Lessons from a low-cost gold miner

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, B.C. Founded in 2007, today, B2Gold has three operating gold mines and numerous development and exploration projects in various countries including Mali, the Philippines, Namibia, Colombia, Finland, and Uzbekistan. This year, B2Gold forecasts gold production to be 990,000 to 1,050,000 oz.

During PDAC 2022 in Toronto, which was the first in-person PDAC in two years, I caught up with Clive Johnson, president, CEO, and director of B2Gold.

Clive Johnson (CJ) has served as a director and the president of B2Gold since December 2006 and chief executive officer since March 2007. Johnson oversees B2Gold’s long-term strategy and development as well as the day-to-day activities. Previously, he was involved with Bema Gold and its predecessor companies since 1977.

CMJ: To start our conversation, could you please talk briefly about the history of B2Gold, locations of the current projects in different stages, and what are the current reserves and resources?

CJ: Our history is about two public companies. It is about Bema Gold and then about B2Gold. I grew up in the gold exploration business while I was paying for university. Bema Gold is a company that myself and other founders started almost 35 years ago (in 1977). Then, that little contracting and consulting company started to grow, and we decided to go public.

In the early eighties we went public for the first time, looking to build our own exploration company, and in 1988, the companies that we had started amalgamated to become Bema Gold.

When we decided to go public with Bema Gold, we quickly established ourselves. We built a gold mine in Idaho. Then, we went to Chile in 1988 before it was a popular place to go for gold, but we were driven by geology rather than geography. We have always believed in looking around the world for potential gold deposits and then figure out everything else. We have always been very entrepreneurial, and it has paid off well.

Bema Gold made two very large discoveries in Chile. One was the Refugio mine, which we put into production, and the Cerro Casale discovery.

CMJ: Are they both still in production?

CJ: No, the Cerro Casale project has gone through a series of other ownerships and development. It should have been built a long time ago in my opinion; it is a big gold-copper project. The Refugio mine was in production for many years. Being entrepreneurial, we started a project in South Africa where we acquired a producer there to grow our production profile. We then went to Russia in 1998, which was a very contrarian move at that time, but we were attracted by a small but very high-grade deposit in Magadan, in far east Russia.

CMJ: So, you went there despite the political instability?

CJ: That was also when Russia just had a financial collapse, and gold was US$300 an ounce, trading at or near an all-time low. Everyone thought we must be out of our mind trying to raise money to build a gold mine in Russia during that time. That is a good example of being bold; our team has always been prepared to do that. Although it was difficult, we raised the money somehow to build that mine, and that was a great success.

Later, that led us to a discovery in a joint venture north of Russia, right next to Alaska, in the Chukotka region. We entered a joint venture with the local government of Chukotka. Several drill holes and trenches there were spectacular, but we did not know how deep it was, or how big it could be. We ended up discovering one of the richest gold and silver mines in the world in the last 50 years called Kupol and we raised US$300 million to build it.

We are different because we build our own mines, and we do not use many consultants or contractors. Not because they are not good, but because we want accountability. Our whole culture, of both Bema Gold and B2Gold, is based on fairness, respect, transparency, and accountability. That is how we treat people around the world, and that is why we have been successful in so many countries – because it comes down to the way we treat people. And the most important thing, if there is a secret sauce to our success, is delivering on the promises we make.

I have been around the world, meeting leaders of countries, mining ministers, and all sorts of people in the local communities, and I have told them that we would like to build a mine in 2.5 years, we will pay a fair tax rate, we will create jobs, we will help to develop the local community, and as a world leader in ESG and CSR, we are going to take care of the environment. In developing countries, they believe me when I tell them we are going to do that because I am the CEO of a Western company. They are not as cynical as we are; therefore, we better deliver on those promises to avoid losing their trust. Delivering on the promises we make is one of the primary reasons for our success beside our entrepreneurial spirit.

In 2007, Bema Gold attracted the attention of Kinross Gold Corp. because they also had a mine in Russia. We were two thirds of the way through building Kupol in Chukotka. Kinross Gold made an offer to our shareholders. We did not want to sell Bema Gold; you do not want to let go of your baby, but we work for the shareholders. So, Kinross Gold acquired Bema Gold for US$3.1 billion; a big disappointment for us because we wanted to keep going, but at the end of the day, the shareholders accepted the offer.

