Costing the mine of the future: the impacts of ESG

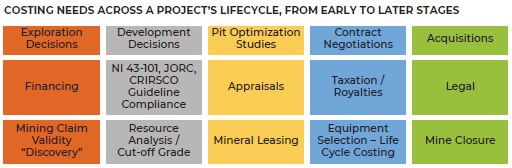

There are many reasons for which we might estimate costs in the mining industry. Several of them, representing very specific needs spanning the full life cycle of a project, starting at the early stages of a project and progressing to later stages of development and production are outlined in the graphic below.

The reader may note that there are common threads connecting each of these. Cost estimates provide companies with a means for making decisions. They can also provide an indication of whether a project will be profitable.

Of course, success is no longer just about profitability; it is also about environmental protection and social buy-in. And as such, the traditional lenses through which we view projects and companies – jurisdiction, permitting, reclamation, commodity, geology, investor sentiment, capital and operating costs, etc. – are not enough to gauge success. We must add environment, social, and governance (ESG) factors to the list, because ESG is driving the mine of the future.

ESG concepts have been around for a while now, but our industry moves slowly and we’re having to play catch up when we should have been leaders from the start. Surely, there are many reasons for this, but the author suggests a leading cause is related to ESG costs, associated with both compliance and non-compliance.

Points of consideration

There are several points of consideration that may help us better understand this relatively new ESG lens and its effects on both mine costs and the estimating process itself. This article will briefly discuss several of them, but the list is not exhaustive by any means.

Research and development

Research and development (R&D) for new, ESG-friendly technologies and processes costs money, and as such, suppliers will inevitably need to pass this cost to consumers. Cost estimators should consider this when conducting their trade-off studies for alternative ESG-friendly equipment and processes. The good news on this front is that costs should come down over time as ESG assumes a mainstream role.

Permitting

We are going to see extended permitting times for various reasons, including additional environmental studies, continued public pushback to mining, and government bottlenecks to name just a few. What does this mean for the estimator? The reliability of cost predictions wanes the further into the future we make our estimates, so we will be required to deal with the additional uncertainties (risks) associated with project timing and cost predictions. One way to mitigate some of this risk would be to improve upon and add to our industry’s public and government outreach/education programs. This could potentially stabilize or shorten the permitting period.

Appropriateness/practicality/reliability

ESG initiatives are certainly driving positive and much-needed industry changes. However, we should not abandon the ideas of practicality and reliability. The cost estimator should ask themselves questions similar to the following:

> Is the project timeline reasonable?

> Is the new initiative both ESG-positive and profitable? Does it need to satisfy both criteria?

> Is this alternative equipment selection appropriate for the task?

> What might the cost be if an initiative fails?

