Historic deal ensures First Nations participation in new potash mine

Three levels of government, a mining company and a First Nation have come together in a historic agreement to develop a new potash mine in Saskatchewan.

The joint venture between Encanto Potash Corp. and the Muskowekwan First Nation is truly unique. Together they plan to develop a solution mine near the town of Lestock on property within the Muskowekwan reserve.

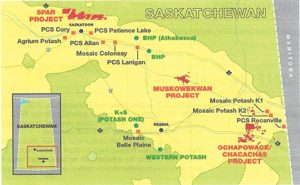

The Muskowekwan project relative to other

Saskatchewan potash mines. Credit: Encanto Potash.

The Muskowekwan are joining the project as full participants, with all the economic and revenue opportunities that entails. And the community is enthusiastic about the prospects.

Over the long life of a Saskatchewan potash mine, this could be worth billions to the First Nation, as chief Reg Bellerose told CMJ. There are about 2,000 members of the Muskowekwan First Nation, but only about 700 or 800 live on the reserves because the economic opportunities lie elsewhere.

“We want to attract investment to the reserve,” he said. “The goal is to take back control of our lives and priorities.” That means becoming economic contributors, with the new mine only one of several revenue streams for the First Nation.

A government first

The mineral lease and regulations for Muskowekwan required the co-operation of three levels of government – federal, provincial and First Nations.

Negotiations involved the federal departments of Justice and of Indigenous and Indian Affairs, the Province of Saskatchewan, and the Council of the Muskowekwan First Nations.

This is the first ever lease issued under the Indian Mining Regulations, and Muskowekwan Resources, a joint venture of the First Nation and Encanto Potash, will be the lessee of 248.5 sq. km of land on the reserve.

The initial step was for the First Nation to request the federal government to develop regulations applying to a specific project on its reserve. That was done under the First Nations Commercial and Industrial Development Act. The act essentially reproduced the provincial rules and regulations that apply to similar largescale commercial projects off-reserve.

The Muskowekwan First Nation drew up its Solution Potash Mining Regulations that will govern the venture. The regulations have the force of law, and will be administered and enforced by the Province of Saskatchewan.

The First Nation’s relationship with Encanto Potash goes back several years. The two had exploration agreements in place before Encanto began drilling. Bellerose says Encanto has brought a desire to learn about the First Nation’s culture and patience to their interactions, and that makes the partnership one of equals.

Going forward, the Muskowekwan First Nation is putting emphasis on training and employment for its members. In that way they will have skills that lead to well-paid jobs anywhere they want to live.

To advise them, the Muskowekwan First Nation has asked AMEC Foster Wheeler to lend their expertise. Not only can AMEC advise on technical and engineering topics, the company has helped the First Nation create its partnership with Encanto.

The company has its own culture of shared benefits, capacity building and a holistic viewpoint.

“It has been a privilege and enlightening to work with the Muskowekwan First Nation,” said AMEC’s senior vice-president for North America Duane Gingrich. In the future he hopes his company’s relationship with all concerned will lead to engineering and construction contracts.

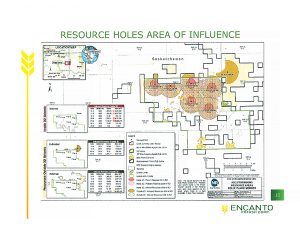

Schematic showing six of seven injection wells on the Muskowekwan. reserve. Credit: Encanto Potash

Plans for the mine

The preliminary feasibility study for the mine was drawn up in 2013, and the bankable feasibility study is due soon. This is what Encanto has in mind, subject, of course, to de-risking and the BFS.

According to the preliminary feasibility study, the Muskowekwan potash project will have a 58-year life as a solution mine with a before tax net present value of $4.1 billion and an internal rate of return of 20%. After taxes, the NPV becomes $2.8 billion and the IRR 18%.

The preproduction capital requirement is $2.9 billion for the initial phase, plus $130 million for deferred capital associated with secondary mining as well as production of a granular type of potash. There will be a brine field, tank farm crystallization pond, evaporation and crystallization plant, drying and compacting plant, load-out facility plus salt storage, infrastructure and utilities.

At full production, the project will produce 2.8 million t/y of potassium oxide.

Operating costs per tonne will be $54.32 at the plant site, with rail and port costs of $50/tonne and sustaining capital of $32.21/tonne.

The mine is estimated to contain proven reserves of 34.2 million tonnes of potassium chloride or 43.9 million tonnes of product containing 62% potassium oxide. There is also a probable reserve of 127.7 million tonnes of KCl or 130.3 million tonnes of 62% K2O. The reserves lie in the Patience Lake and Belle Plaine members, and a 15% cut-off was applied.

Encanto has arranged a takeoff contract with India’s ministry of fertilizer agreeing to purchase 2 million t/y of product from the mine for 20 years. The ministry has the option to buy potash directly through Encanto now (Encanto would secure the potash from third parties) and also secure worldwide distribution rights when the mine begins production. A large farmer’s co-operative has agreed to take another 5 million t/y for the same term.

Indeed the Muskowekwan potash mine is going to be a winner – for Encanto, for the First Nation, and for the provincial and Canadian economies.

Comments