Made in Canada: Securing the supply of low-carbon nickel

Martin Turenne, President, CEO and director of FPX Nickel talks to CMJ about “the dirty secret of the EV industry”

FPX Nickel is a company that has “many irons in the fire.” Earlier this year, the company announced that it has closed the private placement financing with a new cornerstone strategic investor, Sumitomo Metal Mining Canada, a wholly owned subsidiary of Sumitomo Metal Mining. Later, FPX announced the creation of a Technical Advisory Committee (TAC) to provide guidance to FPX’s management regarding the exploration and development of the Baptiste nickel project. Additionally, the company successfully completed a large-scale mineral processing pilot testing campaign for the Baptiste nickel project.

Then, an expansion of the Company’s Global Generative Alliance program with Japan Organization for Metals and Energy Security (JOGMEC) was announced last April. And the list goes on.

FPX Nickel is a Vancouver-based junior nickel mining company developing the large-scale Decar nickel district in central British Columbia.

During PDAC 2024, I met with Martin Turenne (MT), president, CEO, and director of FPX Nickel to discuss the latest news and success story of FPX Nickel.

CMJ: As a conversation starter, please talk to us about your background, the history of FPX Nickel, and the current company’s portfolio.

MT: I have a background in accounting and experience in the chemicals industry, but I have dedicated the last 15 years to the mining sector. Almost all that time has been with FPX Nickel, where I have held the position of CEO since 2015. Our primary focus at FPX Nickel is the development of the Baptiste nickel project located northwest of Prince George, B.C., and home to one of the world’s largest undeveloped land nickel deposits. It is a project that holds enormous potential. We are pioneering the development of a new nickel source from awaruite, a mineral known for its low sulfur content and strong magnetic properties. This means we can extract nickel without the need for chemicals and produce high-quality concentrate directly at the mine site. By bypassing the traditional, more carbon-intensive smelting process, the Baptiste nickel project has the potential to become a leader in low-carbon mining. It is important to acknowledge that the Baptiste nickel project is situated on the traditional territories of the Tl’azt’enne, Binche Whut’enne, Yekooche, and Takla Peoples. We are deeply committed to listening to and understanding the priorities of First Nations’ communities, and we respect and appreciate their guidance and leadership as we advance the development in a responsible manner.

The Baptiste nickel project has the potential to be a high-margin, long-life, large-scale, and low-carbon mine with unparalleled flexibility to produce either a high-grade concentrate (60% nickel) for direct feed into the stainless-steel industry or further refining into battery-grade nickel sulfate, cobalt precipitate, and copper concentrate products for the battery material supply chain.

CMJ: Can you please give highlights of the 2023 prefeasibility study (PFS) of the Baptiste nickel project?

MT: Our PFS shows a very robust project that can produce nickel at a cost below US$4.00 per pound. Based on current estimates, the carbon intensity of Baptiste would be less than two tonnes of carbon dioxide for every tonne of nickel produced. This is significantly lower than the London Metal Exchange’s proposed limit of 20 tonnes of carbon dioxide per tonne for “green” nickel. The fact that it is in B.C. and well-located to plug into the North American electric vehicle ecosystem makes it a very strategic asset. Based on that and the prefeasibility study, we have seen a significant amount of interest from large players in the industry who have made strategic investments in our company, including Japan’s largest mining company, Sumitomo Metal Mining.

CMJ: What is the status of the worldwide nickel supply after the Covid-19 pandemic? Was it affected by the pandemic? And if so, how?

MT: Overall supply was not too negatively impacted by Covid-19. What occurred during the pandemic, and what we continue to see today, is a regionalization of supply chains. Many western companies and governments are seeking to break their dependence on certain geopolitical actors who are not aligned with their values. What is very interesting to me about nickel, in that context, is the high concentration of geopolitical risk in the nickel supply chain. Approximately 70% of global nickel supply is controlled by China and Russia. So, one of the key things emerging out of Covid-19 is a growing realization that we need to break reliance on that supply. That means expanding production in Canada, Australia, and other allied nations.

CMJ: Can you please explain the deal and the benefits of the Sumitomo partnership announced recently, including the refinery option?

MT: Sumitomo Metal Mining is one of the world’s largest nickel producers. It is the largest mining and metal processing company in Japan, and they are very focused on supporting the Japanese nickel consumption ecosystem. Their customers include companies like Toyota, Panasonic, and Honda. As long-term players in the nickel space, they are constantly doing evaluations of next-generation projects, and their investment in FPX Nickel is their first in a nickel project in more than a decade. It represents the culmination of significant due diligence, and it expresses their positive views on the technical and economic viability of our project. Sumitomo is particularly expert at the processing of nickel into battery grade sulfate for the EV supply chain, so we see opportunities to collaborate with them not just on the project, but also on a potential refinery to produce that battery grade nickel.

CMJ: FPX, the University of British Columbia, and Trent University completed a study on the Baptiste deposit waste rock that demonstrates the tailings at the Baptiste deposit “can sequester significant quantities of carbon dioxide (CO2) when exposed to air through a natural process of mineral carbonation.” Can you explain the study and how carbon sequestering could play a large role in a future mining operation?

MT: The study examines the carbon capture potential of the minerals present in the waste and tailings material that would be generated from our project. In short, we believe that material can act as a significant carbon sink, that would further reduce the carbon emissions on a net basis for our project, even lower than the two tonnes of carbon dioxide per tonne of nickel produced.

