Gold exploration booms in La Belle Province

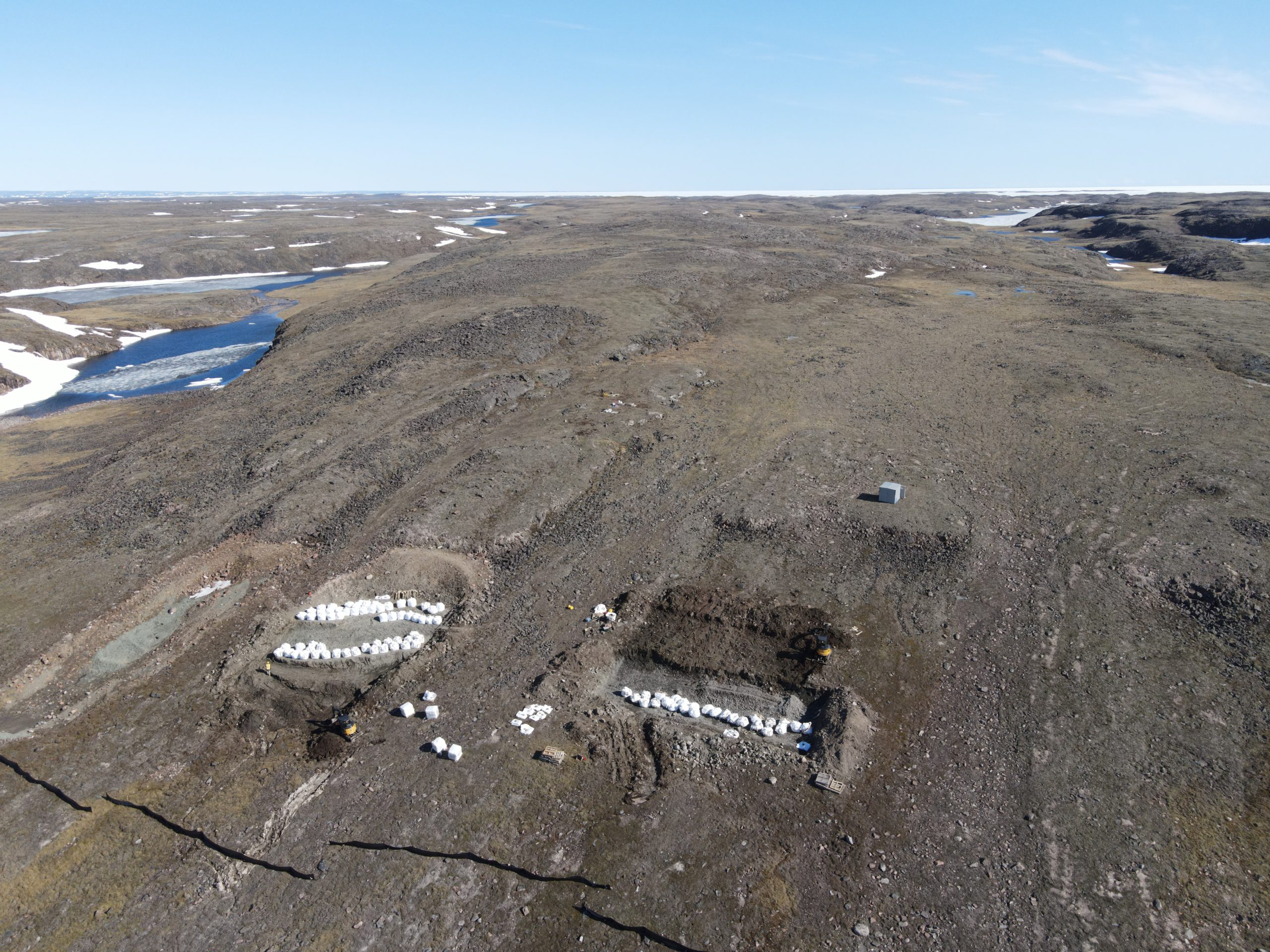

Barge drilling at Bonterra Resources’ Gladiator project in Quebec Credit: Bonterra Resources

A combination of prospective geology, a mining–friendly culture, and generous exploration incentives have made Quebec a popular destination for explorers. A climbing gold price has made it especially so for precious metals juniors.

