Seabridge Gold’s KSM story

Interview with Brent Murphy,

senior vice-president of environmental affairs

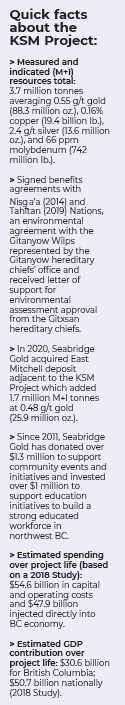

This year, Seabridge Gold is planning to spend approximately $150 million to ramp up field activities and to undertake early-stage construction activities to achieve the “substantially started” status for the KSM (Kerr-Sulphurets-Mitchell) project by July 29, 2026. Approximately 75% to 85% of the funding will go to local and Indigenous contractors. This investment will make Seabridge one of the largest private spenders in B.C. this year.

To date, the company has spent more than $480 million on the KSM gold-copper-silver-molybdenum project on exploration, engineering, and environmental work to move the project forward. The project underwent one of the most comprehensive environmental assessments in Canada and British Columbia. After a seven-year review process (2008-14), the project received approvals under the B.C. Environmental Assessment Act, the Canadian Environmental Assessment Act (1992), and the Nisg-a’a final agreement.

KSM is the world’s largest undeveloped gold project by resources: 88 million oz. measured and indicated (M+I) plus 66 million oz. inferred in addition to 19.4 billion lb. of copper resources in the M+I categories. More than half of these resources are categorized as reserves.

Seabridge released the updated prefeasibility study for the KSM project in June 2022. It shows a more sustainable and profitable mining operation and estimates the annual gold output at the KSM project to rise 90% to more than 1.0 million oz. in each of 33 years.

The project could play a major role in providing the critical metals necessary to fuel the transition to a green economy and provide a continuous and stable source of responsible copper to help Canada meet its 2050 target of net-zero carbon emissions.

Location and climate

KSM is in the rugged coastal mountains of northwestern BC with elevations ranging from 520 m to over 2,300 m. Located about 950 km northwest of Vancouver, 65 km north-northwest of Stewart, and 21 km south-southeast of the Eskay Creek mine (see page 37 in August issue of CMJ), this area has been the site of mining and exploration for decades. The climate is typical of the northern coastal rainforest with sub-arctic conditions at high elevations.

During PDAC 2022 in Toronto, I caught up with Brent Murphy, senior vice-president of the environmental affairs at Seabridge Gold and discussed KSM project with him.

CMJ: Let us start the conversation with you; how long have been with Seabridge Gold? How did you join Seabridge, when, and why did you really think that it is a much better place to work and why focus on the environment?

BM: I have been with Seabridge Gold since March 2008. I was brought in by Rudi Fronk, the chairman and CEO and Bill Threlkeld, our senior VP of exploration, to lead the team for the environmental assessment of the KSM project. I had done work for Rudi and Bill in the Northwest Territories assisting them in completing their initial due diligence on Courageous Lake in 2002, which is another property owned by Seabridge Gold. Prior to that, I was working for a consulting firm, and I kept in touch with Rudi and Bill. I liked their approach, and I was very impressed with them. When I was hired on, Rudi said, “come on and have some fun for six months.” Here I am 14 years later.

CMJ: Please give us a quick idea on Seabridge Gold and the history of the KSM project in terms of location, acquisition, why specifically this project? What are the current reserves and resources?

BM: Seabridge Gold is the owner of KSM project, the world’s largest undeveloped gold project by reserves and resources, which is in northwest British Columbia.

Seabridge Gold acquired the property in 2000 from Placer Dome, who had conducted approximately $25 million in expenditures yielding a defined resource of 3.4 million oz. of gold and 2.7 billion lb. of copper. In 2004 we optioned the project to Noranda who focused on exploring for copper. In a limited drill program in 2005 they intersected predominantly gold mineralization at the Mitchell zone. Since they had little interest in gold, as well as going through a merger with Falconbridge at the time, we were able to buy Noranda out of their option thereby restoring 100% of the project back to Seabridge.

