HudBay goes for the gold at Snow Lake

HudBay Minerals’ Lalor mine, in Manitoba. Credit: HudBay

Hudbay Minerals’ 777 mine and Flin Flon mill in Manitoba will be closing in 2022, but that same year, investments in another mine in the province – Lalor near Snow Lake – will begin to pay off in a big way.

The 90-year-old base metals company is in the middle of transitioning its Lalor mine into one that derives the majority of its revenue from precious metals. Thanks to this shift, by 2022, Hudbay estimates 33% of its overall revenue will come from gold and silver, up significantly from 18% in 2019. Copper, the company’s main focus, will continue to generate more than half of its revenues – 52% in 2022 vs. 58% in 2019.

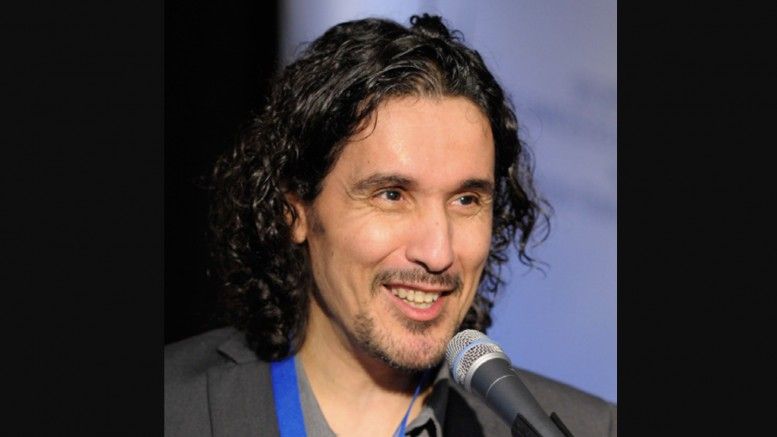

Peter Kukielski, Hudbay’s president and CEO, says the company’s Snow Lake gold strategy can be traced back to 2007, when it discovered Lalor, a volcanogenic massive sulphide deposit that hosts gold and silver as well as copper and zinc.

“Lalor was put into production in 2014, but as we started drilling deeper, we discovered that there was a zone with higher gold content,” Kukielski told CMJ in an interview in late May.

The discovery inspired the company to purchase the 1,500 t/d New Britannia gold mine and mill, located 16 km east of Lalor, in 2015, for $10 million. Hudbay plans to refurbish the mill to process gold-rich Lalor ore by 2022. The New Britannia mill will recover 93% of the gold in Lalor ore, compared with 53% at Hudbay’s existing Stall 3,800 t/d base metals mill.

“(Our gold strategy is) highly reliant on our completing the New Britannia mill refurbishment over the course of this year and next,” said Kukielski, who was appointed as interim president and CEO of Hudbay in mid-2019 before winning the job permanently in January. “But we’re very confident that we’ll do it and we’ve prefunded it with a gold prepay so that we can continue to spend on the New Britannia refurbishment no matter what the environment looks like.”

That “environment” is one of considerable uncertainty thanks to the coronavirus pandemic. But while the pandemic has pushed down base metals prices, it has lifted precious metals, underscoring their countercyclical nature and allowing Hudbay to fully fund the New Britannia refurbishment with a forward sale of gold announced in early May.

The US$115-million gold prepay arrangement is based on gold forward curve prices averaging US$1,682 per oz. Under the deal, the company will deliver a total of 79,954 oz. gold in 2022 and 2023, representing 25% of Lalor’s forecast production for those two years.

“The purpose of the prepay was to prudently fund the mill refurbishment with the right balance between protecting our balance sheet while preserving upside for gold in the future,” Kukielski said. “We felt that securing the funding while the gold price was high and base metals prices were low was a very prudent way of making sure we could execute regardless of what happens in the pandemic environment.” And although base metals prices have suffered as a result of the pandemic, Kukielski says he is extremely bullish on base metals over the longer term – in particular, copper.

“Copper demand has been impacted by the pandemic, there’s no doubt. But at the same time, the world’s objectives of decarbonization can ony be supported through more electrification and copper is a key ingredient of that,” he says.

Snow Lake gold strategy

Hudbay released the details of its initial Snow Lake plan last February. With the New Britannia mill refurbishment completed by the end of 2021, the company projected a near doubling of its gold production in Manitoba to 140,000 oz. per year for 10 years.

After completing additional drilling and technical studies, the company released its updated mine plan this March. The updated plan extends the mine life to 18 years with gold production of 150,000 oz. per year at all-in sustaining costs of US$655 per oz. The New Britannia mill will handle gold-rich ore, producing copper as a byproduct, while the Stall mill continues to receive zinc-rich ore, producing gold as a byproduct.

In addition to refurbishing the New Britannia mill, Hudbay plans to build a 6.8-km pipeline corridor between it and the Stall mill to the southeast to transport tailings, copper concentrate and reclaim water.