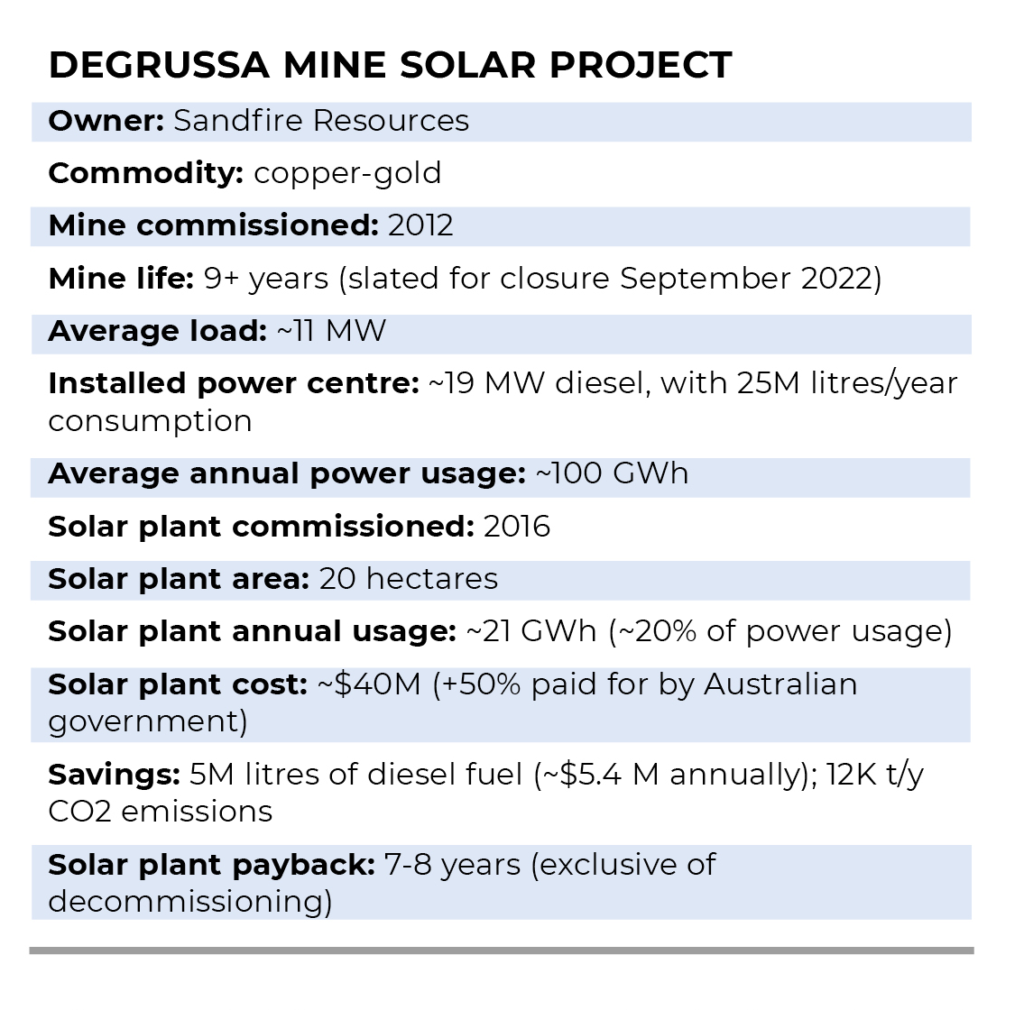

To better illustrate this concept of appropriateness and practicality, we should consider an example. Specifically, let us look at a known solar project, the DeGrussa Mine Solar Project, located 900 km north of Perth, Australia. This project was built to showcase the possibilities with mining and renewable energy, and as such, the project information summarized below is publicly available.

There are obvious benefits to this solar installation, namely the significant CO2 emissions savings, as well as the financial savings related to lower diesel consumption. However, there are also obvious limitations to practicality in terms of scale – i.e. limited solar power load, large space requirement, and short mine life. A 20-hectare space requirement is very significant, particularly when you consider that only 20% of the load is met via solar. Many projects do not have this space available, and many projects would require an even larger footprint (an environmental concern in itself) than this moderately small project (power-wise). And lastly, it is our presumption that a 7- to 8-year payback on this solar plant would necessitate a longer mine life to make it economically feasible after decommissioning costs are considered. (Note: Costmine has not reviewed detailed economics for the project.)

The point: companies and cost estimators must consider practical limitations when conducting their estimates to aid in determining the appropriateness of initiatives.

Project design

Cost estimators should be flexible in their project design and implement ESG initiatives as early in the project planning phase as possible. This helps to ensure an ESG focus and to minimize costly changeovers later.

Additionally, estimators should conduct lots of trade-off studies that are inclusive of ESG-positive alternatives, as the importance of these studies is elevated during this industry shift. As an example, Eric Gentis of Flottweg Separation Technology indicated that relative to filter presses, their decanter centrifuges offers several benefits, including: reduced cost (20% lower capital cost and 90% lower cost to operate); a fully automatic and continuous process; higher water qualities and recoveries; and a reduction of process water and tailings storage requirements.

The reduced process water and tailings storage requirements are both ESG-positive outcomes attributed to the use of decanter centrifuges, so is this a change that operators should make? Perhaps, if it is practical and appropriate for any specific project.

Difficult to obtain costs

Cost data is time consuming to gather and some suppliers are leery of providing budget numbers for early-stage projects. This is especially true for new, innovative ESG-conforming line items. While this is an understandable approach for suppliers, it dramatically slows our understanding of ESG costs industry wide.

For example, let’s say you have a medium-sized operation that you are interested in developing. You want to have an idea of whether or not it would be practical and financially feasible to move forward with autonomous haulage. You know there is an up-front cost and you know it isn’t as simple as pulling a driver out of a truck and putting them somewhere else, but what is really involved? What does it really cost?

As estimators, we know it costs more to add autonomy to trucks: there are sensors, the network, the control room, annual software maintenance fees, and the tech-savvy labour replacements and additions. We can all work this general outline, but it is very difficult to start putting numbers to these components without an industry-wide improvement in cost transparency.

Cost of non-compliance

Anytime a company chooses to minimize or completely avoid the shift towards ESG compliance when practical and reliable opportunities exist, there is, at the very least, a missed opportunity to make positive industry change and to change public and government perceptions. Progressively worse possibilities are a loss of dollars, a loss of the company, and the loss of a life. It doesn’t matter what your capital and operating estimates/actuals may be — they all blow up the moment a disaster occurs.

In summary

ESG is driving the mine of the future, and this new lens has brought much needed focus to previously minimized aspects of our industry. Each of the ESG points of consideration outlined has the potential to be significant from the cost perspective, and cost estimators must understand and work through these considerations to better navigate the risk versus reward spectrum.

For more information, check out Costmine’s presentation at Canadian Mining Journal’s recent Reimagine Mining Symposium:

Brad Terhune is a cost analyst and senior geologist with Costmine (www.costmine.com), part of the Glacier Resource Innovation Group, based in Spokane, Wash. He can be reached at bterhune@glacierrig.com or 509-328-8023.

Comments