Canada’s lithium is in Quebec

While battling the biggest wildfire in its history for most of 2023, la belle province is ramping up mining of its key minerals required to manufacture electric vehicle batteries. Quebec plans to become a leader in the critical strategic minerals mining sector and a leader in the electric vehicle battery manufacturing sector for the North American automotive industry.

In its plan for the development of critical and strategic minerals 2020-25, the province identified four policy pillars to promote the development of critical strategic minerals to encourage investment in the province, meet the growing demand for these mineral resources, and play an active role in the global energy transition.

Last year, the government of Canada announced its “critical minerals strategy” in which lithium is listed as one of six top critical minerals due to its importance in the clean technology sector, in particular the manufacturing of rechargeable batteries for hybrid and electric vehicles

The federal and provincial governments are planning to make Quebec a North American leader in supplying the metals that will support the global green transition. Quebec is a highly attractive investment destination for lithium production because of its supportive resource development sector, access to skilled labour, and its proximity to high-growth electric vehicle markets in North America and Europe.

However, as Quebec prepares to supply the world’s needs for several critical minerals including gold, the province is already holding leading spots in Canada for gold, copper, graphite, nickel, and now lithium, and with development projects covering 30 commodities, what happens in Quebec does not remain in Quebec, but it impacts the global mining world.

Mining companies that are making progress in developing lithium mining projects in Quebec this year include Vancouver-based Arbor Metals with a lithium mining project in the James Bay region of Quebec. At the biginning of this year, Australia-based mining company, Allkem, through its subsidiary, Galaxy Lithium, received federal government approval for the construction of a lithium mine in the James Bay area, too. The spodumene operation would include an open pit mine and concentrator facility, tailings, waste rock, ore, and overburden storage areas, as well as related infrastructure. It is expected to produce an average of 5,480 tonnes of ore per day over a mine life of 15 to 20 years.

“This is an important decision for Canada. The James Bay lithium mine project will produce a key ingredient of clean technology like electric vehicle batteries and solar panels,” said Canada’s Minister of Natural Resources, Jonathan Wilkinson. The James Bay project has been subject to a thorough review process conducted by a Joint Assessment Committee consisting of representatives from the Impact Assessment Agency of Canada (IAAC) and the Cree Nation Government. Based on the environmental assessment report, the Minister of Environment and Climate Change, the Honourable Steven Guilbeault, has determined that the project’s environmental mitigation measures provide a sustainable path for the project to proceed.

Also, earlier this summer, Nemaska Lithium, a Quebec-based mining company, signed an 11-year deal to supply a maximum of 13,000 tonnes of lithium hydroxide annually to Ford to be used in the automaker’s electric car batteries. Prior to that, Ford said it will create a battery pack manufacturing wing at its Oakville manufacturing complex. A press release by Lisa Drake, Ford’s vice-president of EV Industrialization, stated that the Nemaska Lithium project will be a sustainable source of lithium, supporting Ford’s ability to scale, making EVs more accessible and affordable to millions of customers.

Nemaska says it will produce lithium ore from its Whabouchi mine in the James Bay region of northern Quebec starting in 2025. The ore will then be converted into lithium hydroxide at Nemaska’s Bécancour conversion facility when it opens the following year.

Additionally, North American lithium producer, Sayona Mining, and Piedmont Lithium have restarted commercial spodumene concentrate production at their jointly owned North American Lithium (NAL) project in Quebec’s Abitibi-Témiscamingue region at the end of last March. As part of the deals signed with LG Chem and Tesla earlier this year, NAL’s minority partner Piemont will provide 200,000 tonnes of spodumene concentrate to LG Chem over four years (50,000 tonnes per year). Piemont will supply 125,000 metric tonnes of spodumene concentrate to Tesla starting in late 2023 until 2025. NAL is currently the only active producer of lithium concentrate in Canada.

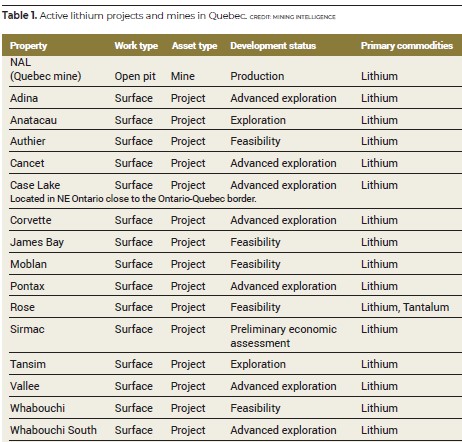

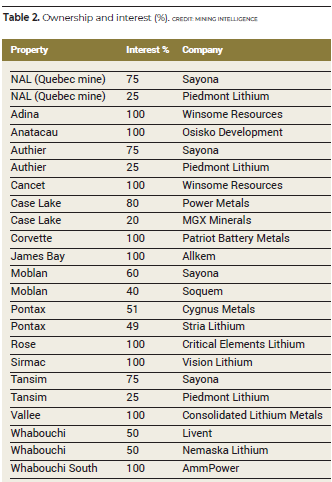

Table 1 lists all active lithium projects and mines in Quebec currently while Table 2 lists the ownership and interest percentage for these projects.

