Seabridge seeks base metal major for KSM development

Something very interesting is happening in the scenic mountains of northwest British Columbia. That’s where Seabridge Gold is defining its KSM copper-gold project near Stewart.

The KSM camp.

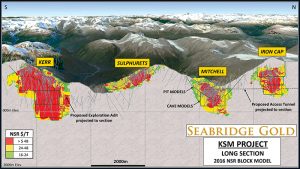

KSM stands for Kerr-Sulphurets-Mitchell, the three deposits originally outlined on the property. But given Seabridge’s success at drilling new mineralization, we might add Iron Cap and Deep Kerr to the alphabet. (No, that becomes unwieldy.)

So we will stick with KSM, a project with the potential to be the largest mine in Canada if the option of a 170,000-t/d concentrator is built.

“KSM is one of the few projects in the world that is shovel ready,” chairman and CEO Rudi Fronk told CMJ. All the necessary permits are in place to begin construction and build the tailings storage facility.

The company has also negotiated a benefits agreement with the Nisga’a Nation, who have thrown their support behind the project. As have the mayors and councils of Smithers and Terrace, BC.

Long section of KSM. (Image: Seabridge Gold and Google Earth)

Seabridge makes no secret of the fact that it is seeking a joint venture partner to develop the project with a price tag of either $5.0 billion or $5.5 billion.

“KSM needs a major base metal company as a JV partner. We’ve already signed confidentiality agreements with 10 of them,” said Fronk. “The big companies are willing to pay up from for a life-of-mine copper concentrate contract.”

The Seabridge team has outlined reserves of 14.5 million oz Au and 10 billion lb Cu – so far.

He added that Seabridge has turned down joint venture proposals in the past. The company is being picky about what its participation and share of the profits will be.

“It might even come down to our taking a gold stream and the major company taking all the copper,” Fronk speculated.

“One of the key metrics in any joint venture will be that the major only earns its interest if it takes the project through to production by a certain date,” he insists.

The KSM project is a world beater: in terms of both copper and gold reserves it contains more metals than any other project on the globe (and that includes Agua Rica, Galore Creek and Donlin). With 45 million oz of gold in reserves, Seabridge would be among the 10 largest gold companies (between AngloGold and Goldcorp). And the property contains more than 10 billion lb of copper.

Getting the goods

Seabridge began assembling the KSM property in the late 1990s when it could acquire the assets for pennies on the dollar. The total outlay was only $15 million, and the company later sold off some of the assets for $50 million. The original property, consisting of the Kerr and Sulphurets deposits, was optioned to Noranda (later Falconbridge) in the early 2000s, but Seabridge regained 100% ownership in 2006 with a shares-and-warrants deal.

Cutting diamnd drill core.

With the release of the maiden Mitchell resource estimate the following year, all two million warrants were exercised putting $27 million in the Seabridge treasury, and the company hasn’t looked back. With the discovery of the Iron Cap deposit and the North Mitchell and Deep Kerr zones, KSM now estimated to contain 49.8 million oz of gold and 13.6 billion lb of copper in its measured and indicated resources. There are also inferred resources containing an additional 30.8 million oz of gold and 19.2 billion lb of copper.

Careful examination of core.

Fronk estimates that Seabridge will have spent $240 million at KSM by the end of this year for exploration, permitting and engineering.

The geological potential keeps the drills turning.

The property lies within an area known as Stikinia, which is a terrain consisting of Triassic and Jurassic volcanic arcs that were accreted onto the Paleozoic basement. Early Jurassic sub-volcanic intrusive complexes are scattered through the Stikinia terrain and are host to numerous precious and base metal-rich hydrothermal systems. These include several well-known copper- gold porphyry systems such as Galore Creek, Red Chris, Kemess, Mt. Milligan, and Kerr-Sulphurets.

The Kerr deposit is a strongly deformed copper-gold porphyry, where copper and gold grades have been upgraded due to remobilization of metals during later and/or possibly syn-intrusive deformation. Alteration is the result of a relatively shallow, long lived hydrothermal system generated by intrusion of monzonite. Subsequent deformation along the Sulphurets thrust fault was diverted into the Kerr area along pre-existing structures. The mineralized area forms a fairly continuous, north-south trending, west dipping irregular body measuring about 1,700 metres long and up to 200 metres thick. Deep drilling since 2012 has identified two sub-parallel, north-south trending, steep west dipping mineralized zones that appear to coalesce near the topographic surface. After significant deep drilling was completed at the Kerr deposit, an updated geological interpretation and subsequent updated mineral resource model were completed. That new model forms the basis for the 2016 mineral resources and mineral reserves.

The Sulphurets deposit comprises two distinct zones referred to as the Raewyn copper-gold zone and the Breccia gold zone. The Raewyn zone hosts mostly porphyry style disseminated chalcopyrite and associated gold mineralization in moderately quartz stockworked, chlorite-biotite- sericite-magnetite altered volcanics. The Raewyn zone strikes north-easterly and dips about 45° to the northwest. The Breccia zone hosts mostly gold-bearing pyritic material mineralization with minor chalcopyrite and sulphosalts in a potassium-feldspar-siliceous hydrothermal breccia that apparently crosscuts the Raewyn zone. The Breccia zone strikes northerly and dips westerly.

