Seabridge Gold: a Canadian icon of responsible operations

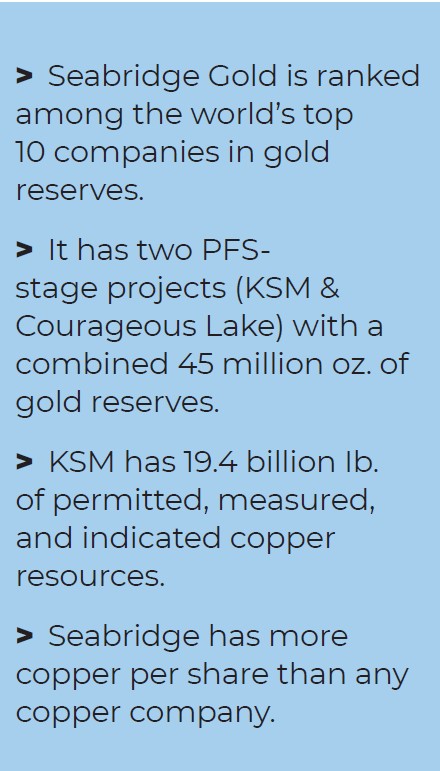

Seabridge Gold holds a 100% interest in several North American gold projects. The company’s principal assets are the KSM and Iskut projects, located near Stewart, B.C., and the Courageous Lake gold project located in the Northwest Territories. Other core assets owned by the company are Snowstorm in Nevada, which is a 103 km2 property located at the intersection of three major Nevada gold belts, and 3 Aces in Yukon, which is a 314 km2 property with year-round access. Additionally, Seabridge retains an interest in non-core assets from which it expects to generate approximately US$30 million in cash over the next several years such as Quartz Mountain and Grassy Mountain projects in Oregon.

An essential part of Seabridge’s business strategy is being a responsible and welcome member of the communities in which it operates. KSM project has been the primary example of this philosophy in action through the environmental assessment (EA) process in both B.C. and elsewhere in Canada. The company has worked hard to earn trust from community members near the KSM project for over 10 years, which resulted in the company being tagged as a “responsible operator.”

On June 28, 2022, Seabridge announced the results of an updated preliminary feasibility study (PFS) for its 100% owned KSM project located in northern B.C. The 2022 PFS shows a considerably more sustainable and profitable mining operation than its 2016 predecessor, now consisting of an all open pit mine plan that includes the Mitchell, East Mitchell, and Sulphurets deposits only.

Recently, I caught up with Rudi Fronk (RF), Seabridge chairman and CEO. Fronk started our interview by asserting that Seabridge is pursuing three value-enhancing strategies. First, the search for gold projects in North America which would be accretive in terms of gold resources. Second, funding exploration and engineering work likely to expand resources and upgrade them to reserves. Third, Seabridge sells or partners its projects when they reach the production stage to limit risk and share dilution.

Normally, I would start an interview with the CEO of Seabridge by asking questions about KSM project; however, in this article, I would like to start by highlighting the recent recognition of Seabridge Gold for outstanding achievement in legacy mine reclamation.

CMJ: Seabridge was recently awarded the 2022 Jake McDonald Annual Mine Reclamation Award presented by the British Columbia Technical and Research Committee on Reclamation (TRCR) to recognize outstanding achievement in mine reclamation in B.C. Can you talk to us about the award and why Seabridge deserved it?

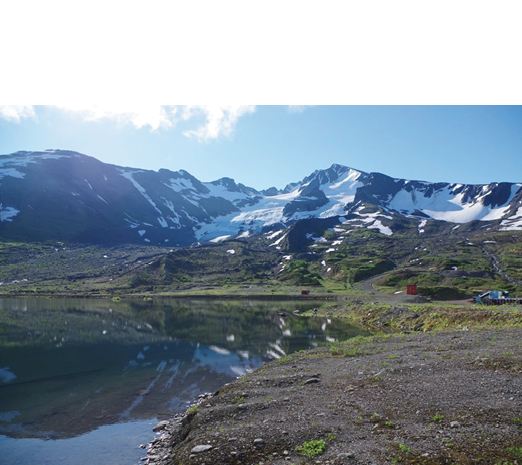

RF: The award recognizes outstanding achievement in mine reclamation in B.C. and is presented annually by the B.C. TRCR. It recognizes the multi-year, $12 million environmental and reclamation activities Seabridge Gold is voluntarily undertaking with the Tahltan nation at our 100% owned Iskut project, located in the transboundary region of northwest B.C., bordering southeast Alaska. The $12 million program is reclaiming the historical legacy of the former Johnny Mountain mine, which was operated by a previous owner in the late 1980s. Our program is designed to bring the site back to its pre-mining conditions.

