preparation and storage system

• Plant building

Our model also recognizes that as we mine deeper into the pit, the stripping ratio changes, which is reflected below. The increase in waste production also requires additional equipment, supplies and staff as the mine matures. Overall, the average stripping ratio for the life of mine is 3 tonnes of waste for each tonne of ore.

Stripping ratio

• Years 2 through 4 1:1 waste to ore

• Years 5 through 7 2:1 waste to ore

• Years 8 through 10 4:1 waste to ore

• Years 11 through 13 6:1 waste to ore

Development assets (buildings, haul roads, etc.) are designed for the fleet size during the final stage of production.

The following is scoping level estimate of the project outlined above.

At this point, we turn to the impact on the economic viability of this theoretical project by running a sensitivity analysis on the gold price using the Apex for Economic Analysis Software for Mining Projects, available from CostMine. It is no surprise that as the price of gold goes up, the potential profitability for heap leach operations increase.

But as the gold price rises and miners dust off projects that were not profitable a few years ago when the price of gold was lower, it is important to note that the price of gold fluctuates widely and a careful analysis of historical gold prices is crucial to selecting a gold price that will at least break even in leaner years to ensure the potential success of the project.

As the sensitivity analysis shows, this theoretical project would not be considered at a gold price of US$1,000 per oz. As noted above, the 2015 gold price averaged just US$1,160 per oz. For the last 15 years, the price of gold has averaged US$1,137 per oz. Based on the analysis above, would this project make the cut?

As cost estimators, considering the gold price is just one of the many factors that can make or break a project. While we simply looked at the gold price in this article as a variable, so many other factors need to be analyzed to develop a successful gold heap leach mine. Investing in mining is expensive and it is clear that miners and investors need to take the long view on all costs and factors when evaluating projects.

This data and more can be found in CostMine 2020 Gold Heap Leach Cost Estimating Guide, available at www.costmine.com. Please contact us for more information at info@costmine.com.

Comments