Power to change: CMJ and MiningIntelligence take a look at Canadian projects that will help power a net zero future

The time has come to take urgent action on climate change. A century and a half of industrialization supported by reliance on fossil fuels has resulted in global warming. The trend is unsustainable.

Industry, individuals and governments are turning to responsibly sourced electricity to cut the production of greenhouse gases (GHG), one of the main culprits of temperature rise. Electric power generated from renewable sources reduce carbon dioxide emissions. These choices are a large step toward a net zero future, but the energy produced from solar and wind sources must be stored, hence the interest in battery minerals.

Canada has these minerals in the ground. Natural Resources Canada estimates that 2020 production of copper was 475,898 tonnes, cobalt 3,535 tonnes, graphite 12,000 tonnes, and nickel 163,362 tonnes. For a brief time in 2018-19 lithium was also produced. These and several other metals available in this country are critical to creating an economic means of storing renewable power.

Unfortunately, Canada’s share of these minerals is dwarfed by countries such as Chile (copper and graphite), Democratic Republic of Congo (cobalt), Australia (lithium), and Indonesia (nickel). For this country to be a leading supplier of these and other critical minerals for a sustainable and responsible future, the industry is going to have to develop many of the projects listed herein and more. That can only happen when industry, investors, Indigenous communities, and regulators work together with the will to re-establish an exploration and mining powerhouse.

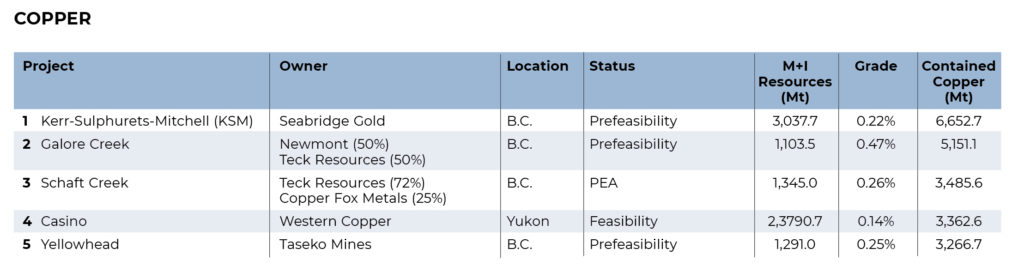

COPPER

There are over 50 active copper projects in Canada spread from sea to sea to sea. Four of the five largest are in British Columbia and the fifth in Yukon.

The largest project, in terms of contained metals in measured and indicated (M+I) resources remains Seabridge Gold’s Kerr-Sulphurets-Mitchell (KSM) project in B.C. Last year, the company announced its intention to roll the resources of the Snowfield porphyry deposit into its copper-gold resources for the project. An updated preliminary economic assessment (PEA) that will reflect this change is due before mid-2022. As of this writing, the KSM project contained 6.65 million tonnes of copper and is poised to grow.

Also in B.C., is the Galore Creek project containing 5.15 million tonnes of copper. Joint venture partners Newmont and Teck Resources have advanced it to the prefeasibility stage, but work is stalled as costs continue to spiral upward. The estimated capital cost rose to $5.15 billion in 2011 from $828 million in 2004. A decade later, costs will be even higher.

The Schaft Creek project, also in B.C., is another Teck (75%) undertaking with partner Copper Fox Metals (25%). The amount of contained copper in M+I resources is estimated at 3.49 million tonnes. The PEA released in September 2021 put the cost of development at US$2.7 billion. It has the potential to produce 5 billion lb. of copper over a 21-year mine life.

Western Copper is conducting a feasibility study for its Casino project in Yukon; the study is due mid-2022. The prefeasibility study (PFS) completed in June 2021, estimated there are 3.36 million tonnes of copper in the deposit. The project is expected to mine the oxide portion of the deposit as a heap leach operation for 25 years.

The fifth largest copper project is again in B.C., Taseko Mines’ Yellowhead proposal with an estimated 3.67 million tonnes of contained copper. The 2020 PFS study put the pre-production capital cost at $1.3 billion. The company is ready to move ahead with the environmental assessment as soon as the initial project description is filed.

