Canada’s edge in the race to decarbonization

Rio Tinto’s BC Works operation in Kitimat, B.C., includes a recently modernized aluminum smelter (pictured), powered by hydroelectricity. Credit: Rio Tinto

Canada has a diverse, vibrant mining industry, but is also a global leader in establishing greenhouse gas (GHG) emissions reduction targets backed up with a federal carbon tax – although provinces may implement independent regimes, provided they broadly comply with the federal scope.

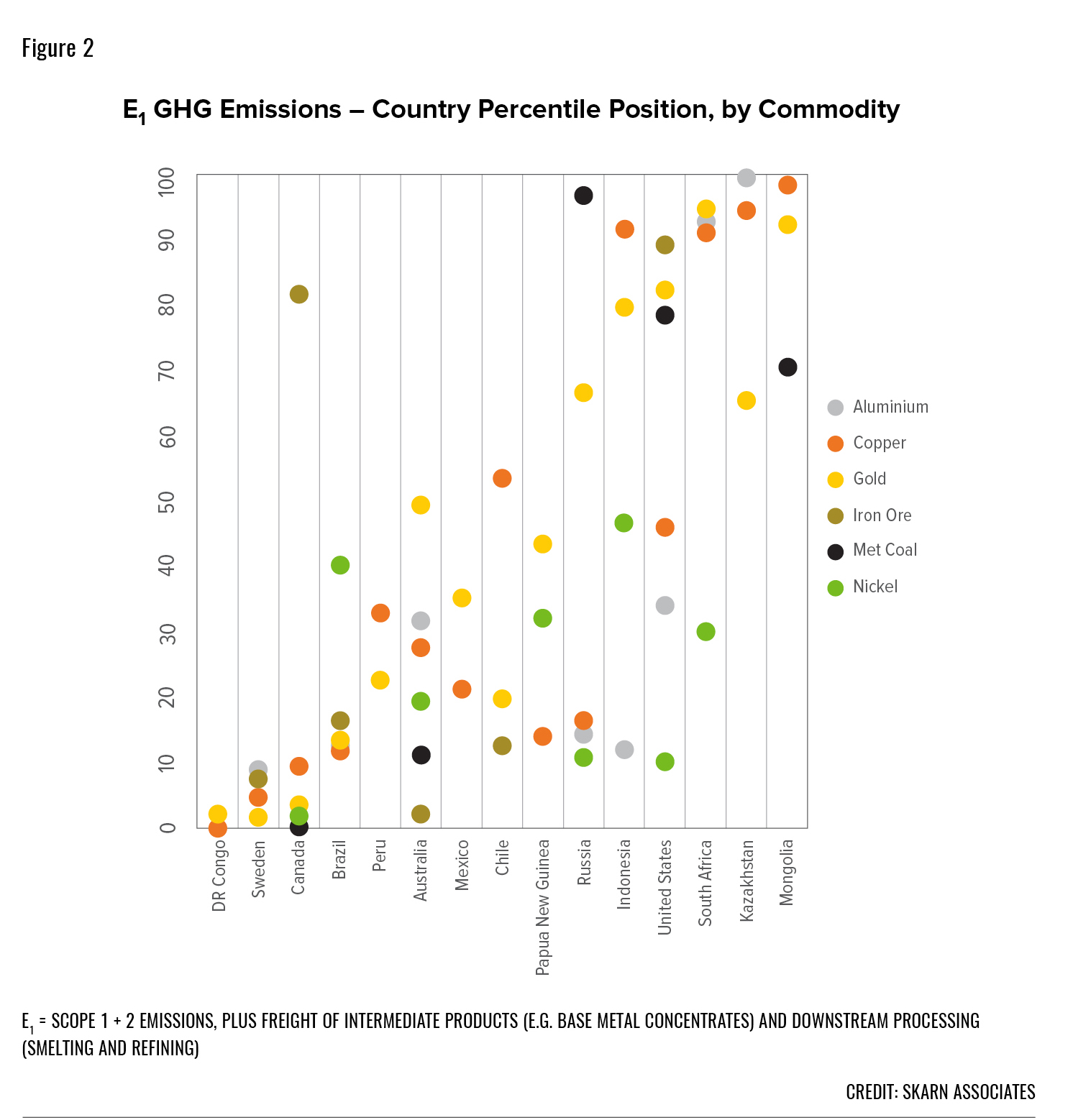

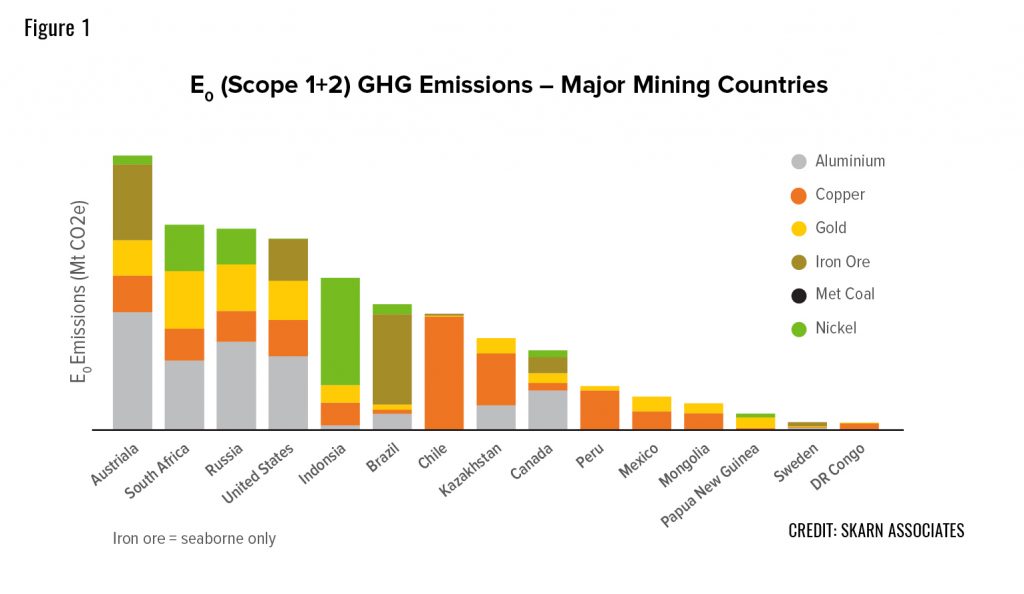

This juxtaposition of a prominent mining sector and GHG reduction leadership places Canada in an interesting position, which is highlighted by Skarn Associates’ research. We quantify mining sector energy use and carbon emissions intensity on an asset-by-asset basis globally, currently covering iron ore, copper, nickel, gold, metallurgical coal and aluminum (including bauxite and alumina). When this data is aggregated into country totals and averages, a picture emerges of each country’s competitive position with regard to GHG emissions. Figure 1 shows total E0 for the major mining countries split by commodity; E0 is Skarn’s proprietary mine site Scope 1 (combustibles used on site) and Scope 2 (purchased energy) GHG metric.

This simple graph reveals some interesting facts. Canada’s total carbon emissions from the five commodities are substantially lower than Australia, the United States, Russia, South Africa, Indonesia, Chile and Brazil. Figure 2, which shows each country’s percentile position on Skarn’s E1 GHG intensity curve for each commodity, reveals yet more.

Canada’s relatively low emissions volumes are facilitated by low emissions intensity; on aggregate, the country’s copper, nickel, gold and metallurgical coal mines rank in the lowest decile of their respective global emissions curves.