As for deserving this award, we thank the committee for this honour. I believe the award recognizes the fact that Seabridge prioritizes protecting the environment at its project sites and its relationships with local Indigenous communities. Seabridge is one of very few companies within Canada that knowingly and voluntarily decided to deal with the liability associated with an abandoned and un-reclaimed mine which was not generated by our activities. Simply put, we are doing the reclamation work because it is the right thing to do.

CMJ: Seabridge has a reputation as a “responsible operator.” Is this reputation also enhanced by the fact that you are committed to working with Indigenous communities such as the Tahltan nation?

RF: Absolutely! We pride ourselves on the fact that we strive to develop respectful and constructive relationships with all the local Indigenous groups associated with each of our projects. This means that we listen carefully and are willing to adjust or redesign our project activities and design to address or mitigate local concerns. Our relationship with both the Tahltan and Nisg–a’a nations in B.C. are testaments to our commitment to “try and do it right.” Another example is our recent work with the Liard First nation at our 3 Aces project in Yukon, where we worked closely with them to address their concerns regarding our application for a new class 4 quartz mining permit.

CMJ: Based on your experience, what are the benefits of working with First nations?

RF: I can state with certainty that our relationships have resulted in many benefits both on the personal and the professional levels. Many of our staff have developed long lasting friendships, especially as we have developed the KSM project over the past 14 years, which has assisted in developing respectful relationships. Additionally, working constructively with the First nation’s has resulted in their support for our various projects such as the signed benefit agreements we have with the Nisg–a’a and the Tahltan nations at our KSM project and our signed co-operation agreement with the Liard First nation at our 3 Aces project. This mutual respect does not mean that we agree all the time, but that when we do disagree, we can have constructive dialogue to overcome the disagreement and find a solution.

CMJ: Seabridge Gold purchased SnipGold Corp. and its mineral tenures, including the former Johnny Mountain mine, so you took over other companies existing reclamation liabilities before you even start drilling. Why is this considered an opportunity for Seabridge?

RF: We saw the opportunity to acquire a large land package, that already hosted a mineral resource, with very similar geologic characteristics to our nearby KSM project. When we purchased KSM in 2000, the project hosted two small gold-copper deposits. KSM has now become the world’s largest undeveloped gold-copper project. We are now focusing our exploration at Iskut on gold-copper exploration targets. We just completed a drill program beneath the Bronson Slope resource and expect to announce the results prior to year end.

Additionally, with the acceptance of the liability associated with the former Johnny Mountain mine, we saw an opportunity to further strengthen our credentials as a “responsible operator/developer,” especially as we continue to advance the KSM project.

CMJ: Now that you mentioned KSM project, why did Seabridge need an updated PFS? What are the primary reasons for the improvements in the plan?

RF: The 2016 PFS was completed prior to our acquisition of the East Mitchell (formerly known as Snowfield) deposit from Pretium in December 2020. The addition of East Mitchell allowed us to simplify the mine plan, incorporate metal price and currency exchange rate changes since 2016 as well as the impact of inflation.

CMJ: Was it prepared by the same company?

RF: Yes. The 2022 PFS was prepared by Tetra Tech, which is the firm that had also authored the 2016 PFS. The 2022 PFS results propose mining only 25% of the KSM resource inventory and do not include material from the copper-rich Kerr and Iron Cap deposits that will require underground block caves for development. An analysis of a stand-alone development of these deposits was included as a preliminary economic assessment (PEA) forming a separate part of the NI 43-101 technical report that was filed in August.

CMJ: What are the major improvements in the base case 2022 PFS compared to the Base Case 2016 PFS?

RF: The improvements were plentiful. Design improvements over the 2016 PFS include a smaller environmental footprint, reduced waste rock production, reduced greenhouse gas (GHG) emissions by the electrification of the mine haul fleet, a 50% increase in mill throughput, and the elimination of capital-intensive block cave mining. Some highlights also include the following:

> Proven and probable gold reserves increased 22%, to 47.3 million oz., due to higher gold grades added from East Mitchell.

> Mill throughput was expanded from 130,000 t/d to 195,000 t/d.

> Average annual gold production increased by 90% and is now estimated at just over 1.0 million oz./y over a projected 33-year mine life.

