Is V the new Li?

Vanadium use to surge with battery growth

Energy storage has transformed the electricity industry with huge growth in the U.S., for example, of more than six times in the last few years. The demand is growing exponentially for the batteries used in portable devices, energy storage, and electric mobility. Both lithium and vanadium are reliable sources of energy storage.

Recently, the Biden administration announced it will spend more than $3 billion to support the domestic manufacturing of advanced batteries used in electric vehicles and energy storage.

Additionally, about $3.16 billion in grants will be made available to produce key battery metals such as lithium, cobalt, and nickel, according to the U.S. Energy Department’s Office of Manufacturing and Energy Supply Chains.

Currently, the largest source of lithium production is hard rock mining in Australia. However, most deposits are found in the salt flats of Bolivia, Argentina, and Chile.

Recently, the demand has been surging for vanadium because of its potential use in the battery market; and whether lithium can be dethroned by this new challenger in the battery industry or not remains a very legitimate question that we will also try to answer in this article.

Lithium-ion batteries have the biggest share of the energy storage market, but technological advances in flow batteries that could reduce costs and improve the safety and environmental friendliness are likely to boost the emergence of utility-scale battery storage for energy. Also, the interest in vanadium exploration is driven by the experts’ forecast for all battery metals to witness supply deficits in the next decade, as several mining projects struggle to start production in addition to the fact that lithium-ion battery cell prices are set to increase as the cost of raw materials now is set to absorb the effect of the technological advancements in mining in the last few years.

As Canada starts building its battery metals industry, with a huge emphasis on the recycling of battery metals, there is a need to consider the potential advantages of using vanadium in battery manufacturing for energy storage and the potential vanadium exploration and mining projects in Canada.

What we know about Vanadium?

Vanadium (V) is a hard, silver-grey metallic element that is named for Vanadis, the Nordic goddess of beauty. In addition to being a ductile transition metal, it is also known for its resistance to corrosion and its stability against alkalis, acids, and salt water. Vanadium is naturally found in over 60 different minerals, including vanadinite, carnotite, and roscoelite.

Vanadium has an atomic number of 23. In nature, vanadium is a combination of two isotopes, 50V (0.24%) and 51V (99.76%).

What V can be used for

Vanadium is mainly used in steel alloys, as a pigment, as a catalyst, in the manufacturing of smart construction material, and in several medical applications. Most recently, vanadium is used in vanadium redox flow batteries (VRFBs) to create a reliable, safe, and stable alternative for the storage of energy. The Chinese government is promoting vanadium-flow batteries as an alternative to lithium-ion. A massive backup power facility (twice the size of Tesla’s plant in Australia) is under construction in Dalian.

Advantages of VRFBs

Currently, the dominant form of energy storage is lithium-ion batteries, but there are several advantages of VRFBs: they last longer (VRFBs have a lifespan of 25+ years) and can be charged and discharged repeatedly without any significant drop in performance. They offer immediate energy release, and unlike lithium batteries, vanadium-flow batteries can always discharge at 100%, without any damage to the battery (there is no decaying over time). They are also low maintenance and easy to recycle (they use only one element in the electrolyte, vanadium oxide (V2O5), and vanadium electrolyte can be re-used and does not need to be disposed of).

VRFBs are good for projects where space is not an issue (superior to lithium-ion in large-scale grid storage applications) in both grid and off-grid settings. They have improved safety over lithium-ion batteries, as they are non-flammable and non-explosive because the electrolyte is water-based. In general, the versatility offered by VRFBs energy storage guarantees uninterrupted power supply.

Further advancement will be made as the technology of VRFBs develop and once future innovation leads to cost reductions allowing their use in a more economic scale.