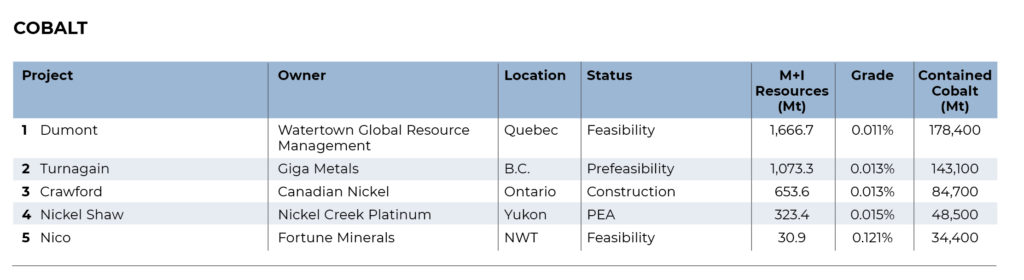

COBALT

Cobalt has been mined in Canada for well over 100 years, often as a by-product of nickel or silver production. Its importance continues to rise as does its use in lithium-ion batteries as well as superalloys.

The largest cobalt resource in Canada is the Dumont nickel deposit owned by Watertown Global Resource Management in Quebec. There are an estimated 178,400 tonnes of cobalt in an M+I. The project is shovel-ready, but the owner announced in 2020 that they were seeking a buyer.

Giga Metals owns the second largest cobalt resource at the Turnagain project in B.C. It is at the prefeasibility stage with an estimated 143,100 tonnes of contained cobalt. Giga has plans to develop the world’s first carbon-neutral nickel mine, a venture that will require $1.4 billion.

Canada’s next new cobalt producer is likely to be the Crawford project in Ontario. Owner Canada Nickel has begun construction on what is poised to become Canada’s largest base metal mine, eventually producing 69,000 tonnes of nickel-equivalent (including cobalt) annually. There are 84,700 tonnes of cobalt contained in the M+I resource, and exploration drilling continues to expand potential resources with high-grade results.

Two other potential cobalt producers are under study. Nickel Creek Platinum’s Nickel Shaw project in Yukon contains 48,500 tonnes cobalt, and the company continues to drill with the aim of expanding resources. Fortune Minerals’ Nico project in the Northwest Territories contains 34,400 tonnes cobalt, and the company has proposed buying a defunct steel plant in Alberta and turning it into a cobalt refinery.

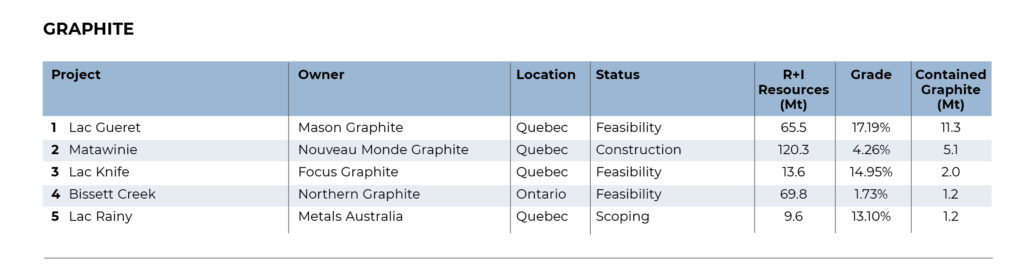

GRAPHITE

Graphite is a good conductor of electricity, making it much sought after by makers of electrodes, batteries and solar panels.

The largest resource in Canada is in the Lac Gueret project belonging to Mason Graphite. The property in Quebec has an M+I resource containing 11.3 million tonnes graphite. The company has patented a battery, which contains coated spherical purified graphite, and it is working on a graphene product that includes both graphite and silicon nanoparticles.

Nouveau Monde Graphite has begun construction on its Matawinie mine in Quebec, where 5.1 million tonnes of graphite have been outlined in M+I resources. This will be the world’s first all-electric open pit mine. Commercial production of 45,000 tonnes of anode material and purified jumbo flake graphite is expected by the end of 2023.

Focus Graphite owns the Lac Knife project (2.0 million tonnes contained graphite) in Quebec, completing a feasibility study in 2014 for a 25-year open pit and plant.

Tying for fourth and fifth place are the only Ontario project on our list and another in Quebec. The one in Ontario belongs to Northern Graphite at Bissett Creek (1.2 million tonnes). The other, in Quebec, belongs to Metals Australia at Lac Rainy (1.2 million tonnes).

