Cobalt’s central role in supporting the global battery sector

Eurasian Resources Group’s Metalkol hydrometallurgical facility Credit: ERG

A recent landmark study by the Global Battery Alliance – a public-private coalition led by the World Economic Forum – found that demand for lithium-ion batteries is expected to increase by 19 times by 2030, reaching 3,600 GWh (gigawatt hours). On the basis that batteries are sustainably sourced, a range of socioeconomic benefits would follow, including the creation of 10 million safe jobs, a 70% reduction in the number of people lacking electricity and a 30% emissions reduction in the power and transport sectors. Batteries can, as a result, provide significant support not only for the Paris Agreement goals but also for a range of the United Nations Sustainable Development Goals (SDGs).

The current value chain, however, would not be able to create these benefits and harness that demand momentum unless it is scaled up through far-reaching collaboration among a range of entities, including businesses, governments, organizations, civil society and academia.

A ‘just’ energy transition

According to the report, which was delivered with the contributions of Global Battery Alliance members, and global consultancies McKinsey and SYSTEMIQ, collaborative action should aim to address three core areas. One of these is the facilitation of a “just energy transition” and economic development in line with human rights and the SDGs. Batteries, in short, may directly affect the wellbeing of people and local communities and this is particularly true of areas and regions that rely on the sourcing of battery materials. Over two thirds of cobalt, which is identified as a key metal by the Global Battery Alliance, is found in the Democratic Republic of the Congo (DRC). More than 250,000 people are estimated to work in the sector in dangerous conditions, about 35,000 of them children. By some estimates, as many as 1 million children are affected by the DRC’s mining industry. In order to facilitate a just energy transition, it is important to ensure that cobalt is produced responsibly and that efforts to tackle challenges associated with poor working conditions and human rights issues, including forced and child labour, continue to be heightened.

Nowhere is this more relevant perhaps than vulnerable communities in Kolwezi, DRC, which is home to abundant cobalt reserves and cobalt mining activity. The vulnerability of the communities lies in the negative consequences that may arise in connection to cobalt production that is not responsible. These activities can put in jeopardy the health and long-term development of participants, some of whom may be young and lack access to alternative livelihood opportunities as well as healthcare and education.

With that in mind, Eurasian Resources Group (ERG) is proud to support the Good Shepherd International Foundation’s Bon Pasteur program, as part of which over 1,900 children in 2018 and early 2019 have been protected from the worst types of child labour. Last summer, Kolwezi saw the inauguration of a Bon Pasteur Child Protection Centre, supported by ERG, providing a safe space and extending sustainable opportunities for up to 1,000 children to transition out of mining. A comprehensive facility, the centre provides free education as well as healthcare, nutrition, counselling and human rights training, and the opportunity for families to learn about alternative livelihood opportunities. In addition to child labour, the Bon Pasteur program has helped address gender-based violence, food insecurity and a lack of vital social infrastructure over the past seven years. The program’s founder, Sister Catherine Mutindi, was recently awarded the Opus Prize for her outstanding efforts in Kolwezi.

While that is a commendable contribution, some of the challenges that the country faces are deep-seated and this includes the irregularities that are currently seen in the cobalt value chain. One of the poorest countries in the world, the DRC receives only 30¢ of every $1,000 of economic value generated in a mobile phone. The mobile phone would simply not exist without the DRC and its cobalt and yet people at the beginning of the supply chain are not seeing the benefits they should in terms of alternative livelihoods and sustainable jobs. It is therefore encouraging that the GBA study found that the global battery industry, powered by rising demand for electric vehicles, could produce 10 million safe, sustainable and good quality jobs by 2030. Importantly, more than half of these jobs would be in emerging economies. These jobs could help address the current imbalance, ensure that the energy transition is inclusive, and its benefits are distributed across wide geographies.