There are multiple reasons for this. Hydroelectricity is a key factor, reducing Canada’s Scope 2 emissions to negligible levels, a massive competitive advantage relative to countries with predominantly coal-fired power grids such as South Africa or Indonesia. The other major advantage Canada has is the high quality of many orebodies. The Sudbury and Manitoba nickel mines, for instance, achieve low GHG intensities by virtue of their high grades and the energy efficiency of the sulphide smelting and refining process, in comparison say, to the laterite nickel-ferronickel or HPAL (high-pressure acid leaching) processes used in Indonesia.

While the orebody quality advantage is likely to remain a long-term strength, Canada’s edge in Scope 2 emissions is already eroding, as the roll-out of renewable energy globally begins to accelerate, slowly levelling the playing field. It seems likely therefore that in the next 10 years, the competitive effort will shift from decarbonization of grid power to reduction of mine site Scope 1 emissions, which will require significant investment by miners in zero carbon mobile equipment fleets. That pressure to reduce Scope 1 emissions will be greatly amplified by Canada’s ambitious carbon taxation plans.

Carbon taxation – amplifying the pressure to decarbonize

The federal carbon tax in Canada is set under the federal Greenhouse Gas Pollution Pricing Act (GGPPA) which includes a federal fuel charge paid by fuel producers, distributors and certain prescribed users and an output-based pricing system (OBPS) requiring large emitters who emit 50,000 t/y or more of GHGs to meet emissions intensity standards by reducing their emissions, remitting for retirement surplus carbon or offset credits and/or paying a carbon tax on excess emissions. The tax is scheduled to increase by $10/y until it hits $50/t in 2023. At the end of 2020, the federal government announced that the carbon tax will increase from $30 per tonne of GHG emissions to $170/t in 2030, a rise of some 467% over 10 years, although this has yet to be passed into law. If implemented, the new law will increase the carbon tax by $15/t per year starting in 2023 until it hits $170/t.