Then we said, what are we going to do next? Nobody on the management team wanted to retire. Let’s try and do it all over again. Bema Gold was zero to US$3.1 billion over about 30 years, so let’s start over with B2Gold. We started B2Gold in 2007 with nothing but our own money and several exploration projects in Colombia. We then went on to acquire Central Sun in Nicaragua in 2009 and built a new mill there and had another great success story. Those Nicaraguan assets, the Limon and La Libertad mines, were vended into another company called Calibre Mining in 2019. We made sure they adopted all our employees in Nicaragua because we care very much about our people.

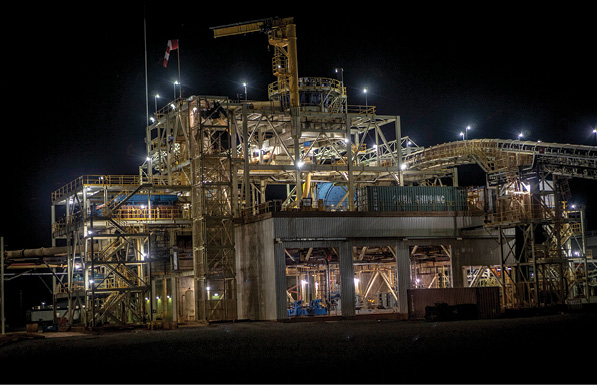

Then, we acquired and upgraded a mine in the Philippines in 2013, the Masbate mine. It is a very low-cost producer, and a well-run mine that produces about 200,000 oz. of gold/year. In 2014, we acquired a project in Namibia, the Otjikoto mine, which our own construction team built very successfully, on budget and ahead of schedule. It has been a successful producer around that 200,000 oz. of gold/year range. The last acquisition was when B2Gold acquired the world-class Fekola project in Mali through a merger with Papillon Resources Limited in October 2014.

The Fekola project had some good drilling results and a good feasibility study, but the market attitude towards growth was very negative because so many global companies had overpaid for assets or had not delivered on construction. So, we got a good deal. It was about 3 million oz. of reserves when we acquired it, meaning 10 years at 300,000 oz./year, but it also had excellent exploration potential. Thus, we overbuilt the mill capacity so we could expand very cheaply. We started the mill at 300,000 oz./year, and now we have doubled the size of the reserve base and are producing 600,000 oz./year. It is a world-class gold deposit, and we think we are just started there because we have a whole belt of 20 km, and we have another 3 million oz. resource to the north on the Anaconda area. There is a good chance we will end up building a second mill, north of the Fekola mine.

Part of our way to grow the company is a little thinking outside the box, by overbuilding a mill for example. If our exploration is telling us there is a good chance for more gold, let’s not build something smaller and regret it three years later. Now, we are world-class in our safety and all the aspects of ESG and CSR, but we are also low-cost miners, very disciplined and entrepreneurial.

We were born of exploration twice. You know, the cheapest ounces will always be the ones you find, not the ones acquired, but we have done a combination of good acquisitions and found our own gold. We are debt-free. We have about US$600 million in cash in the bank, we will generate US$600 million cash this year in gross profits. It is one of the reasons I still do this after 40 years: it is still fun and still entrepreneurial.

CMJ: After so many years of pursuing opportunities in prospective gold regions, what are B2Gold plans for exploration in new regions?

CJ: Most exploration companies should never become a producer because it is a totally different business. At B2Gold, we have the hunger of the explorer and the technical and financial strength of a respected senior producer.

We have allocated approximately US$28 million in 2022 for our grassroots exploration program, which includes several new regions.

In Finland, we allocated approximately US$11 million to the Central Lapland joint venture with Aurion Resources. It lies immediately to the west of Rupert Resources’ Ikkari discovery, comprising similar geology. Diamond drilling in 2021 has confirmed the presence of mineralization on this structure.

In Uzbekistan, we allocated approximately US$6 million to advance exploration on the ground we have acquired in proximity to the world-class Muruntau super mine. A total of 32,700 metres of diamond and reverse circulation drilling has been planned.