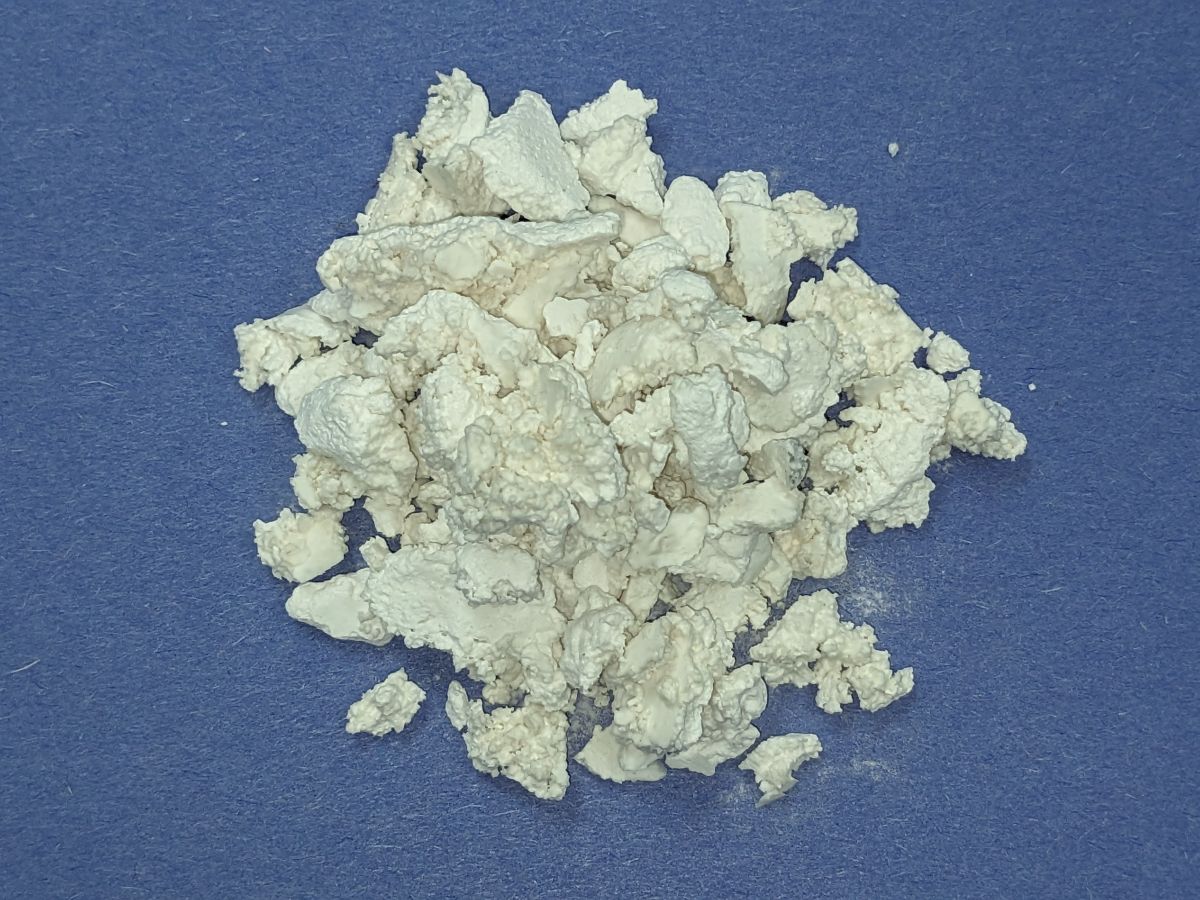

In this context, the report also alludes to a need for cobalt producers to monitor and manage their environmental impact. While the green economy revolution would not be possible without cobalt, a culture of vigilance and innovation can accelerate its momentum. This focus is strongly reflected at ERG’s Metalkol RTR, a hydrometallurgical facility to decontaminate historic copper and cobalt tailings deposited by previous operators into the Musonoi river and Kingamyambo dam near Kolwezi. As a result, over 1.3 million tonnes of historical tailings have already been reprocessed at Metalkol instead of continuing to pollute the local environment.