Vanadium exploration in Canada

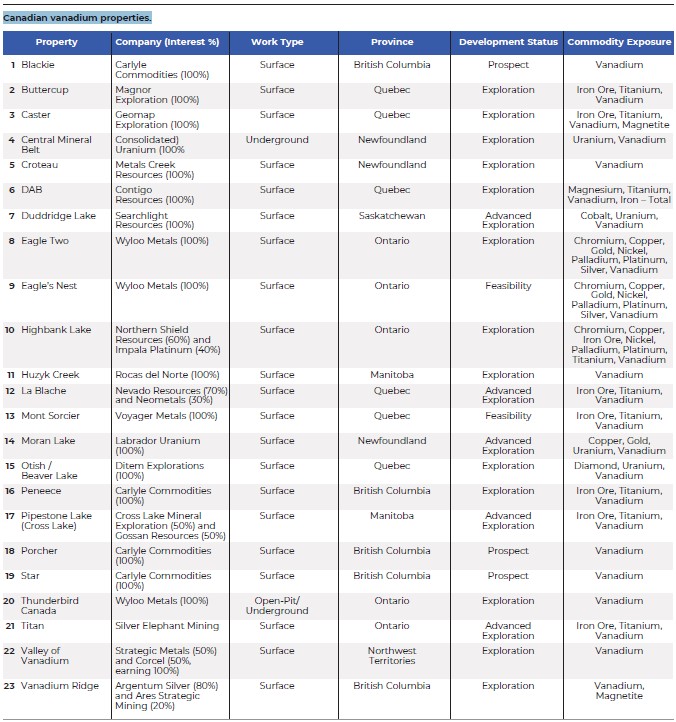

There is a huge potential for vanadium exploration in Canada. The table shows all current 23 Canadian vanadium properties that are in different development stages. The projects are scattered across Canada from coast to coast to coast with a special emphasis on the provinces of Newfoundland, Quebec, Ontario, and British Columbia. After Quebec, Ontario comes second with five surface projects. Vanadium production from most of those properties would occur as a by-product of gold, iron, titanium, and sometimes uranium mining.

Only seven properties are exclusively explored for vanadium, three of which are in British Columbia, one in Newfoundland, one in Ontario, one in Manitoba, and the last one is in the Northwest Territories. The latter “Valley of Vanadium” (also called “Dempster Valley of vanadium project” by the new owners) was originally 100% owned by Strategic Metals.

Early in 2019, Corcel plc (LSE: CRCL) exercised an option to acquire a 50% interest in the Dempster project that was first announced on Dec. 6, 2018.

The project includes 196 claims covering almost 41 km2 with up to a 20 km potential strike.

An exploration program started at the site in August 2020 to increase the understanding of the geology at the site and to produce drill targets for 2021.

According to Corcel’s website, the entire property lies alongside the Dempster Highway, some 65 km north of the Eagle River Lodge, in the northern Yukon. The area already has the infrastructure, including highways, and access to ports and logistics.

This project aims to identify and exploit vanadium in black shales, a potentially ideal source of material for the battery metal markets.

Previous work on the property was focused primarily on nickel, and it was from the seven existing drill holes dating back to 2006 that vanadium results were initially identified at 0.26% V2O5 in roadcut. Soil, silt, and rock sampling outlined broad zones of anomalous vanadium. All those findings, along with possible government investment matching, lead Corcel to identify the Valley of Vanadium as a low-cost, blue-sky exploration.

Another example of vanadium exploration is the Huzyk Creek property in Manitoba. In 2019, Vanadian Energy (TSXV: VEC) completed two holes totalling 745 metres of NQ drill core there. Both holes successfully intersected vanadium-bearing graphitic metasediments (0.22% V2O5 / 9.74 metres). Vanadian Energy is building a leading vanadium-focused resource company. The results confirm that the graphitic metasediments within the Huzyk Creek property host significant vanadium mineralization, which is a new exploration target in Manitoba. According to the company, there was no previous exploration for this type of vanadium mineralization in the province. Vanadian has an option granted by Rocas del Norte whereby Vanadian can earn up to a 100% interest in Huzyk Creek.

Comments