Our first exploration program was in 2006 resulting in an initial resource estimate at Mitchell of 13 million oz. of gold. Over the next several years we continued exploration activities, yielding exceptional annual growth in gold and copper resources.

As part of Seabridge’s strategy to de-risk its projects for eventual sale of joint ventures, we advanced the engineering and permitting activities at KSM. In 2008 we initiated the environmental assessment process. We immediately started consultation and engagement with the various Indigenous groups in northwestern BC, including the Tahltan and Nisg-a’a Nations, the Gitxsan, Gitanyow and Tsetsaut Skii km Lax Ha which ultimately led to a seven-year environmental review process. In 2014, we were successful in receiving a joint harmonized BC and federal environmental assessment approvals.

During the environmental assessment (2008-14), KSM continued exploration and identified the Iron Cap deposit that is located to the north of Mitchell, as well as the down-dip extension of the Kerr deposit. Both Iron Cap and Kerr have much higher copper grades than found at Mitchell and Sulphurets deposits.

In 2021, we acquired the East Mitchell (formerly Snowfield) deposit from Pretium Resources which added 25.9 million oz. of M+I gold resources and another 9.0 million oz. in inferred.

We now have five separate deposits at KSM: Kerr, Sulphurets, Mitchell, East Mitchell, and Iron Cap. All of them together are 100% owned by KSM Mining ULC, a wholly owned subsidiary of Seabridge Gold Inc.

CMJ: When you acquired East Mitchell, did you have that information already about its M+I and inferred resources?

BM: Yes, we had conducted joint studies back in 2010 and 2011 with Pretium looking at how East Mitchell could fit into the greater KSM. In 2020 we finally were able to reach terms with Pretium Resources, and we acquired the deposit in December 2020 for US$100 million in cash.

CMJ: Looks like it made perfect sense?

BM: Certainly! Not only did it add to our overall resource base, but more importantly, it will allow us to redesign KSM into a more profitable opportunity.

CMJ: So, would you call it a gold mine or a copper mine?

BM: Depends who you are talking to. A copper company can focus on the higher-grade copper zones, while a gold company can focus on KSM’s gold rich deposits. We believe the flexibility will help Seabridge attract a partner to responsibly build and operate a mine at KSM.

CMJ: How is Seabridge going to work to integrate East Mitchell into KSM?

BM: Adding East Mitchell substantially enhances KSM’s open pit production profile which benefits prospective partners who are more comfortable with this mining method.

We are in discussions with several large mining companies: some are copper focused, and some are gold focused. Our work has shown that the best economics are derived if you initially focus on the open pit gold opportunities which produce less copper.

CMJ: What are the benefits of the project? Jobs and GDP contribution?

BM: The KSM project is a major responsible investment project for British Columbia and will also contribute significantly to the Canadian economy. The estimated GDP contribution over project life (EA approved mine life of 52 years) is $30.6 billion for BC and $50.7 billion for Canada. Over the life of the project, the total fiscal revenues for the BC and the federal governments are estimated at $7.6 and $7.8 billion, respectively. The KSM project will also generate multi-generation employment opportunities, as the project is expected to create 1,550+ direct and 4,500+ indirect jobs during the five-year construction period and another 1,400+ direct and 4,000+ indirect jobs when in production.

CMJ: Did you work with the Alaskans during the environmental assessment process?

BM: Yes, we did that deliberately even though there was no legal requirement for us to do that at the time, because we knew it was the right thing to do. As Alaska is located downstream from KSM, we engaged vigorously and extensively with Alaskan regulators and stakeholders throughout the environmental assessment review and permitting phases of the KSM project to ensure their concerns were heard and addressed. Because of the input we received from the Alaskans and the various local First Nations, we made significant design changes to our project that added over $330 million in capital estimates to address concerns.

The KSM project was approved on the basis that there would be no significant downstream impact to the receiving environment. We put forward a whole series of mitigation water treatment processes to minimize the impact of the project.

