Mining executives see ESG and decarbonization as the top risks facing their business heading into the new year

Looking back a year ago, as we wrapped up 2020, Canadian mining and metals companies had a laser focus on addressing high-impact risks and proactively planning for future disruptions. Since then, the sector has seen several new disrupters, including an acceleration of decarbonization commitments, expectations of the energy transition and the delivery of more accountability around ESG – all factors that are increasingly linked to capital availability. At the same time, these companies are operating in a market where demand and prices are surging as governments pour stimulus into markets and economic activity returns to normal. These external influences, coupled with growing stakeholder and capital market pressures, continue to drive new risks and opportunities in the sector.

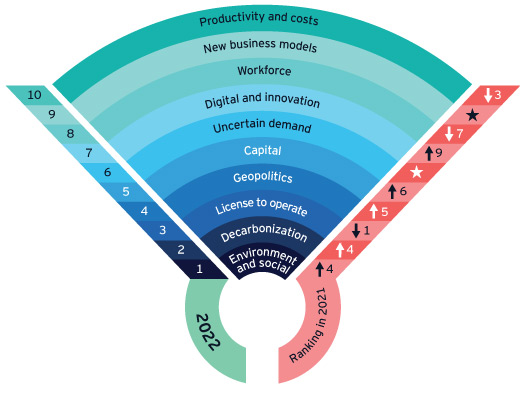

That’s why it’s no surprise that respondents in the EY Top 10 business risks and opportunities for mining and metals in 2022 survey rank environment and social issues at number one, followed by decarbonization and then licence to operate (LTO).

Purpose, long-term value and sustainability are not just add-ons, they’re business as usual

While LTO has been the number one priority for the past three years, mining and metals companies are broadening their perspectives and beginning to integrate ESG factors into corporate strategies, decision making and stakeholder reporting – an indication that biodiversity, social impacts and water management are emerging issues that are top of mind this coming year.

Taking it a step further, decarbonization has moved up to the second ranked risk this year as many companies and investors accelerate conversations and actions around their energy transitions in the face of declining investments in thermal coal and increasing climate regulations. And while many companies have committed to net-zero goals by 2050, few have worked out what it actually means for their business and allocated the necessary capital to achieve it.

Ultimately, decarbonization needs to be treated like any other strategic risk – dealt with at a board and executive level and managed as part of the overarching business strategy. Tactics such as switching to renewables, fleet electrification and replacing diesel with zero-carbon fuel options across the value chain can offer opportunities to decrease on-site emissions. But emissions from processing, ventilation, heating, cooling and backup power generation remain significant. Other forms of carbon offsets will be needed to successfully achieve net-zero targets.

Ongoing market volatility creates two new trends: uncertain demand and new business models

Economic recovery and stimulus have caused a surge in demand in most commodity markets, and we’ve seen prices rise accordingly. In parallel, the energy transition is driving up demand for renewable energy, electric vehicles and energy storage systems, and the minerals required to manufacture them.

In response, major mining and metals companies are moving into technology and battery minerals, announcing large projects, acquisitions or long-term deals to supply lithium, cobalt or rare earth minerals. But bringing on this supply of ‘new world’ commodities is challenging, and economic projects are harder to find due to increasing remoteness, complexity and rising royalties and taxes.

On top of these external factors, the threat of substitution is very real. Though mining and metals companies may start investing in a market, due to long project lead times, technology may move on or the energy transition could change direction in the interim. We’ve already started to see a shift underway from conventional lithium nickel-manganese-cobalt-oxide batteries to lithium iron-phosphate batteries. And some companies have even started to produce batteries without metal at all.

With disruption and uncertainty likely to be ongoing, respondents indicate it may be time to consider reshaping around a new business model. Today’s landscape provides a unique opportunity to analyze where optimal value can be found – and to redefine business models to capture that value. While dependent on scope and exposure of the business, exploring shared value or circular business models, vertical integration or joint ventures can help to futureproof the business to better deal with disruption and changing commercial relationships, and ultimately win competitive advantage.

THEO YAMEOGO is the Americas Mining & Metals Leader at EY, based in Toronto

(www.ey.com/en_ca/mining-metals).

Comments