Updates on some projects

North American Lithium (NAL)

Canada Lithium began construction of the mine in 2011 and some production activities in 2012. At the time, the company anticipated reaching full production capacity in 2014. In February 2014, RB Energy acquired the mine site assets but, due to financial difficulties, had to stop production in October 2014. Jien International acquired the company in June 2016 and resumed mine activities in the winter of 2017. NAL operation was acquired by Sayona Quebec in August 2021 and is jointly owned by Sayona Quebec, a subsidiary of Sayona Mining (75%), and Piedmont Lithium (25%).

concentrator. CREDIT: BUSINESS WIRE

In March 2023, Sayona announced the successful restart of production at NAL. The restart was achieved both on time and on budget, marking a major milestone as the largest source of hard rock lithium production in North America.

Forming the key part of Sayona’s Abitibi hub along with the nearby Authier lithium project, the restored NAL operation, together with Sayona’s emerging northern hub, is now considered North America’s largest spodumene resource base.

NAL comprises 19 contiguous claims covering 582.31 ha. and one mining lease, covering approximately 700 ha. It is situated in La Corne township in Quebec’s Abitibi-Témiscamingue region. The project lies 60 km north of the city of Val d’Or, a major mining service centre, and in proximity to Sayona’s Authier lithium project.

Sayona plans to combine ores produced from Authier and NAL to facilitate a significant improvement in plant performance and economics and transform both operations.

All NAL’s power is from clean and green hydroelectricity, while it is well serviced by provincial highways and an all-weather secondary road.

In August 2023, Sayona announced the first shipment of NAL spodumene concentrate to the international lithium market, marking a major milestone and paving the way for the first revenues within two years of NAL’s acquisition.

Sayona’s Authier, Tansim, and Moblan lithium projects

Authier, Tansim, and Moblan lithium projects are also parts of the Abitibi hub, especially Authier. From Table 1, we can see that Tansim is at the exploration stage while both Authier and Moblan are at the feasibilityy stage. Sayona is the major interest owner in all three projects, as seen from Table 2.

Sayona Mining acquired 100% of the Authier project in July 2016. In April 2023, Sayona announced a definitive feasibility study to produce spodumene concentrate, combining its North American Lithium operation with the Authier project.

Sayona’s Authier lithium project is a hard rock spodumene lithium deposit set to play a key role in the Company’s planned multi-project Abitibi lithium hub, as a source of supplementary ore for processing at NAL. Following the acquisition of the NAL mine and concentrator in August 2021, the Authier project’s operating strategy was revised to include only mining operations and waste and water management on-site.

The project is set to become a supplier of ore to Sayona’s nearby North American Lithium operation, which has an established concentrator, thereby minimizing the need for mining infrastructure and related environmental impacts at Authier.

As for NAL, the project has a huge near-term development potential, access to world-class infrastructure and labour, economical hydroelectric power, and its strategic location near North American battery markets.

The Authier project is situated 45 kilometres northwest of the city of Val d’Or, a major mining service centre in Quebec. Val d’Or is located approximately 466 kilometres north-east of Montreal. The project is easily accessed by a rural road network connecting to a national highway a few kilometres east of the project site.

In October 2021, Sayona completed the acquisition of the Moblan lithium project in a joint venture with Soquem, a wholly owned subsidiary of Investissement Quebec.

Moblan is in the Eeyou-Istchee James Bay region of northern Quebec, a proven lithium mining region which hosts established, world-class lithium resources including the Whabouchi mine. It is also well-serviced by key infrastructure and transport and has access to low-cost, environmentally friendly hydropower.

Finally, Tansim lithium project is situated 82 km south-west of the Authier lithium project. Tansim comprises 355 mineral claims spanning 20,546 hectares and is prospective for lithium, tantalum, and beryllium.

Sayona is also targeting the Viau-Dallaire prospect, highlighting the potential for the development of a new lithium deposit.

Adina lithium project

The Adina lithium project was mapped in 2016, with a successful maiden drilling campaign completed in 2018. The initial drilling returned several well-mineralized, albeit narrow intervals of mineralization, warranting additional field prospecting and mapping.

Since then, further drilling has delivered some impressive results, including 1.34% Li2O over 107.6 m from 2.3 m to 109.9 m, including 30 metres grading 2.21% 2 from 41 metres.

The total strike length of the lithium mineralized trend at Adina was initially over 3 km, with mineralization remaining open to both the east and west of reported intercepts. The recent discovery of the new Footwall Zone at Adina also opens the potential for multiple parallel zones below the main bodies.