CMJ: Is the feasibility study complete? Is it being updated?

BM: We are in the process of updating the 2016 KSM prefeasibility study (completed in June 2022) to incorporate East Mitchell in the original KSM project.

Our business strategy is that we will not bring the project into full operation, as we want that to be done by a major responsible mining company. We will leave the completion of the final feasibility study to our potential joint venture partner. However, we will have an updated preliminary feasibility study which shows a considerably more sustainable and profitable mining operation and estimates the annual gold output at the KSM project to rise 90% to more than 1.0 million oz. for 33 years.

CMJ: What kind of mill are you planning?

BM: The mill we are using is a carbon flotation mill that will create a concentrate containing gold, copper and silver, and then we will be treating a pyrite concentrate which will go through a cyanide circuit to extract the gold and silver that is tied up in the pyrite and not recovered in the flotation concentrate

CMJ: How will the tailings management facility be engineered to avoid potential spills?

BM: We have proposed a tailings management facility (TMF) based on industry-leading best practices and best available technologies. We worked with the local First Nations to select a tailing storage facility and evaluated over 15 different options. During the environmental assessment, the design of the tailings management facility was reviewed independently by First Nations and by the federal government and they decided that it was an acceptable and safe design.

Currently, I am the executive responsible for managing the work associated with the existing design of the TMF.

After we received the assessment approvals for the existing location which consists of a U-shaped valley, we also commissioned a leading geoscience and engineering consulting firm to undertake a best available tailings technology (BATT) review to ensure the proposed TMF will be utilizing the safest and most reliable technology. This study concluded that our selected and approved approach with wet tailings deposition was the best option. KSM’s designed tailings facility has centerline constructed dams located at either end of the valley with low permeability cores; seepage collection dams are downstream of tailing dams.

In January 2015, more than a year before it became a legally mandated requirement, we also announced the creation of an independent geotechnical review board, and we committed to full public transparency. Our reports are publicly shared. The board has over 350 years of experience among its members of senior world class engineers who worked on similar structures worldwide and they meet annually. To date, we have completed seven meetings with our eighth meeting scheduled for October 2022. In April 2016, the IGRB concluded, “The layout and type of structures, the tailings management approach, runoff and seepage control measures, and the closure plans are appropriate for the site conditions and intended purposes.”

BM: For the first strategy, a fantastic example is acquiring East Mitchell in 2021. We paid $100 million for the deposit, and we received approximately 35 million oz. in total gold resources. At approximately $3 per ounce, the acquisition was certainly accretive.

The example for the second strategy is the work we have done at KSM since 2006 when we got the property back from Noranda and expanded the resources to the existing resource base. Additionally, we have taken the project through the environmental assessment review process and have received the approvals. We also have the permits required to allow us to do the first 2 to 3 years of construction.

Finally, our goal is to sell or joint venture our projects. At KSM we had various deals offered to us in the past. Our view is we only get to do this once, and we will be patient to ensure we do the right deal with the right partner able to finance, build and operate the project responsibly.

When the gold price was lower (1999-2002), Seabridge Gold acquired nine North American projects with substantial gold resources, including Courageous Lake and KSM. During the subsequent 20 years, we have sold some of these that we did not see the opportunity to drive further value. To date we have received over $75 million in proceeds from selling non-core assets.

Those sales basically funded most of our early work for KSM, and because of that, we minimized dilution to our shareholders.

CMJ: You mentioned the collaboration with Indigenous Peoples, which is currently a crucial part of the mining process in Canada, especially in BC. Recently, the BC government and Tahltan Nation announced a landmark agreement that will ensure Indigenous consent is obtained before mining takes place, and it will benefit all projects in that province. The Tahltan are very savvy when it comes to mining. How is that kind of agreement and social license going to affect the KSM project, and what are the differences between this kind of agreement and the ones that Seabridge already had entered (comprehensive environmental and socioeconomic impacts agreement) for the KSM project with several First Nations?