With 275,000 metres of drilling planned for 2020, Osisko Mining, profiled in our September issue, is certainly the most active gold explorer in La Belle Province, but it’s far from the only company busy at work. Here’s a look a few at some of the other most active gold exploration projects.

Amex Exploration – Perron

In September, Amex Exploration added four drill rigs at its Perron property and increased the program to 300,000 metres from 100,000 metres. The junior is working toward a maiden resource at Perron, located 110 km north of Rouyn-Noranda, near the village of Normétal.

The $21-million program includes 40,000 metres completed last year, and at least 60,000 this year and should be completed in November 2021. The program is focused on exploration between known gold zones that have been identified along 3 km of strike along the Perron gold corridor, to test continuity of mineralization.

The 45.6-sq.-km Perron project, in the Abitibi greenstone belt, hosts both high-grade gold zones (Eastern gold zone, Gratien gold zone and Grey Cat) as well as base metals (Central Polymetallic zone). It also includes the near-surface Denise zone, part of the Eastern gold zone, which the company has flagged as a potential starter pit before underground mining at the High Grade zone (HGZ) portion of the Eastern gold zone.

Of the 10 drill rigs at work at Perron, six will continue to define the Eastern Gold zone, including the depth extension of the HGZ targeting mineralization at 1.5 km depth. Two will focus on outlining a bulk-tonnage, near-surface zone at the Denise zone. Two drill rigs will be assigned to the Grey Cat and Gratien zones to continue to define near-surface mineralization; and the last two will be dedicated to exploration.

Recent results from Denise include 115.6 metres of 1.39 g/t gold from 265 metres and 50 metres of 2.12 g/t gold from 196 metres. Highlights from the HGZ, which has intercepted visible gold at vertical depths of up to 1,025 metres, include 15.6 metres of 32.41 g/t gold, including 0.5 metre of 853 g/t gold.

Bonterra Resources – Urban-Barry camp

In preparation for a preliminary economic assessment (PEA) in early 2021, Bonterra Resources is planning to complete 91,000 metres of drilling this year across its Urban-Barry camp projects, 200 km northeast of Val-d’Or. The eight-rig drill program is focused on both expanding the three high-grade Moroy, Gladiator and Barry deposits and testing new targets. A resource update should be complete late this year, or early 2021.

Moroy is located on the Bachelor property, which also hosts the Bachelor mill; Gladiator and Barry are on the Urban-Barry property, 125 km and 110 km, respectively, from the Bachelor mill.

Bonterra completed more than 34,500 metres of drilling early in the year before the pandemic struck. It restarted exploration in July, with plans to complete another 56,000 metres of drilling this year, including 20,000 metres (surface and underground) at Moroy; 16,000 metres at Gladiator and 20,000 metres at Barry.

Bonterra is also conducting a 10,000-tonne bulk sample (up from 5,000 tonnes originally planned) at its Moroy project, focused on confirming grade continuity in the M1 shear zone, 440 metres below surface, and reconciling the resource grade to the recovered ounces.The zone is being accessed via an existing exploration drift starting from the Bachelor shaft, 900 metres north of Moroy. The sample will be processed at Bonterra’s Bachelor mill under the supervision of a third-party engineering firm, with results expected in the fourth quarter.

The company is also planning a mill expansion from 800 t/d to 2,400 t/d, with construction starting in the spring of 2022 following detailed mill and tailings design, PEA and feasibility studies and permitting.

Current combined resources for Gladiator, Barry and Moroy are 302,000 measured tonnes at 5.66 g/t gold for 55,000 oz. gold; 3.2 million indicated tonnes averaging 6.33 g/t gold for 643,000 oz.; and 6.2 million inferred tonnes grading 7.04 g/t gold for 1.4 million oz.