In Côte d’Ivoire, we have planned work on two newly acquired early-stage permits. Other areas include Zimbabwe, Papua New Guinea, and Egypt. Our scope is international.

CMJ: Recently, B2Gold announced an updated, significantly increased mineral resource estimate for the Anaconda area, located near the Fekola mine in Mali; then B2Gold acquired Oklo Resources and its extensive land package near the Fekola mine.

Why did you make that acquisition, is it the proximity to the Fekola mine? What are the benefits of the project?

CJ: We are seeing excellent drill results on the Anaconda area, with more than 3 million ounces of resources in the updated estimate. With the proximity of Oklo’s properties to the Anaconda area, it made sense: the acquisition of Oklo is expected to provide B2Gold with an additional landholding of 1,405 km2 covering highly prospective greenstone belts in Mali, West Africa, including Oklo’s flagship Dandoko project (550 km2), which has a near surface resource of approximately 600,000 ounces. The Oklo properties are located on a subparallel, north-trending structure east of the prolific Senegal-Mali Shear zone, approximately 25 km from the Fekola mine and approximately 25 km from the Anaconda area, where we are conducting a drill program of approximately 225,000 m of drilling with a budget of US$35.5 million.

CMJ: So, are you happy with where you are now?

CJ: Definitely, and I think for us, the success is great, but more importantly is how we did it by taking care of the communities, by being environmentally responsible and innovative and building things like solar plants, by thinking outside the box with supporting local populations and programs and agriculture. We are an extension of the Canadian culture of fairness, transparency and respect.

I tell people that the Canadian passport might get you a smile, and it might get you a meeting or an introduction to somebody, but then you’ve got to deliver on your promises. It is the culture and delivering the promises you make. My parents came to Toronto from Liverpool, England, and I was brought up in Vancouver, so I am very proud of being Canadian in the mining industry and of what we give back worldwide.

CMJ: B2Gold released its 2021 responsible mining report prior to PDAC, a tradition that started in 2016. How is that commitment reflected across the company? What are the major highlights from the 2021 report?

CJ: I think last year, we spent over US$9 million on our CSR and community development projects. It is great that investors are demanding this now, but I think it is important to point out that we have been investing in our communities for a long time, before it became cool or required. It is part of our culture again. As a responsible mining company, B2Gold is committed to developing resources in a way that is protective of people and respectful of human rights and cultural heritage, creates socio-economic development, and mitigates environmental and biodiversity impacts.

We show people that we respect their country and the environment. For example, in the Philippines, we have replanted more than 1.5 million mangroves and planted 38,000 corals on over 2,200 installed artificial reef structures. These are huge concrete balls that are sunk into the ocean, to which coral is attached and regrown. The coral reefs have been destroyed, not by us but by overfishing, dynamite fishing, and other damaging practices. Our work has been internationally recognized, including PDAC awarding us their 2021 Sustainability Award.

CMJ: Most of your projects in various stages (exploration, development, and production) are in less developed countries (Mali, Namibia, the Philippines, and Colombia). How do you ensure the economic value B2Gold generates is distributed locally in ways that improve people’s lives in those countries?

CJ: Our investments are part of a win-win partnership with governments, communities and the private sector, all who benefit from our operations. We generate tremendous economic value in the countries where we operate through payment of wages and benefits, payments to governments at all levels, local procurement and support for local companies, local hiring and training programs, and major community investments. The impact is tremendous – last year, for example, we spent over US$153 million on wages and benefits to our almost 5,000 company employees worldwide and paid over US$400 million in taxes and royalties to governments. 97% of our employees are nationals of the countries where we operate, including 64% of senior management positions staffed by local employees.

