Measuring public support for mining in Ecuador

True understanding of the public is crucial to offshore mine making.

Over the past decade, Ecuador has not been the most hospitable country for Canadian mining companies. High taxes, well over the average for other Andean countries, and the sudden introduction of a “windfall profits” tax at the end of 2007, eventually forced Kinross Gold to shut down operations in 2013 after having spent five years advancing Fruta del Norte – what it called “one of the most exciting gold discoveries of the past 15 years.”

Ecuador has suffered the consequences. As the smallest member of OPEC, and one of the poorer countries in South America, Ecuador could see its economy contract further without attracting foreign capital, according to the International Monetary Fund.

To reverse its economic fortunes, Ecuador has rebranded itself a mining-friendly jurisdiction. Ecuador’s mining minister, Javier Cordova, wants to attract US$5 billion in mining investments over the next few years, hoping to improve the living conditions of 15 million Ecuadorians.

The Economist Intelligence Unit has now forecast that foreign direct investment DATA ANALYTICS will rise quickly as long as the government continues to promote investment in its mining sector.

To encourage an infusion of capital and growth, Ecuador is once again open for business with new mining laws that reduce tax and royalty burdens for foreign miners. Though it was once shunned by Canadian miners, companies such as Lumina Gold are taking a second look. Lumina now has the second-largest package in Ecuador with excellent potential for gold and copper.

“Mining is no longer a four-letter word in Ecuador,” said Lukas Lundin, CEO of Lundin Gold at the Prospectors and Developers Association of Canada (PDAC) conference in Toronto in March 2016. Lundin, whose company is the current owner of Fruta del Norte, was referring to government policy.

But will the people follow?

Although the government of Ecuador appears to be fully committed to attracting foreign investment in an effort to catch up and compete with its neighbours in the region, one question remains: will the population support the government’s plan to open the country to more foreign mining projects? When Ecuador’s mining minister appeared at PDAC in 2017, he wasn’t the only Ecuadorian there. Representatives from the Mining Injustice Solidarity Network delivered a statement opposing the government’s plans to expand mining operations in Ecuador. The statement was endorsed by over 20 Ecuadorian organizations claiming that mining brings various human rights violations and environmental destruction to the country.

Sentiment towards foreign mining investment

Companies looking to invest in Ecuador – or anywhere – need to have a better understanding of where the general public stands on foreign investments when it comes to mining. RIWI Corp., a Canadian Big Data company that specializes in public sentiment surveys and message tests in every region of the world, has conducted two independent public opinion surveys on evolving mining attitudes in Ecuador, comparing the data in 2016 and 2017.

RIWI’s data projects on Ecuadorian sentiment were conducted on the heels of the government’s aggressive policy and rhetoric encouraging more mining investment. The first study was completed in the spring of 2016, followed by another in the summer of 2017 verifying its results. RIWI has previously applied its software to conduct attitude and senindustry in different regions of the world for the World Bank.

RIWI surveyed over 12,000 random Ecuadorians in 2016 and 2017 combined, who had access to the internet on any Web-enabled device, including low-cost mobile access in poorer areas.

Along with gathering information on the impact mining has on local jobs, the local economy and the environment, these surveys also present data regarding educational levels, marital status, the number of residents in each home, or whether respondents lived in big or small towns or urban or rural areas.

For both 2016 and 2017, Ecuadorians saw foreign investment in mining as a net positive regarding its effect on local communities and employment. As far as the impact on the environment, the senresults were evenly split between those who felt strongly one way or the other.

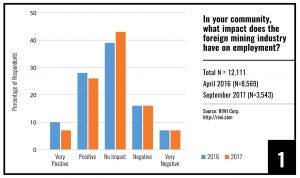

Chart 1 shows that 33% of respondents considered the impact on jobs was either very positive or positive compared to 23% who felt the impact was negative or very negative. Forty per cent answered that mining had no impact on employment.

Chart 1 shows that 33% of respondents considered the impact on jobs was either very positive or positive compared to 23% who felt the impact was negative or very negative. Forty per cent answered that mining had no impact on employment.

These numbers shouldn’t come as a surprise given the high levels of unemployment in the country. Among those who completed the RIWI survey, 17% were looking for work in 2017. This high level of unemployment among those interviewed might help explain the relatively high levels of overall support for more foreign investment.

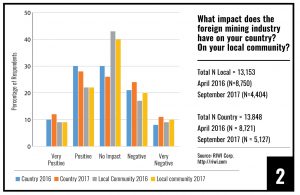

Chart 2 shows that Ecuadorians were generally optimistic about the benefits of foreign investments in mining. Asked about the impact of such investment on the country as a whole, 40% of respondents answered that the impact would be either very positive or positive compared to 35% who believed the impact would be negative or very negative. When it comes to their local community, 30% of respondents believed the benefits of foreign mining investment outweigh the costs while 27% believed that more investment in mining would have a negative impact on their communities.

Chart 2 shows that Ecuadorians were generally optimistic about the benefits of foreign investments in mining. Asked about the impact of such investment on the country as a whole, 40% of respondents answered that the impact would be either very positive or positive compared to 35% who believed the impact would be negative or very negative. When it comes to their local community, 30% of respondents believed the benefits of foreign mining investment outweigh the costs while 27% believed that more investment in mining would have a negative impact on their communities.

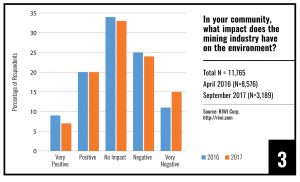

If there is one area where respondents showed more pessimism about foreign investment, it was regarding the environment. In Chart 3 we see that 27% thought the impact on the environment would be very positive or positive while 39% felt the opposite. Seen in a different light, 34% saw no environmental impact from increased foreign mining putting those who were positive or neutral about the impacts on the environment in the majority.

If there is one area where respondents showed more pessimism about foreign investment, it was regarding the environment. In Chart 3 we see that 27% thought the impact on the environment would be very positive or positive while 39% felt the opposite. Seen in a different light, 34% saw no environmental impact from increased foreign mining putting those who were positive or neutral about the impacts on the environment in the majority.

Summary

Local opposition to Ecuadorian mining indeed exists, but this opposition does not appear to be shared by the general population. The government of Ecuador is pursuing an economic policy that is more or less in keeping with the will of the majority of its citizens.

The move to open Ecuador’s resource development is good news for Canadian mining companies. However, taking risks in developing countries today involves more than assessing new tax levels, royalties, and regulatory rules. Companies of social and political issues that require buy-in from all sectors of the population, particularly Indigenous peoples and environmental groups.

Modern mining is as much about understanding public attitudes to resource development as extraction itself. That’s why it’s crucial to gather and monitor attitudes to mining locally and nationally. As more people have greater access to the internet, it is becoming easier for miners to measure shifting public perceptions on social and political issues through companies such as RIWI. By seeking out this type of information, miners can gain a better understanding of the true level of support they might expect to see, and even gain insight into how to build a case for their project to increase that support.

________________________________________________________________Patrick Luciani is Senior Fellow at the Global Cities Institute at the University of Toronto. He has engaged RIWI to do research on public attitudes in Mexico towards a sugar tax.

RIWI has a U.S. patent for its Random Domain Intercept technology to gather random data on public attitudes around the world.

Comments