Probe Metals – Val-d’Or East

Probe Metals has 90,000 metres of drilling planned for 2020 across its Val-d’Or East project, located near Val-d’Or, in preparation for a resource update in early 2021, followed by a preliminary economic assessment.

Of the total, 55,000 metres will focus on resource expansion, 20,000 metres on infill drilling and 15,000 metres on exploration.

The company has defined deposits occurring along two parallel trends (Courvan and Pascalis) at Val-d’Or East, and has been particularly excited by results from the Monique trend, which lies only 5 km southeast of the main New Beliveau deposit on the property.

The company consolidated its ownership of Monique in March, with the acquisition of a 60% stake in the past-producing open pit project from Monarch Gold. It now owns 100% of the 5.5-sq.-km project, which is part of Val-d’Or East.

Recent drill highlights from Monique include the discovery of the new, near-surface P gold zone, which returned 22.5 metres of 1.4 g/t gold; and 24.5 metres of 4.1 g/t gold, including 9.5 metres of 9.2 g/t gold, under the former Monique pit.

Across Val-d’Or East, combined open pit and underground resources in the measured and indicated category stand at 14.5 million tonnes grading an average of 1.85 g/t gold for 866,300 oz. gold. Inferred resources add 37.9 million tonnes grading 1.96 g/t gold for 2.4 million oz.

The property hosts several past-producing mines and falls along four regional mine trends, including 14 km of strike length along the Cadillac Break. Probe expanded its land package to 435-sq.-km (from 334 sq. km) in May, after staking new claims based on regional exploration work that identified prospective gold structures.

Radisson Mining Resources – O’Brien

Radisson Mining Resources is conducting a fully funded 60,000-metre drill program at its past-producing O’Brien project, with plans to extend the program to 75,000 metres into 2021.

Three drills are currently turning at the project, located halfway between Rouyn-Noranda and Val-d’Or, with the aim of growing resources. Recent results from O’Brien suggest the company has found a third, high-grade mineralized trend, 900 metres east of historic workings. The other previously intercepted trends are 300 and 600 metres east of the workings. High grade hits from the most recent find included 2.1 metres of 45.86 g/t gold from 500 metres vertical depth, and 2 metres of 21.29 g/t gold from 260 metres depth.

Current resources at the project include 950,000 indicated tonnes grading 9.48 g/t gold for 289,000 oz., and 617,000 inferred tonnes at 7.31 g/t gold, for 145,000 gold oz.

The resource is mostly within a strike length of 1.5 km and a depth of 550 metres; however there is potential for expansion with an overall prospective strike length of 4.5 km and typical depths in the camp of more than 1.1 km.

The O’Brien project is within the Bousquet-Cadillac mining camp in Quebec’s Larder Lake-Cadillac break. The former O’Brien mine at the site generated 1.2 million tonnes at 15.25 g/t gold between 1926 and 1957.

Radisson recently expanded its claims in the camp nine-fold to 58.4 sq-km by acquiring the New Alger property from Renforth Resources. The two companies have also entered a strategic partnership. The acquisition of New Alger, adjacent to O’Brien, allows Radisson to expand its exploration efforts to the west of the historic mine.

Fury Gold Mines – Eastmain

After a merger between Auryn Resources and Eastmain Resources closes (expected in October), the resulting company, Fury Gold Mines, will start a 50,000-metre exploration program at the Eau Claire project, 80 km north of Nemaska.

The drill program, which will be focused on growing resources, is slated to begin in the fall and continue through 2021. The stated goal is to develop Eau Claire into a 150,000-200,000 oz. gold per year producer.

Part of the 220-sq.-km Clearwater property in the Eeyou Istchee James Bay region of Quebec, Eau Claire holds measured and indicated resource of 4.3 million tonnes grading 6.18 g/t gold for 853,000 oz. Inferred resources add 2.4 million tonnes grading 6.53 g/t gold for 500,000 oz.

A May 2018 preliminary economic assessment outlined a 12-year mine life for Eau Claire with average annual production of 79,200 oz. gold from an open pit/underground project.