The Perth-headquartered lithium explorer and developer, Winsome Resources, held an option to acquire the adjacent Jackpot property to the north, which could increase the Adina project area by 50%, opening further exploration targets and providing flexibility in site layout and infrastructure as development progresses. Last June, Winsome Resources announced the signing of an option agreement to expand its Adina lithium project in Quebec to 44 km2, a 50% increase. “With Adina moving into a development phase later this year, taking an option on attractive terms over the Jackpot property is a strategic move to not only give us access to further exploration upside around Adina but also flexibility in future design of site layout and infrastructure footprints,” said Winsome managing director Chris Evans.

The agreement would allow Winsome to acquire the 29 claims in the bordering Jackpot property and expand its total tenure in the James Bay area to more than 871.5 km2. The Adina project also offers a co-development opportunity with Cancet, as Winsome Resources’ portfolio includes four other projects in Quebec: Cancet and Sirmac-Clappier in the James Bay region, and Decelles and Mazarac near Val d’Or.

Cancet project

Winsome Resources’ Cancet project is at an advanced exploration stage, with extensive drilling and metallurgical test work ongoing. Cancet is comprised of 395 claims, for a total area of more than 20,000 Ha, and is located 155 km East of Radisson, within a favourable geological setting. Surface stripping of the main spodumene pegmatite body at Cancet revealed visible large spodumene crystals, providing a good indication of the structural geology of the at-surface pegmatite body. Exploration results, to date, show an extremely high recovery at a course crush size is achievable at Cancet. Additional targets have also been identified to the west and east, with the potential to significantly increase lithium tonnage.

Pontax lithium project

The Pontax lithium project is situated within the prolific lithium region of the James Bay region in northern Quebec, Canada. The project (145 km2) is host to numerous spodumene bearing pegmatite swarms with the only explored swarm being Central Pontax which outcrops over 620m of strike and remains open along strike and at depth.

Allkem’s James Bay

Located approximately 10 km south of the Eastmain River and the Cree Nation of Eastmain community and 100 km east from James Bay, the James Bay lithium mine project is in the Nord-du-Québec administrative region in the Eeyou-Istchee James Bay territory. The lands of the project are easily accessed by road. The project is well-serviced by key infrastructure including Hydro-Québec power, which provides a low-cost, clean energy source for approximately 45% of site power needs. The project is also located adjacent to the Billy Diamond Highway, which connects it to major roads and railways in the region.

CREDIT: GALAXY RESOURCES

The town of Matagami is located approximately four hours south of James Bay and connects it to the Canadian National Railway network, which allows future production to be railed to various locations in North America or ports along the Saint-Lawrence River for international shipment.

Allkem is proposing to develop the James Bay project as a sustainable, hard-rock operation, maximizing the usage of renewable energy and utilizing spodumene expertise gained from its successful Australian operation, Mt Cattlin. The strategy for development is to advance the upstream mine and concentrator operation whilst simultaneously investigating downstream options.

The 2021 feasibility study and maiden ore reserve detailed an average annual production of 321,000 t/y of 5.6% Li2O spodumene concentrate with a 19-year mine life.

Nemaska’s Whabouchi mine

Also located in the Eeyou-Istchee James Bay territory in Nord-du-Québec, the Whabouchi mine is one of the largest high-purity lithium deposits in North America and Europe. The project is the world’s second richest and biggest deposit with 27.3 million tonnes of proven and probable reserves. Whabouchi will be a long-life, high-tonnage hard-rock lithium mining operation. The reserves estimate a mine life of 33 years, which could be extended further through existing resources. The project includes the operation of an open pit and underground mine, a waste and tailings impoundment area, an ore concentrator, administrative and maintenance buildings. The mine would have a production capacity of approximately 3,000 tonnes per day over the estimated mine life. The mine is partially built and will continue to be constructed at the right time to bring online with the conversion facility. It has access along an all-weather road and uses hydroelectric power to power the entire site. The site is also easily accessed by the Nemiscau airport, 18 km west of Whabouchi.

Corvette lithium project

Corvette property is located in the Eeyou-Istchee James Bay region of Quebec and has great proximity to regional road and powerline infrastructure. As shown in Table 2, the property is 100% owned by Patriot Battery Metals, which is a hard-rock lithium exploration company focused on advancing this property. The Corvette property hosts the CV5 Spodumene Pegmatite with a maiden inferred mineral resource estimate1 of 109.2 million tonnes at 1.42% Li2O and ranks as the largest lithium pegmatite resource in the Americas based on contained lithium carbonate equivalent (LCE). It is also considered one of the top

10 largest lithium pegmatite resources in the world. Additionally, the Corvette property hosts multiple other spodumene pegmatite clusters that remain to be drill tested, as well as more than 20 km of prospective trend to be assessed.

Comments

FF Tools Pro Tech

Great insights on Quebec’s lithium potential! It’s exciting to see Canada positioning itself as a key player in the global lithium market. I believe this could lead to significant opportunities for both the economy and green energy initiatives. Looking forward to more updates on this topic!