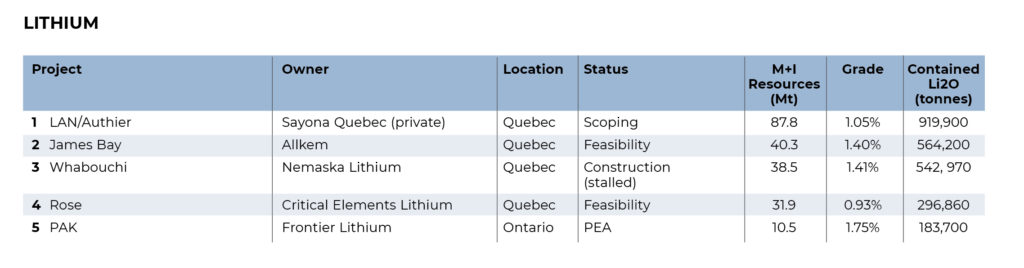

LITHIUM

The largest Canadian lithium resource is owned by Sayona Quebec, a joint venture of Sayona and Piedmont Lithium. The operator recently combined the resources from two separate projects – LAN and Authier – making it the largest in Canada with 919,900 tonnes of contained lithium oxide. Work is at the scoping stage but trading of shares in Sayona Quebec have been temporarily halted pending a resource update.

Allkem, the Australian chemical company, has taken its James Bay lithium project in Quebec through feasibility, estimating there are 564,200 tonnes of lithium oxide in the resource. The company proposes a mine and mill capable of producing 321,000 tonnes of 5.6% lithium oxide annually for 19 years.

Canada’s only lithium producer in recent memory was the Whabouchi mine in Quebec that was operated briefly by Nemaska Lithium in 2018-19. The M+I resources there contain about 542,970 tonnes of lithium oxide. The mine and mill were operational, but the owner ran out of money before it could complete a planned hydrometallurgical plant. The company emerged from creditor protection in August 2020 under the joint ownership of Investissement Québec, Pallinghurst Group and Orion Mine Finance.

Rounding out the top five potential new lithium mines are Critical Elements Lithium’s Rose project in Quebec and Frontier Lithium’s PAK project in Ontario. Resources contain 296,960 tonnes and 183,700 tonnes of lithium oxide, respectively.

NICKEL

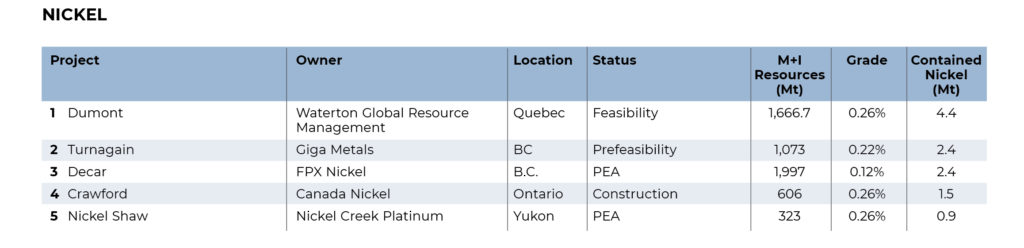

Canada has a long and proud history of nickel production going back to the early days of the Sudbury Basin in Ontario. We already mentioned four of the largest potential new nickel mines in Canada when we referred to their cobalt resources. Here they are again with the slant on nickel, plus a new name in third position.

Waterton Global’s Dumont project in Quebec contains 4.4 million tonnes nickel in M+I resources, and Giga Metals Turnagain project in B.C. has 2.4 million tonnes.

The new name on the list is Decar, owned by FPX Nickel, in B.C. A PEA has been released with an indicated resource of 2.4 million tonnes nickel (no measured number yet). Last year’s infill drill program at the Baptiste deposit returned long intersections including 254.9 metres at 0.151% nickel, including 157.3 metres at 0.154%. The company says the project could produce an average of 99 million lb. of nickel each year in ferronickel briquettes.

The final two nickel projects are the under construction Crawford project of Canada Nickel and the Nickel Shaw project, for which owner Nickel Creek Platinum has produced a PEA. At Crawford, contained nickel is 1.5 million tonnes, and at Nickel Shaw, it is 900,000 tonnes.

Comments