B2Gold is wholly committed to conserving the quality of the natural environment in the areas where we operate, and to minimize the impact from our operations on the environment. We have taken the lead in sustainable mining, building two major solar plants at our mines in Africa. As an example of our commitment to sustainability and responsible mining, we built one of the first hybrid solar plants, a 7 MW facility, at the Otjikoto mine in Namibia. We have now built a larger 30 MW solar plant at the Fekola mine in Mali, one of the largest off-grid hybrid solar-heavy fuel oil plants in the world. It cuts our carbon footprint down, reduces our emissions, and at the same time we save on operating costs.

in Mali, Namibia, and the Philippines to be between 990,000 and

1,050,000 oz

We also initiated a campaign to save the black rhinos in Namibia, through the donation and sale of 1,000 oz. of gold (valued at approximately US$1.9 million) from our Otjikoto mine. We produced 1,000 limited edition Namibian Rhino gold bars in various sizes, and sold them with a 15% conservation premium, which is invested to sustainably finance community driven conservation efforts and support rangers, trackers, and communities who live alongside the black rhino.

We sponsor an orphanage and private academy in northern Namibia for children who have lost their parents to AIDS or other reasons. The first graduates from the academy have been enrolled in a state-of-the-art secondary school to allow them to continue their education, providing them a promising future.

In Nicaragua, we started working with the local people – artisanal miners – around our mine who were processing mineral ore using mercury, which is poisonous and harmful to the environment. We offered them access to gold veins on our property that we were not going to exploit and built a small mill for the miners where their ore would be processed without using mercury. If we could do that in Nicaragua, we could do it anywhere.

In Mali, we worked with a community that was quite close to where we were going to be blasting in our open pit, to come to the joint decision to move the community to allow for them to develop. Our pit was going to be about 200 m from the village, but the government had given a permit without the requirement to move the village. However, the right thing to do was move that village. We talked to the local leaders and asked them to pick a new spot, and now this rebuilt village is one of the most modern in Mali, with solar panels for every home, improved community hygiene infrastructure, water distribution within the community, and accommodation for everyone. I am also proud that in Mali, we partnered with Global Affairs Canada on a program to provide technical and vocational training to villagers so that they could learn skills to apply in their communities.

CMJ: How did the COVID-19 pandemic affect your operations in those countries? How did the company work with local authorities in each country it operates, since those developing countries did not have early access to the vaccines?

CJ: From the beginning of the COVID-19 pandemic, we put measures in place and introduced additional precautionary steps to manage and respond to the risks associated with COVID-19 to ensure the safety of our employees and the surrounding communities.

We worked with national and local authorities in each country we operate in to comply with all public directives. We are very proud of how all our workers in these different countries performed through the COVID-19 pandemic. These countries do not have a safety net. They cannot just shut down mining because the revenue and wages generated are so important. We all wanted to keep mining during COVID-19 pandemic, but only if we could do it safely. It is the building of the social license over years that earns that trust from the governments and the people in these countries. In each country, we made a considerable impact on helping to respond to the pandemic.

CMJ: Let’s get to some technical topics for a change; how are the tailings management facilities engineered to avoid potential spills?

CJ: We are very committed to complying with recognized global standards and then looking beyond that. That is an important part of the business. Historically and currently, we are not having trouble meeting any of the requirements of the regulations because we have got a great team, and our actions can be seen in detail in our annual responsible mining reports.

CMJ: Your interests are international, but are you currently looking for opportunities in Canada?

CJ: We have always been very global. We tend to be driven by geology and mining opportunity rather than geography. We are looking all over the world right now. We are open. We would love to do something in Canada for sure, but it must be the right fit where we can bring our expertise to the table.

We do not have to rush into anything. I think we have an advantage over many companies because we can do it internationally. We have shown our ability to succeed in many jurisdictions.

CMJ: In Canada, would you be looking for exploration and then operating the mine, or are you open to joint ventures with companies that have finished exploration of mines such as KSM in B.C.?

CJ: What we have done in the past was friendly acquisitions of companies where their shareholders receive our shares. That is a map for great success for us. If the project is big enough, we would be interested in a joint venture. We are open, but we are very disciplined in our due diligence. We do not use consultants and contractors to do due diligence. We do it ourselves because we have the team that can do it. And I want accountability – if those guys recommend acquisitions and they do not work well, we expect our stakeholders to hold us accountable. We would like to continue to find the resources ourselves and develop our projects. We want to grow this company by doing exactly what we have been doing for 15 remarkably successful years, from zero to a million ounces of gold production.

Comments