An aim to protect and restore the environment is also embedded within ERG’s Clean Cobalt Framework, which was launched at Metalkol RTR. Its progress was recently independently verified for the first time by PwC. Among the seven goals that comprise ERG’s Framework is ERG’s commitment to sourcing cobalt that is free of child labour, traceable and does not come from artisanal mining.

Blockchain can also assist in providing an additional source of reassurance as to the origin of sourced cobalt. To that end, ERG is exploring a blockchain-based solution built on the IBM Blockchain platform. Moreover, ERG recently joined a consortium of seven leading mining companies to accelerate the responsible sourcing of materials, including cobalt through the World Economic Forum by experimenting, designing and deploying blockchain solutions. This initiative echoes the Global Battery Alliance’s call for greater collaboration and inclusivity across the industry. While blockchain can be useful in the cobalt value chain, though, a more holistic approach to ensuring responsible production is still needed with due regard to safety, human rights, labour laws and environmental impacts.

The central role of cobalt for the future

A strong momentum is in motion, with automotive manufacturers set to launch more than 300 electric vehicle (EV) models in the next five years. According to research by JP Morgan, electric vehicles (EVs) and hybrid electric vehicles (HEVs) will account for an estimated 30% of all vehicle sales by 2025. By that point, ERG expects a more than four-fold increase in cobalt demand in the EV segment, while CRU – in the same area – predicts an uptick of 25% next year. Also significant is that cobalt-bearing NCM and NCA batteries are forecast to expand their market share up to 80% by 2025. Metalkol RTR, ERG’s cost-effective cobalt and copper facility in the DRC, is well positioned to continue to service this increasing demand.

A significant portion of cobalt demand is driven by China, which, according to the Harvard Belfer Centre, aims to have 5 million EVs on the road by 2020 and over 80 million by 2030. This is complemented by the Chinese government’s aim to strengthen the EV industry by stimulating technological innovation, reducing pollution and promoting the technology to sectors beyond private vehicles, including transportation. According to the China Association of Automobile Manufacturers, the number of New Energy buses found in China now exceed 340,000, making it a world leader in the category.

While electromobility is an important lever, it is not the only way in which cobalt supports the Fourth Industrial Revolution. 5G smartphones, in particular, are expected to take off next year, with up to 190 million devices being forecast to be shipped to China, according to IDC, making up 14% of smartphones imported.

That being said, this extraordinary demand growth is not reflected in current cobalt prices. Those prices are not sustainable, particularly given the recent earlier-than-expected closure of the Mutanda mine, the largest cobalt producer in the industry. This will take around 20% out of the global cobalt supply and it is important that this is replenished with responsible production. The news may provide a short-term price support as consumers, particularly those from the Chinese market, may turn to the spot market.

At any rate, cobalt will continue to be a valuable contributor to the Fourth Industrial Revolution and, sourced responsibly, can be instrumental in unlocking the tremendous potential of the global battery sector.

BENEDIKT SOBOTKA is CEO of Eurasian Resources Group and co-chair of the World Economic Forum Global Battery Alliance. ERG is one of the world’s leading mining and smelting groups.

Comments

Derick Frere

Good analysis, thank you Benedikt; however it’s a shame the Cobalt Institute in London isn’t on the front foot promoting the value and benefit of cobalt. We have some correspondence which indicates that the Cobalt Institute don’t see the promotion of cobalt as part of their remit!

At the end of the day perception is all important and cobalt has certainly been muddied by all the problems in the DRC which is definitely leading to some end users questioning its long term viability.

Particularly if premium brands like BMW/Apple/VW etc. are prepared to invest in clean green cobalt from non-DRC sources then consumers should be made aware of their efforts so that these companies are rewarded in the value cycle.

The mechanism for doing this could be as simple as a prominent sticker or badge on the product proclaiming (green) “Cobalt Inside” much in the way that Intel have been so successful with their “Intel Inside” campaign on laptops.

This would provide valuable reassurance of the quality and sustainability of the batteries which would otherwise be seen by consumers as a “black box” of indeterminate origin and quality.