Richmont turns steady producer Island Gold into shining star

For three decades, from 1981 till 2011, Richmont Mines of Rouyn-Noranda, Que., ticked along as a sleepy, conservatively managed operator of shallow, but short-lived underground gold mines – two in Newfoundland, four in Quebec and, most recently, the Island Gold mine in Dubreauville, Ont., 83 km northeast of Wawa .

Underground surveying at the Island Gold mine.

Richmont may well have continued on the same course but for the arrival in 2012 of new investors, a change in senior management and a major discovery at Island Gold that has the company poised for a growth spurt that could catapult it into the ranks of mid-tier producers .

“Island Gold is a transformational asset,” says Renaud Adams, president and CEO .

“It’s very exciting. Our objective is to grow the reserve base and at the same time we’re accelerating development and positioning the mine for growth.” Richmont was founded by Jean-Guy Rivard, an insurance broker turned real estate investor turned miner. He surrounded himself with highly qualified professionals, but maintained a tight rein, especially on the financial side of the operation .

“His business model was based on strong expertise in underground mining, maintaining a tight capital structure and no debt,” says Adams. “They acquired small mines and tried to stretch the life of them. They took a very disciplined approach, but that did not create growth.” In 2003, Richmont made its first foray into Ontario by investing $1 million to acquire a stake in the Island Gold property and the nearby but defunct Kremzar mine and mill from then owner Patricia Mining of Toronto. By 2005, Richmont had invested $12.6 million into Island Gold, which raised its stake in the property to 55%, and it had taken over as operator .

Two years later, in October 2007, the partners put the mine into production and the following November Richmont acquired the outstanding shares of Patricia Mining and became sole owner of Island Gold. At the time of the takeover, proven and probable reserves stood at 1.05 million tonnes, which would yield an estimated 286,000 oz. of gold, sufficient for a mine life about four years .

The elder Rivard died in March 2009 and his son Martin succeeded him as president and chief executive officer. But three years later he announced his resignation, effective in August 2012, and the installation of new management led to significant changes for the company and Island Gold .

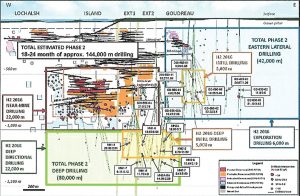

Longitudinal view of underground exploration at Island Gold.

Under the previous management regime, mining was taking place from surface to a depth of 400 metres and, most years, the Island Gold operation was losing money or turning a small profit. The new team launched an aggressive exploration program and to date have completed nearly 42,000 metres of exploratory and delineation drilling .

That led to the transformational discovery of deposits hosting as much as a million ounces of gold at depths of 400 to 1,000 metres – and the deposits are open at depth. “Initially, Island Gold was a low-grade, underground mine and truly nobody had a clue that it would become what it is today,” says Adams.

The discovery of such a significant new resource has made it necessary to expand the underground infrastructure in order to continue exploring and to increase production .

The company has extended the ramp from 400 metres down to 860 metres and financed the work by issuing shares in 2015 and 2016 that led to a 25% dilution .

Production from the mine has trended steadily upward – from 40,000 oz. in 2014 to 55,000 oz. in 2015 and 80,000 oz. last year. The company is currently only mining to a depth of 740 metres, but plans to begin extracting ore from depths of 850 metres this year .

Growing for gold

Adams and his team have now set their sights on boosting production to 100,000 oz. per year and eventually as high as 150,000 oz. a year, but that means they need to increase their milling capacity .

Since the mine was put into production in 2007, the company has been processing ore at the Kremzar mine mill, which was built in the late 1980s and was designed to handle 850 tonnes of ore per day .

Richmont has typically been processing 900 t/d and, on occasion, has put through 1,000 t/d. However, in order to boost production to 100,000 oz. per year the company need to expand the capacity of the mill to 1,100 t/d – an expansion that will cost an estimated $15 million .

Richmont may have to raise that money publicly and management is currently preparing a preliminary economic assessment (PEA), which it plans to release it in the first half of this year. It will contain updated reserve and resource estimates and will outline plans to expand the mill and to extend the ramp to 1,000 metres below surface .

All of this, Adams says, is merely phase one of an ambitious development and expansion plan that will see Richmont mining at 1,000 metres and processing up to 1,200 tonnes of ore per day while maintaining sufficient reserves to ensure a seven-year life of mine. Phase two will involve further exploration to extend the resource to a depth of 1,500 metres, at which point the company may have to sink a shaft rather than extending the ramp .

Furthermore, Adams sees the developments at Island Gold as first steps in the opening of a new Ontario gold camp that could be creating jobs and producing profits for years to come. Richmont alone holds the rights to 77 sq. km of land around the Island Gold Mine .

“Quite frankly, we’ve been drilling within two square kilometres of the mine since 2011,” says Adams. “We have nine very specific targets identified just within a seven kilometer radius of the mine. With 77 kilometres, we can drill for years to come .

“I really see this whole camp in years to come being more focused on exploration and better understanding of the geology,” he adds. “It’s pretty much virgin territory in terms of deep exploration.”

Comments