The Mitchell deposit is underlain by foliated, schistose, intrusive, volcanic, and clastic rocks that are exposed in an erosional window below the shallow north dipping Mitchell thrust fault. These rocks tend to be intensely altered and characterized by abundant sericite and pyrite with numerous quartz stockwork veins and sheeted quartz veins (phyllic alteration) that are often deformed and flattened. Towards the west end of the zone, the extent and intensity of phyllic alteration diminishes and chlorite-magnetite alteration becomes more dominant along with lower contained metal grades. In the core of the deposit, pyrite content ranges between 1% to 20%, averages 5%, and typically occurs as fine disseminations. Gold and copper tends to be relatively low grade but is dispersed over a very large area and related to hydrothermal activity associated with early Jurassic hypabyssal porphyritic intrusions. In general, within the currently drilled limits of the Mitchell deposit, gold and copper grades are remarkably consistent between drill holes, which is common with large, stable and long lived hydrothermal systems.

All of the KSM deposits are open at depth.

Forward thinking

In October 2016, Seabridge filed a 43-101 report containing both a pre-feasibility study and a preliminary economic assessment for KSM. It’s not that the company can’t make up its mind. It’s just that the property has so much potential, every possibility needs to be considered.

Both parts of the report rely on the same resource estimate; however only the PEA includes the inferred tonnage. Total measured and indicated resource for the four deposits is 2.9 billion tonnes grading 0.54 g/t Au, 0.21% Cu, 2.7 g/t Ag and 44 ppm Mo. The inferred portion is another 2.7 billion tonnes grading 0.35 g/t Au 0.32% Cu, 2.0 g/t Ag and 29 ppm Mo.

Successful drilling carried out in the Deep Kerr and Iron Cap zones between 2013 and 2015 returned consistently higher grades. Additions to the resource number since 2013 total 14.5 million oz of gold and 12.7 billion lb of copper at grades 50% better than earlier drilling results. The Deep Kerr zone contains 1.08 billion tonnes grading 0.35 g/t Au and 0.53% Cu. The initial resource at the Lower Iron Cap zone is 164 million tonnes at 0.50 g/t Au and 0.27 % Cu.

The presence of the recently discovered higher grade mineralization put Seabridge engineers to thinking about more underground mining of these high grades and less about open pit mining. The PEA that was created has significant economic improvements over the PFS, with the exception of the upfront capital costs – $5.0 billion for the PFS and $5.5 billion for the PEA. The higher capex is due to a larger mill and earlier underground development.

Other advantages to the PEA include a smaller surface footprint. In an area with a winter avalanche threat, being underground could enhance safety. Hence the extensive tunneling system as well for moving ore between the mines and the mill. The PEA also outlines how it is possible by including these higher grade zones to recover $6.0 billion more revenue from copper output than was planned in the PFS. The higher gold and copper recovery outlined in the PEA is deserving of serious consideration despite the higher price tag.

The PFS outlines three open pit mines – Mitchell, Sulphurets and Kerr – that would transition to block caving beginning in year 20 at the Mitchell deposit. The Iron Cap and Deep Kerr are also candidates for caving.

The PEA takes a different approach. While there will be starter pits, most of the mill feed will come from underground resources. Smaller pits have been designed for the Mitchell and Sulphurets deposits, and mining at Kerr will be entirely underground. The great advantage to this strategy is that the amount of waste rock from the pits is reduced as is the area needed to store it on the surface.

Whichever design the development follows, expect Seabridge to choose its joint venture partner very carefully.

Mineral processing

The processing plant will consist of three separate facilities. Primary ore crushing and handling facilities will be established at the Mitchell ore processing centre (OPC) site near the mine. Crushed ore will be transported through a 23-km-long train tunnel to the process tailings and management area (PTMA). Additional ore crushing and the concentrator (Treaty OPC) will be built adjacent to the tailings management facility (TMF).

Just as the mining sequence differs between the PFS and PEA, so do the plans for the concentrator. In the PFS, a conventional mill is planned with copper-gold-molybdenum bulk rougher flotation followed by pyrite flotation to recover gold. The bulk rougher concentrate will be reground and passed through three stages of cleaner flotation to produce a copper-gold-molybdenum bulk cleaner concentrate. Molybdenum will be separated from the bulk cleaner con to produce a moly con and a copper-gold con with silver values. The gold-bearing pyrite concentrate and the scavenger cleaner tailings will undergo a cyanide-in-leach process. Ultimately, gold and silver will be recovered as doré bars.

Two main differences set the original and newer mill flowsheets apart. First, the PFS specifies a mill with a capacity of 130,000 t/d and the recovery of molybdenum. Second, the PEA version will be larger at 170,000 t/d and there will be no moly recovery circuit.

Expect to find several tunnels at the KSM site. The Mitchell twinned tunnels (MTT) between the mine and concentrator is only the start. Three diversion tunnels totaling 22.4 km are planned to manage glacial melt water and clean surface water from the Mitchell and McTagg valleys near the mine site. The Mitchell and McTagg tunnels are sized in anticipation of a 200- year storm. Twinning the tunnels allows maintenance to occur in one while the second continues to operate.

The TMF will be built in three cells. The north and south cells will collect flotation tailings. Residues from the CIL circuit will be held in a lined central cell. The cells are designed to store the 30-day probable maximum flood with snowmelt behind four dams. In total the TMF will have a capacity of 2.3 billion tonnes.

Seabridge continues to expand the resources at KSM, but the initial size of the TMF may be a limiting factor as to how much ore can be mined. An expansion of the original facility or a new TMF may be necessary before the end of mine life.

The way forward

Seabridge has had great success at KSM. Not many juniors can offer potential partners two viable paths to production. That makes the management extremely far sighted. They know they need a major base metal partner to develop KSM. But they are not willing to relinquish control.

More than that, the people at Seabridge want to see this global scale project through to production. More power to them. Surely they will succeed.

Comments