BM: First, we would like to congratulate the Tahltan Nation and the government of BC on the agreement. The Tahltan Nation is one of our Indigenous partners of the KSM project and we have taken our responsibilities to be transparent, engage and collaborate with the local Indigenous communities very seriously. We are one of the trendsetters in that approach.

In June 2014, Seabridge and the Nisg-a’a Nation entered into a comprehensive environmental and socioeconomic impacts agreement for the project that established a framework for Seabridge and Nisg-a’a to work together on ongoing development matters. The agreement is estimated to provide significant dollars in payments, employment, and contracting opportunities to the Nisg-a’a Nation and its members over the life of the KSM project.

Likewise in June 2014, Seabridge and the Gitanyow signed the Gitanyow Huwilp sustainability agreement within which Seabridge agreed to provide funding for wildlife, fish, and water quality monitoring to address concerns raised by the Gitanyow Huwilp, as well as a joint committee to maintain co-operation and communications for the life of the KSM project.

In 2019, we signed an impact benefits agreement (IBA) with the Tahltan after several years of negotiations. This agreement received a 76% approval rating following a community vote. We have been transparent with all the Indigenous groups, throughout the environmental assessment process; we changed our design and added capital as I mentioned before: it was one of the most comprehensive environmental assessment processes in Canada and working with the Indigenous groups remains one of core priorities as we advance KSM

CMJ: And you said you listened to them, or you consulted them for the tailings?

BM: Yes, they were part of the process in selecting our tailing site. We initially selected 15 sites and cost was the least of the evaluation process in selecting the final tailings management location. Land disturbance, impact on the receiving environment, impact on any traditional First Nations land were the main concerns that we worked with Indigenous Peoples to resolve.

CMJ: In March 2022, Seabridge Gold entered into agreement with BC Hydro to supply green, low-cost construction power to KSM project. How does connecting to BC Hydro’s Northwest Transmission Line (NTL) earlier than previously planned benefit the project, including the ESG and economics?

BM: The agreement with BC Hydro is significant to KSM. It will reduce our carbon footprint and it will help with the overall decarbonization approach of the province. It provides several significant ESG and economic advantages:

> Green hydro power will replace significant diesel generation over the five-year construction phase, with a corresponding reduction in greenhouse gas emissions.

> Hydro power is less than 25% of the cost of diesel-generated power with operating cost savings.

> The transmission line will eventually be required for operations and moving this infrastructure forward in the project schedule de-risks construction.

> The installation is part of our work towards “substantially started” designation which will ensure that KSM’s environmental assessment certificate remains in place for the life of the project.

CMJ: Can you give us some information on the financing deal with Sprott Resource Streaming, Royalty Corp., and Ontario Teachers’ Pension Plan for a KSM silver royalty? Is that the kind of partnership you were looking for as part of your third strategy for KSM?

BM: This agreement is a significant validation of the KSM project. It is an investment by Sprott Royalty Corp. and the Ontario Teachers’ Pension Plan. The latter does not make investment decisions lightly. That is why we are very pleased. They gave Seabridge Gold $225 million for KSM in exchange for a note that will convert into a 60% silver royalty at commercial production.

This money will be used to continue our early-stage construction activities, including site access roads, camps, bridges, and fish habitat, which will allow us to de-risk the project. It makes us a more attractive partner for potential joint venture companies because we are making a significant investment that is advancing the project.

Our project staff went up to approximately 60 people from 20 since August 2021. We are spending a budget of $150 million (each) this year and next year. Since we have already invested more than $480 million in the project, we have been a significant investor company in BC and in Canada for the last 14 years. CMJ

Note: Seabridge Gold announced the results of a preliminary economic assessment (PEA) study for a potential copper-rich underground mine at its 100% owned KSM project. The 2022 PEA outlines a stand-alone mine plan that has been undertaken to evaluate a potential future expansion of the KSM mine to the copper-rich Iron Cap and Kerr deposits after the 2022 PFS mine plan has been completed.

Comments