Proven and probable reserves at Lalor stand at 15 million tonnes grading 0.74% copper, 3.8% zinc, 4.2 g/t gold and 28 g/t silver.

The updated plan incorporates feed from satellite gold deposits – the WIM zone 15 km north of New Britannia and the 3 Zone at the past-producing New Britannia mine –

starting in 2030. The WIM zone adds probable reserves of 2.5 million tonnes grading 1.63% copper, 0.25% zinc, 1.6 g/t gold and 6.3 g/t silver, while the 3 Zone contains probable reserves of 662,000 tonnes grading 4.21 g/t gold.

This year, Hudbay will be focused on executing its updated Phase 2 plan, released in March.

But the company will also be working on phase three, which will look at a potential expansion of the New Britannia mill capacity as well as converting more resources to reserves.

“One of the key elements of the strategy revolves around the high level of success we had in converting resources to reserves,” Kukielski says. “Because we’re fairly conservative, our conversion rate was between 80% and 90%.”

Currently, the company has 1.3 million oz. gold in inferred resources at Snow Lake, he adds. At the historic conversion rate, that would mean another million ounces that could be converted to reserves. “That provides for a very interesting business going forward,” Kukielski says.

Satellite gold deposits in the Snow Lake region, such as Birch and the New Britannia deposit, could also provide feed for the New Britannia mill and further extend the mine life, with the nearby 1901, Watts and Pen II base metals deposits also having potential.

Pandemic effect

Hudbay’s Manitoba operations have been mostly unaffected by the coronavirus pandemic thanks to very low rates of the virus in the province. In fact, the performance of the Manitoba operations in the first quarter of the year was exceptional, says Kukielski. The quarter saw record mine production at Lalor (up 8% from the previous quarter) and record throughput at the Stall concentrator (up 19%).

“Through all of this, the guys have managed to keep the operations up and running and their performance through the first quarter was extraordinary. We are so proud of them and what they’ve achieved in the last few months,” Kukielski says.

However, the company’s Constancia open pit copper mine in Peru, where the virus is more widespread, did see a shutdown of just over two months beginning in late March. The government gave the go-ahead to restart operations on May 14 and full production has resumed with about half of the workforce.

“We started operations by processing ore from the stockpiles rather than starting to mine because mining requires additional personnel – so we’re doing it progressively and working very carefully with suppliers to make sure our supply chain is strong and we won’t see any interruptions as a result,” Kukielski said. “We believe the workforce restrictions will continue to be a bottleneck, but we have adequate ore inventory – we don’t need to start mining for another few weeks. Then we’ll progressively bring mining personnel back to site. We’re just being very cautious as to how we do that.”

Guidance for the year for Hudbay’s Manitoba operations is unchanged (18,000-22,000 tonnes copper, 105,000-125,000 tonnes zinc and 110,000-135,000 oz. gold-equivalent), but guidance for Constancia (previously 80,000-95,000 tonnes copper, 45,000-55,000 oz. gold-equivalent and 1,300-1,600 tonnes molybdenum) was suspended in March and won’t be updated until the release of the company’s second-quarter financials.

Kukielski says the company has rigorous protocols in place for people coming to the mine, which is located in southern Peru’s Chumbivilcas province. These include isolation before transport and a “quick test” for the virus during isolation. That’s followed by a standard test from health authorities if the quick test is positive.

“Nobody goes to site without first being isolated in Cusco or Arequipa for a week, tested and then mobilized to site, following which they’re segregated for another 14 days.”

The company says it hasn’t had any coronavirus cases at any of its sites. There have been reports of cases at Constancia by Human Rights Without Borders, however, Hudbay says those results were based on quick tests, and that follow up testing with higher-accuracy molecular tests did not confirm any infections.

Litigation

While its current operations appear to be on track, Hudbay is in court trying to move its US$1.9-billion Rosemont copper-molybdenum project in Arizona forward. The project is currently on hold after the U.S. Forest Services’ approval of the project of June 2017 was overturned in July 2019 by the U.S. District Court for Arizona.

Appeals by Hudbay and separately, by the Department of Justice, are ongoing.

Kukielski says the court will likely render its decision sometime next year.

“We remain highly confident that we will prevail and that Rosemont ultimately will come back on track. In the meanwhile, we’ve got to go through the litigation through our appeal.”

The company is also involved with another piece of litigation stemming from alleged human rights abuses by security personnel at the Fenix nickel project in Guatemala against Indigenous communities. Hudbay owned the project between 2008 and 2011.

Kukielski says there’s not much he can say about the case while it’s before the courts. “Our position is unchanged in that the facts don’t support the plaintiffs’ claims,” he said. “We’re sympathetic to the conditions in which the claims live, but we disagree with the statements and we’ll defend our case rigorously.”

Comments