> Although the initial capital increased from US$5.0 billion to US$6.4 billion mostly due to inflation, the total life of mine capital was reduced by about US$900 million due to the elimination of block cave mining from the mine plan.

> The total after tax net cash flow increased from US$10.0 billion to US$23.9 billion.

> After tax NPV increased 5% from US$1.5 billion to US$7.9 billion.

> After tax IRR increased from 8.0% to 16.1%.

> The payback period dropped from 6.8 years to 3.7 years.

We have redesigned KSM for an inflationary environment. The themes for the 2022 PFS are capital and energy efficiency. The mine plan is simplified to bring total capital down below 2016 estimates despite inflation by reducing sustaining capital. We have accomplished this by eliminating underground block cave mine development which is deferred to future years. Important steps have also been taken to make the project less dependent on oil, especially diesel fuel, by maximizing the use of low cost, green hydroelectric energy.

CMJ: Did the increase in ore delivery to the mill from an initial 130,000 t/d to 195,000 t/d in year 3 result from the acquisition of the East Mitchell open pit resource?

RF: Yes. In the 2016 PFS, daily ore throughput was constrained by limitations of production from underground block cave mining. By going to an all open pit mine plan where we can mine ore from Mitchell and East Mitchell at the same time, we increased the throughput. This also reduced the mine life from 52 years to 33 years.

CMJ: In August 2022, Seabridge Gold announced the results of a preliminary economic assessment (PEA) study for a potential copper-rich underground mine at KSM. Why was the recent PEA based on Kerr and Iron Cap deposits not included in the updated PFS?

RF: Although we have 11 billion tonnes of economic resources at KSM, we have always limited our total ore production in our PFS mine plans to the 2.3 billion tonnes of tailings capacity we have permitted. Ore production in the 2022 PFS fills this space. By including a PEA, we were able to show additional production potential beyond the permitted 2.3 billion tonnes of tailings space, focusing on the higher copper grade, block cavable deposits at Kerr and Iron Cap. This added the potential of an additional 39 years of very profitable mine life on top of the 33 years we have in the 2022 PFS.

CMJ: Seabridge Gold received class 4 exploration permit for the 3 Aces project drilling at the Hearts zone. Did you have to work with First nations to obtain the permit, can you talk to us about the agreement you signed recently with Liard First nation?

RF: Absolutely! We worked very closely with both the Liard and Ross River’s First nations during the renewal process of our exploration permit. Our recent agreement with the Liard First nation focused on how we will work with each other as we explore the 3 Aces project. The agreement specified our commitments to the Liard First nation on how we would address their concerns with respect to wildlife management, land access, long term cumulative effects, and for ongoing and respectful engagement.

CMJ: Recently, Seabridge Gold completed drilling at the Snowstorm project in northern Nevada. What is the plan/outlook for this project?

RF: We still believe that Snowstorm has tremendous potential. We are in the process of planning exploration programs for 2023, not only at Snowstorm, but also at Iskut and 3 Aces where 2022 exploration programs are winding down. The size and extent of our 2023 exploration programs will be based on where we believe we have the best opportunity to add ounces and value to our shareholders.

CMJ: Courageous Lake is one of Canada’s largest undeveloped gold projects, and the project’s first PFS was released in July 2012. Do you have any updates on this project; are you expecting a joint venture or an acquisition soon?

RF: We are currently looking at the best path forward for Courageous Lake. The 2012 PFS showed a project that was marginal, mostly due to the Canadian dollar being at par to the U.S. dollar at that time. At today’s exchange rate and higher gold price, the project looks far more attractive. We have also completed internal studies looking at perhaps a smaller starter project that reduces initial capital and improves economics. Our goal is to find the best path forward for Courageous Lake that will generate the best value for our shareholders. An updated PFS may be the answer.

CMJ: You have over 40 years of experience in the gold business, mostly as a senior officer and director. You co-founded Seabridge and have served as the company’s CEO since 1999. When you look back at your journey with Seabridge Gold, is there anything you would have done differently?

RF: I need to update that number! It is now 42 years! Looking back, I am proud of what we have accomplished at Seabridge. Our goal from the beginning was to create the industry’s best leverage play to a rising gold price. Our discipline of growing ounces in the ground faster than shares outstanding has provided our shareholders with outsized returns over the long haul compared to the gold price and to other gold equities. I am often amazed looking back that we have built this significant reserve and resource base over the past 23 years and only have 80 million shares outstanding. To be honest, I would not have changed anything!

Comments