This aligns with our core value, which is protection of the environment. We need a safe, sustainable nickel supply to help the world transition to a low-carbon economy, and to support the growing prevalence of electric vehicles. One of our big competitive advantages is our ability to leverage the hydroelectric power available in B.C. and the carbon sequestration capacity of our material. It is very important for people to know that, in advancing this project, we are collectively enabling this transition to electrification and decarbonization and doing it in a responsible way.

CMJ: Can you give us an update on the activities of CO2 Lock?

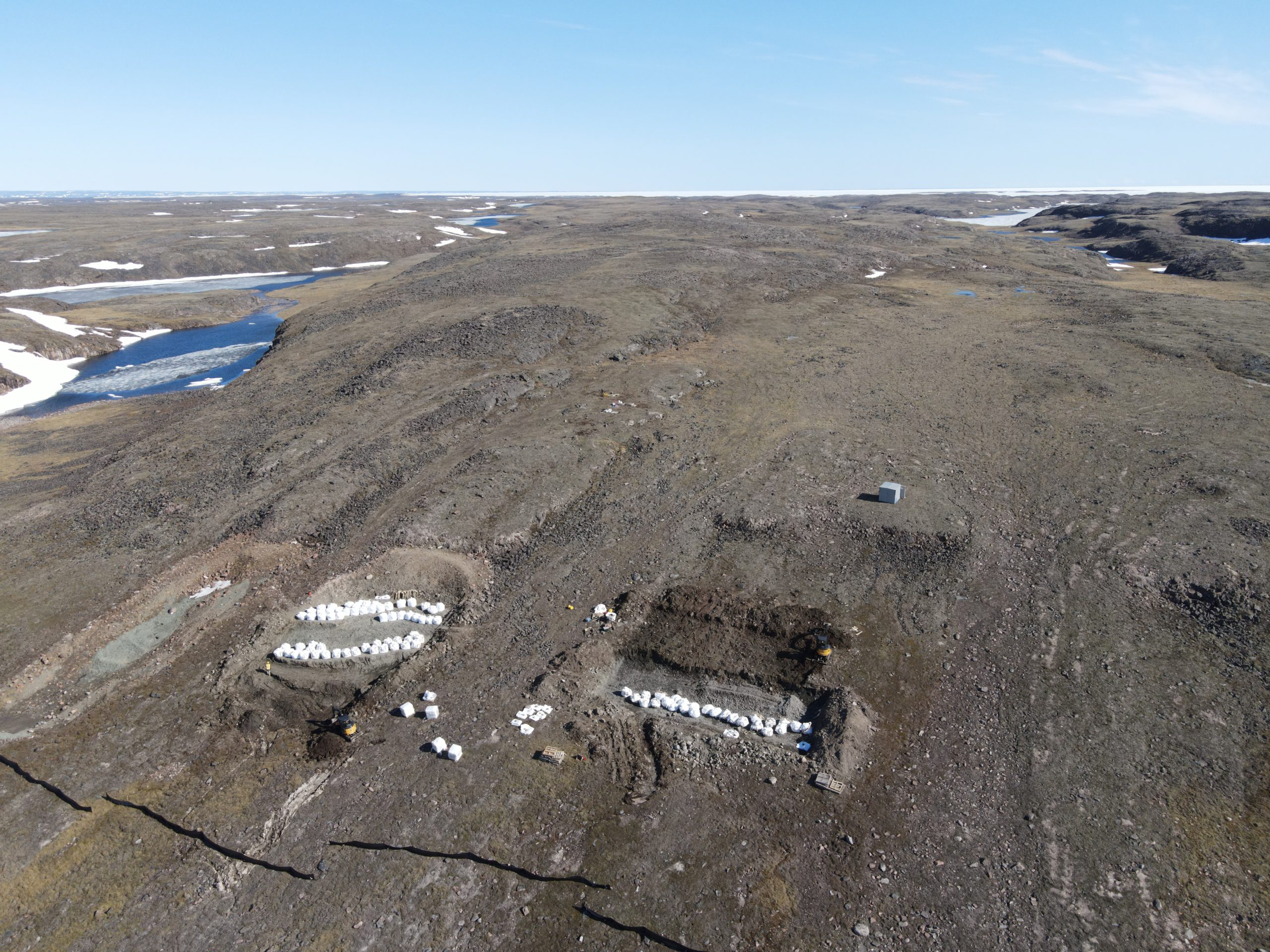

MT: CO2 Lock is a majority-owned subsidiary of FPX, formed to find mineral deposits that are particularly high in minerals reactive with carbon dioxide, primarily brucite. We have identified an initial study area in B.C. and are now evaluating three methods to mineralize and store carbon. Through these initial assessments, our aim is to identify the best approach and proceed to pilot plant trials in the field as soon as this year. Additionally, we are studying prospective international locations to demonstrate potential global impact. This activity has attracted great interest, and we are very keen to see the progress it can make so that we are able to apply learnings to FPX’s project development at Baptiste.

CMJ: In one of your recent presentations, you talked about “the dirty secret of the EV industry;” can you elaborate on that?

MT: The nickel production processes we see in other parts of the world, and that currently goes into making Tesla batteries, emit excessive amounts of carbon dioxide for every tonne of nickel production. If 20 people each purchase a Tesla, they are collectively responsible for 80 tonnes of carbon dioxide emissions. And that is just for nickel. Whereas if those same 20 people bought cars that had nickel coming from our batteries project, they would collectively be responsible for only two tonnes of carbon dioxide. I do not think many consumers understand the implications of the full supply chain. We see that certainly in things like food, for example, where people are very concerned about buying organic or fair-trade coffee, and I think we need to apply that mentality to our other purchase decisions. When consumers and governments put those puzzle pieces together, the strategic environmental value of our project becomes clear.

Comments