Energy transition: The benefit and risk behind metals and minerals dominance in Canada

The demand for critical metals and minerals is advancing dramatically as energy transition gathers momentum globally. Rare metals and minerals are essential to many clean energy technologies, including wind turbines, electricity transmission, and electric vehicles (EVs).

But when comparing fossil fuel-based resources such as hydrocarbons with the metals and minerals needed to meet emerging needs to build renewable power generation assets and energy storage devices, the numbers are staggering. According to the International Energy Agency (IEA), it takes six times the mineral inputs of a conventional car to power an EV and nine times more for a wind plant than its gas-fired counterpart. It is anticipated that nickel production and output will need to double by 2030, and the demand for metals and minerals will need to increase a whopping six times what it is today by 2040 to meet net-zero targets.

The race is on

This demand curve poses both a benefit and risk to Canada’s minerals industry, along with the ecosystem it supports. While countries outside Canada are ramping up production at pace and looking to shape the supply chain crucial to the new EV industrial base, we may already be playing catch up.

Holding a dominant position in supply chains that transform raw materials — like cobalt, graphite, and rare earths — into finished products supporting renewable energies, Beijing recently banned the export of technology to extract and separate rare earths to protect its dominance in strategic metals and cement its competitive position.

The U.S., likewise, is reshaping the landscape with its Inflation Reduction Act (IRA), triggering a surge in critical minerals development, including rare earths metals like neodymium used in powerful turbine magnets. Mining companies are qualifying for production credits equal to 10% of production cost, while consumers buying IRA compliant cars — made with critical metals from the U.S. or free-trade countries — are receiving up to US$3,750 in tax credits.

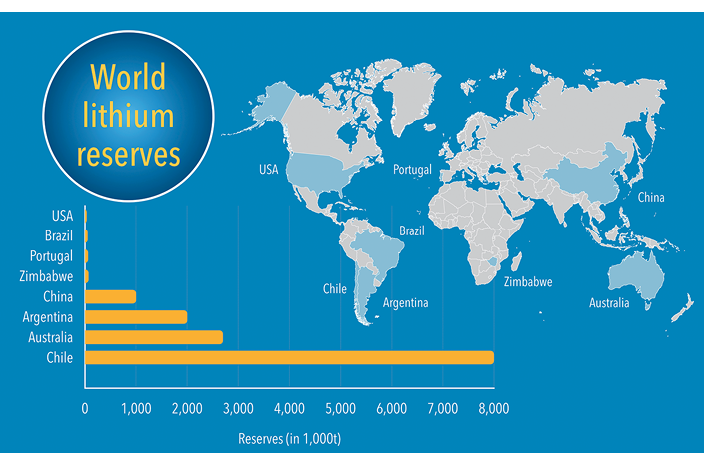

Metals like lithium are expected to play a vital role in electrified transportation, so reserves will be a good foundation for any competitive positioning. While the largest lithium reserves are found in Australia and Chile, totaling 9.3 million and 6.2 million tonnes, respectively, Canada is not to be dismissed, with 930,000 tonnes.

Time to act

With other countries rolling out similar initiatives, where does Canada stand? And can we get out of our own way to take advantage of the benefits? The key factor determining whether resources benefit a nation’s populace or lead to hardship lies in how effectively the country manages them. In resource-rich countries, abundance often disrupts accountability between citizens and government and can hinder democratic and social progress, benefitting a select few and contributing to inequity.

In Canada, we are not dependent on a single commodity and our natural resource sector constitutes only a small fraction of our broader economy. Additionally, stringent standards for financial transparency and accountability are well-established and rigorously enforced in both the private and public sectors. We invest public wealth into education, training, and social services and direct funds towards infrastructure and governance, cultivating a diversified economy.

The bad news is we are already behind in energy transition minerals and not a competitive player. Complacency and abundant natural resources have the potential to transform our blessing into curse. Fundamental safeguards are needed to protect our natural resources and retain competitive advantage.

Getting competitive

Canada’s Critical Minerals Strategy is a great start to optimize our minerals eco-system and maintain mining primacy. The $2.78 billion strategy aims to boost production and processing of critical minerals, but does it go far enough? With a seemingly dysfunctional regulatory process and added pressure to align with the U.S., the development of mines in Canada could take from five to 25 years, massively hindering our aspirations to be a player in the U.S.-led initiative challenging China’s dominance in the sector.

On the flip side, developing the sector could catapult Canada to the top in the global race to decarbonize and monetize the EV revolution. With half of global passenger-vehicle sales in 2035 expected to be electric and major companies phasing out internal combustion engines, the lithium-ion battery is at the heart of this evolution. The following are seven success factors that can advance Canada in the metals and minerals race and position us to take hold of unparalleled opportunity:

1 | Resource identification and mine development: Identifying and mapping reserves will be vital, including developing technologies and infrastructure, flow-through share funding for drilling and feasibility studies and construction.

2 | Building end-to-end value: Comprehensive value chains, spanning from mineral extraction to refining capacity should be prioritized and downstream economic benefits secured.

3 | Strengthening partnerships: Connecting the resource sector and Indigenous communities could help Canada emerge as a global leader in this space.

4 | Workforce development: People drive innovation. Investing in education and training to develop a skilled workforce and creating employment opportunities in exploration, extraction, processing, and manufacturing will be essential.

5 | Tax incentives: Collaborating with industry to financially motivate investment will ensure the federal government has skin in the game.

6 | Regulatory modernization: Any strategy should recognize the urgent need for a modern regulatory system that is outcomes-driven, flexible, and predictable to foster innovation and adoption and provide the business sector the certainty it requires.

7 | Protecting intellectual property: Knowledge is power. To grow competitive advantage, Canadian companies must safeguard assets and ideas, including the development and protection of intellectual property and data.

The surge in demand for critical metals and minerals driven by energy transition creates a tremendous opportunity for Canada. But competition underscores the need for a strategic, get-it-done approach. While the Critical Minerals Strategy provides a foundation, it needs to move faster to ensure Canada excels in the global race to decarbonize and monetize the electric vehicle revolution. Opportunities will not last forever unless we act with urgency, Canada’s primacy in mining will not either.

Jon Wojnicki is a partner and a co-leader of EY Parthenon at EY Canada. Dr. Lance Mortlock is the managing partner for energy & resources at EY Canada. For more information, visit: https://www.ey.com/en_ca/mining-metals.

Comments