Commodity prices: Boon or bane of tomorrow’s mines

It is difficult for a mining company to develop new mines today. Profitability is the endgame of any project, but with rising inflation, energy and equipment costs, and higher taxes, the ability to build a new mine can seem out of reach.

Most of these costs can be estimated and accounted for, but fluctuating commodity prices can make or break a mine.

In the last fifteen years, we have seen just how volatile commodity prices can be (Figure 1). After a period of rapid growth, prices crashed along with the stock market in 2008, clawed their way back up, and then crashed again in 2013.

In the six years since, commodity prices have experienced a lot of change, but have not reached the highs they saw in 2011 and 2012. As a result, many late stage projects and mines were placed into long-term maintenance or shut down completely. Many companies changed their areas of business or went bankrupt.

In the six years since, commodity prices have experienced a lot of change, but have not reached the highs they saw in 2011 and 2012. As a result, many late stage projects and mines were placed into long-term maintenance or shut down completely. Many companies changed their areas of business or went bankrupt.

Aim

A need to better understand the sensitivity to commodity prices of projects nearing the end of the development pipeline has been identified by CostMine and Mining Intelligence (divisions of Glacier Resource Innovation Group).

Method The concept is simple, create economic models of a sample of feasibility level mining projects so the commodity price can readily be varied, and sensitivity assessed.

We will focus on proposed open pit copper projects, specifically those projects furthest along in the development pipeline. To get a reasonable sample size, we searched the Mining Intelligence database for open pit copper projects, limiting the scope to feasibility-stage projects. This limit ensured that each project in our study had undergone the most advanced technical work while still being within the pre-mine phase. Of the 42 projects in the database fitting these criteria worldwide, 11 were selected based on the quality of information and most recent activity. Projects across Asia (3), Oceania (3), North America (2) and South America (3) are represented. The sum of proposed production rates for the 11 projects is roughly 320,000 tonnes of ore per day. About 80% of this rate is accounted for by three large projects with mining rates of more than 40,000 tonnes per day. The difference is made up by eight smaller projects of less than 40,000 tonnes per day.

To build accurate economic models for the 11 projects, we extracted relevant information from the most recent technical reports for each project. This information included reserve estimates, strip ratio, pre-stripping requirements, proposed production rate, mine life, concentrate transportation costs, etc. Using this information, we built economic models of each project using Mining Intelligence Evaluate software, an application built to provide users with realistic capital and operating costs for surface mining projects and conduct economic analyses.

We then varied the copper price in the application to determine sensitivity.

Capital and operating cost estimates produced by Evaluate and used in this study are prefeasibility level and account for mines, processing plants and, if required, camps and remote infrastructure. Local tax rates and royalties (where applicable) have been accounted for. Itemized costs were sourced in 2018.

Results

We will be presenting the net sum of cash flows to investigate sensitivity. The figures presented here are not net present values and do not account for the time value of money. Rather, the net sum of cash flows are simply the result of subtracting expenses (capital, operating, taxes, royalties) from revenues over the life of each mine.

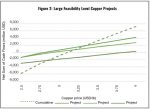

The results for the three largest projects (more than 40,000 tonnes per day) at copper prices ranging from US$2.50 to US$4 per lb. are presented in Figure 2.

Also included is the total net sum of cash flows of all three large projects Of those large, prefeasibility level projects sampled, most break even between US$2.75 and US$3 per lb. copper. If this sampling is taken as representative, on average, large prefeasibility level copper projects break even between US$3 and US$3.25 per lb. copper. Of the most favorable projects, net sum of cash flow ranges from -US$1.4 billion to US$4.2 billion at these copper prices.

Also included is the total net sum of cash flows of all three large projects Of those large, prefeasibility level projects sampled, most break even between US$2.75 and US$3 per lb. copper. If this sampling is taken as representative, on average, large prefeasibility level copper projects break even between US$3 and US$3.25 per lb. copper. Of the most favorable projects, net sum of cash flow ranges from -US$1.4 billion to US$4.2 billion at these copper prices.

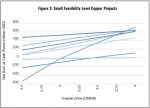

The results of the remaining small projects of less than 40,000 tonnes per day are presented in Figure 3.

There is a much higher number of active copper projects at production rates below 40,000 tonnes ore per day. They are also more likely to remain above break even at low copper prices and show less sensitivity to the copper price compared to large, more than 40,000 tonne-per day projects. Most small projects show net sum of cash flows ranging from lows of about US$50-450 million to highs of US$450-650 million.

There is a much higher number of active copper projects at production rates below 40,000 tonnes ore per day. They are also more likely to remain above break even at low copper prices and show less sensitivity to the copper price compared to large, more than 40,000 tonne-per day projects. Most small projects show net sum of cash flows ranging from lows of about US$50-450 million to highs of US$450-650 million.

The authors found that overall sensitivity to copper price was correlated with production rate. In other words, those planning to excavate the most ore per day are more likely to win or lose big due to volatile copper prices, with smaller potential producers being less exposed.

Low cost mines are still best equipped to remain profitable during periods of depressed copper prices.

Conclusion

Realistic, up-to-date cost models paired with sensitivity analysis yields a powerful tool that can be used to efficiently assess project viability at any stage of development.

We used this method to assess a sampling of surface copper projects furthest along the development pipeline as these projects have the most available data and are most relevant to the industry.

Large projects show the greatest sensitivity to volatile copper prices and small projects are less sensitive and can remain profitable at depressed copper prices.

And of course, those with favourable grades and the lowest costs have the best odds of remaining profitable.

Sam Blakely is a cost analyst and geologist with CostMine, a division of Mining Intelligence (www.costs.infomine.com). He can be reached at sblakely@infomine.com. Colin Finkbeiner is a geological analyst with Mining Intelligence, a division of Glacier Resource Innovation Group (www.MininigIntelligence.com). He can be reached at colinfinkbeiner@infomine.com.

Mining Intelligence has been analyzing companies and projects and collecting data on resources and reserves, production, drill results, and other information since 1989.

CostMine has been evaluating projects and collecting data on supplies, equipment, labour and other key costs since 1983.

Comments