The GGPPA only applies if a province or territory does not have its own carbon pricing scheme or industrial emissions regulations that meet federal benchmarks. If a provincial carbon pricing scheme is deemed equivalent, then the federal carbon tax on fuels does not apply in that province. Provinces and territories without a carbon pricing scheme for fuels or industrial emissions deemed equivalent are subject to the federal carbon tax on fuels and the OBPS. Provinces with carbon taxes on fuels will have to match the federal increases in 2023 to 2030 or else their carbon taxes may no longer be deemed equivalent.

Both emission and offset credits can be used under GGPPA for compliance purposes. The increases in the federal carbon tax can therefore be expected to result in similar increases in the market prices of carbon and offset credits, which may increase the development of renewable energy and emission reduction projects as developers may receive greater revenues from the sale of credits and offsets from their projects.

However, Alberta, Ontario and Saskatchewan have brought court cases challenging the constitutionality of GGPPA, with the appellate courts in Ontario and Saskatchewan ruling it is constitutional under the “peace, order and good governance” power of the federal government. The Alberta Court of Appeal, on the other hand, found GGPPA was not within the federal government’s constitutional power. All three provincial court challenges have been appealed to the Supreme Court and were heard together in September 2020. At press time in late March, the Supreme Court issued a ruling upholding the federal carbon tax.

British Columbia introduced a carbon tax in 2008, which is the highest not just in Canada, but in North America. The provincial government increased the tax from $35/t to $40/t in April 2019 and it is due to rise to $45/t in April, moving to the federal target of $50/t after that as it aims to reduce the province’s GHG emissions by 40% by 2030. Alberta charges $30/t from facilities that emit more than 100,000 t/y of GHG while Quebec has had a cap-and-trade system since 2013 with the minimum price for credits in 2020 being about $21/t. The federal backstop applies in Ontario.

Mining companies’ GHG reduction plans become more ambitious

Vale’s 2019 review of its climate goals established the aim of becoming carbon neutral, with a 33% Scope 1 and 2 emissions reduction target by 2030, using 2017 (14.1 million tonnes) as a baseline. Key factors to reach these goals include the adoption of carbon pricing for capital projects, achieving self-sufficiency in renewable energy and to electrify and replace diesel consumption in mining and transportation activities. It aims to invest around US$2 billion in renewable energy over the next 10 years.

Mining giant Glencore aims for a 40% reduction of its Scope 1, 2 and 3 emissions by 2035 on 2019 levels, and net zero by 2050. In Canada, it is rolling out new technologies in its mining operations. Its Onaping Depth deep nickel mine development has been designed to use battery electric mobile equipment, innovative ventilation technology and energy efficient cooling systems, and to maximize real-time remote operation to eliminate diesel emissions. Battery electric vehicles with zero emissions are expected to play an increasingly important role in its underground operations.

Rio Tinto’s Alcan aluminium smelter at Kitimat in British Columbia underwent a four-year $6-billion modernization in 2016 to ensure it has one of the lowest carbon footprints in the world. The smelter now employs AP40 smelter technology, which is more energy efficient using 13kWh/t of aluminium compared to 18.5 to 20kWh/t previously.

Teck Resources aims to reduce the carbon intensity of its operations by 33% by 2030 and accelerate the adoption of zero-emissions alternatives for transportation by displacing the equivalent of 1,000 internal combustion engine vehicles by 2025.

Canada’s largest gold miner Agnico Eagle, reported direct and indirect GHG emissions of 520,832 tonnes in 2019, an increase of 27% from 2018 attributed to the opening of the Meliadine mine in Nunavut. The mine accounts for 21% of Agnico’s emissions due to a lack of grid power which necessitates the use of diesel power generation. The company’s recent acquisition of TMAC Resources and its Hope Bay mine in Nunavut could provide opportunities to further reduce its CO2 footprint through optimizing seaborne freight logistics as well as extending road and grid infrastructure into the region in the longer term. Agnico is pursuing a wind farm project at Meliadine and supports infrastructure development initiatives to bring hydroelectricity from northern Manitoba to the Kivalliq region in Nunavut.

Canadian Malartic emitted 1.5 million tonnes of GHG in 2019 compared to 1.6 million tonnes in 2018. With mining operations transitioning from an open pit to underground, emissions are set to fall significantly with the partners (Agnico Eagle and Yamana Gold) claiming the Odyssey underground development will be a state-of-the-art electric mine. An automated fleet of battery electric 60-tonne trucks will be operated from surface, with on-demand ventilation.

Other examples of Canadian miners making investments to reduce emissions include Kirkland Lake Gold, which was an early adopter in using use BEVs underground, and Pretium Resources, which invested $141.4 million to build a 57-km transmission line to connect its Brucejack gold mine development to the hydropower grid in B.C.

All of the above is just the beginning of the mining industry’s fascinating journey into decarbonization. We expect Canada to maintain its position in the vanguard.

Mark Fellows is a cofounder of Skarn Associates (www.skarnassociates.com) and Paul Harris is an editorial consultant.

Comments