With a preproduction capex of $175 million, the project’s after-tax net present value was calculated at $260 million (at a 5% discount rate), with a 27% internal rate of return. Average all-in sustaining costs were estimated at $746 per oz.

O3 Mining – Marban

O3 Mining is planning a 40,000-metre drill program at its Marban gold project, where a preliminary economic assessment completed in September outlined a potential 15-year, 115,000-oz.-per year mine.

The drilling will test extensions of current resources, upgrade resources from inferred to indicated, and test greenfield targets.

A prefeasibility at the project, located on its Malartic property, midway between Val-d’Or and Malartic, is now under way.

The PEA outlined an 11,000 t/d open pit operation with mining at five deposits at Marban. With an initial capex of $256 million, the early stage study projected an after-tax net present value of $423 million (at a 5% discount rate) and a 25.2% internal rate of return.

The PEA used a gold price of US$1,450 per oz. and forecast all-in sustaining costs at US$822 per oz.

Mining would only take place for 13 years, with production over the last two years based on processing of low-grade stockpiled material.

The PEA was based on a measured and indicated resource of 54.2 million tonnes grading 1.1 g/t gold for 1.9 million oz., and inferred resources of 13.2 million tonnes grading 1.44 g/t gold for 610,830 oz. gold. A small portion of the total resource is underground.

QMX Gold – Bonnefond

QMX Gold is planning a 36,000-metre drill program this year at its Bonnefond deposit, near Val-d’Or, and plans to release an updated resource for the project this fall.

A maiden pit-constrained resource released last year pegged measured and indicated resources at 4.8 million tonnes grading 1.69 g/t gold for 258,700 gold oz. and inferred resources at 2.4 million tonnes at 1.87 g/t gold for 145,100 oz.

Bonnefond is located in the Val-d’Or East zone of QMX’s 200-sq.-km land package, which is divided into four zones (East, Central, Southwestern and Bourlamaque).

After the resource drilling was completed in the summer, the company shifted its exploration focus with 10,000 metres planned for the Bonnefond shears, north of the current pit shell in the East zone; and in the Bourlamaque zone, 5,000 metres planned for the high-grade River target and 3,000 planned for the Poulmaque target.

The North shear zones have returned intercepts of 6.2 metres of 3.14 g/t gold and 114.6 metres of 3.69 g/t gold, while the River target has returned 2 metres of 39.83 g/t gold and 3.5 metres of 38.69 g/t gold.

Troilus Gold – Troilus

After releasing a positive PEA for its Troilus project, 170 km north of Chibougamau, in September, Troilus Gold is following up with a 20,000-metre drill program focused on upgrading and expanding resources.

The 1,070-sq.-km project, located in the Frotêt-Evans Greenstone belt, hosts the past-producing Troilus mine.

The PEA outlined a 22-year, 35,000 t/d open pit and underground mine, producing 246,000 oz. gold annually in its first 14 years. With an initial capital outlay of US$333 million, the study pegged the after-tax net present value of the project at US$576 million (at a 5% discount rate), with a 22.9% internal rate of return. The study, which used a gold price of US$1,475 per oz. gold, estimated all-in sustaining costs at US$1,051 per oz. of gold.

Earlier this year, Troilus discovered the Southwest Zone, with some of the best drill results ever from the property, including 73 metres of 1.56 g/t gold equivalent. The zone, located 3.5 km southwest of the main 787 zone, contributed 583,000 gold-equivalent ounces to a July resource update, and the company believes the SWZ has potential for more near-surface, higher-grade material that could have a positive impact on future mining scenarios.

The project holds an indicated resource of 177.3 million indicated tonnes grading 0.87 g/t gold equivalent (or 0.75 g/t gold, 0.08% copper and 1.17 g/t silver) for 5 million gold-equivalent oz. Inferred resources add 116.7 million tonnes grading 0.84 g/t gold equivalent (or 0.73 g/t gold, 0.07% copper and 1.04 g/t silver) for 3.2 million gold-equivalent oz.

Comments