Falco Resosurces restores Horne mine

There are few places in Canada deeper in tradition, and minerals, than the historic Abitibi Gold Belt that extends from Wawa, Ontario to Val-d’Or, Quebec.

It’s a 650-km-long stretch of mineral-rich ground that spans two borders and meanders through some of the more picturesque countryside found anywhere in Canada. In fact, tourism is also now a major contributor to the local economy thanks in part to the drawing power of gold found in the Abitibi greenstone belt.

For example, one of Canada’s larger roadside attractions is a 12-foot replica of a 1908 gold sovereign built to commemorate Canada’s first five-ounce coin made from gold from the local Kerr Addison Mine; once Canada’s largest gold producing mine.

But the Kerr Addison Mine wasn’t the only mine in the area because, since the gold belt was officially established as a gold-mining district in 1901, about 100 other mines have broken ground in the region and produced more than 170 million ounces of gold.

Names like Hollinger, MacIntyre and Big Dome mines are just a few of the others, and even towns like Val-d’Or and Kirkland Lake got their subsequent nicknames (“Valley of Gold” and “The Mile of Gold”) from the rush for gold in the surrounding countryside.

Beyond those two towns are many others that also base their existence on gold; namely Rouyn-Noranda, and Noranda Mines, a powerhouse on the Quebec Falconbridge in 2005, and was later acquired by Xstrata, which was acquired by Glencore.

Like most mines, however, it closed for financial reasons in 1976 and not because it ran out of gold because the site once contained the highest gold grade volcanogenic massive sulfide (VMS) deposit of its size in the world. It’s Horne Mine produced 11.6 million ounces of gold and 2.5 billion pounds of copper.

A combination of historic photos and recent core on display.

Today, thanks to Falco Resources Ltd., of Montreal, one of the larger claim holders in Quebec with a 100 per cent interest in the 74,000 hectares of land in the historic Rouyn-Noranda mining camp, the Horne Mine is coming back to life.

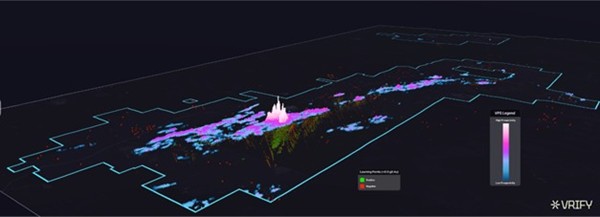

With more than 5,360,000 (Indicated Resource) gold equivalent ounces, including 3,418,232 ounces of gold hosted in 58.3 million tonnes averaging 2.86 g/t AuEq (1.82 g/t Au; 15.60 g/t Ag; 0.20% Cu; 1.00 Zn) still in the ground, it’s no wonder that Falco Resources Ltd. has expressed new interest in the old mine.

The Horne 5 resource estimate is based on 4,384 underground drill holes (305,788m) drilled by Noranda between 1924 and 1976 and 18 new confirmation drill holes (17,300m) drilled by Falco Resources Ltd. in 2015.

The resource estimate also includes silver assays from earlier metallurgical testing by Noranda, comprising 2,112 drill holes representing 75,540m grouped in 54 lots.

Vincent Metcalfe, Falco’s Chief Financial Officer says, “Falco’s confirmation drill holes were collared from the surface and successfully confirmed previously drilled areas between 650m and 2035m below the surface. The historic Noranda holes were also collared at depths ranging from 600m to 2300m below the surface across a strength length of up to 1000m.”

Technically, Luc Lessard, Falco’s President and Chief Executive Officer, explained that the majority of drilling was conducted as radiating “fan drilling” on 15m spacing from 40 underground working levels developed throughout the deposit. He said the 15m spacing is significantly closer than standard drill spacing used in resource estimation work today to further help ensure a higher level of confidence in the data.

Falco sampled at 1m levels and produced more than 87,000 assays.

Armed with new and historic data, Falco recently released a preliminary economic assessment (PEA) on its Horne 5 deposit, which proposes a bulk-tonnage underground mine that would cost more than $900 million to build.

The PEA also suggests a 15,000-tonne-per-day surface mine that would produce about 236,000 ounces of gold annually from a semi-autogenous and ball-milling crushing facility that would divide flotation and thickening into three circuits to also recover copper, zinc and pyrite concentrates.

Other figures in the PEA propose a 12-year mine life with a target of producing 64 million tonnes of volcanic-massive sulphide (VMS) material with an average diluted grade of 2.6 grams gold equivalent per tonne for 4.8 million contained ounces of gold.

Furthermore, the payable life-of-mine gold recovery is expected to average 87 per cent, while by-product metallurgical recoveries would average 74 per cent for copper, 67 per cent for zinc, and 75 per cent for silver.

As for the actual mine, the underground deposit is located (as already mentioned) at a depth of approximately 600m to 2300m below the surface and will primarily be accessed initially through an existing and rehabilitated shaft which extends to a depth of 1200m.

Once again, CEO Lessard says, “The shaft will provide for the hoisting of mineralized material and waste, service personnel and materials, and the supply of ventilation to the underground workings. We also foresee rehabilitating several of the old Horne shafts for ventilation purposes and using old underground excavations to tailings disposal.”

Additional design features will include gravity transport of mineralized material and waste through raises, shaft hoisting, minimal mineralization material and waste re-handling, higher productivity bulk mining methods, and unconsolidated waste rock backfill where possible.

Where possible, Lessard says the mine will be designed to use as much state-ofthe- art technology including automated and remote-control equipment, including 21-tonne loaders to transport muck to the ore-pass system.

An underground crushing facility will be fed by two ore-pass systems and the crushed material will be transported via a 600-m conveyor to the shaft loading point where it will be hoisted to the surface using 43.5- tonne skips on a continuous basis.

Because of the mine’s location in the popular Rouyn-Noranda mining district of Northern Quebec, Falco Resources will have little to no trouble drawing from the community’s 41,500 residents to fill its staffing requirements because, as mentioned at the outset, there are few places in Canada deeper in tradition than where Falco is setting up shop and that includes a deep tradition of experienced miners too.

Comments