Assessing the next move to succeed beyond COVID-19

Veteran executives of Canadian mining and metals companies have seen many adversities through their careers, including extreme market volatility and long cyclical troughs. Together with global peers, they have also witnessed many healthcare (Ebola, H1N1), political (wars, organized crime) and weather crises.

The industry started off 2020 on a high note. Base metals visible inventories were trending down while prices were trending up. The electric vehicle revolution was accelerating, driving macro factors supportive for battery metals. Even capital markets were starting to show renewed interest in the sector. But the COVID-19 pandemic has radically changed the once promising outlook.

Despite the resiliency of this group, COVID-19 is causing a whole new playbook of operating and cashflow challenges – especially at a time when many balance sheets were already under strain.

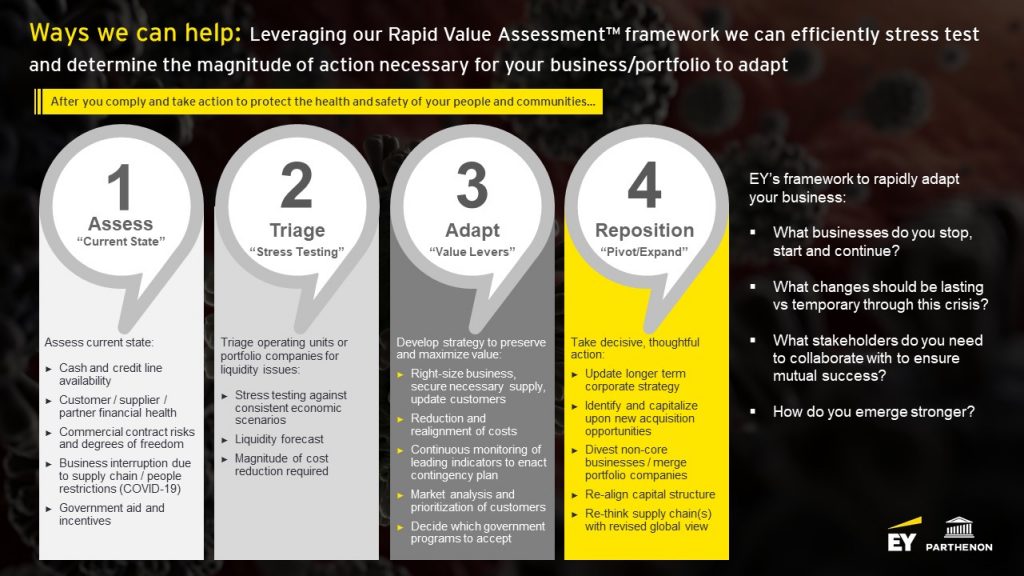

After the initial burst of energy focused on compliance, employee health and safety, and stakeholder communication, mining companies are starting to shift to the “next” phase. Logical next steps for the executive team are outlined in the EY Rapid Value Assessment framework (exhibit one) to assess the current state, stress test the impact of several scenarios on various operations, adapt value levers to make necessary moves on the core business and reposition to emerge as a strong business.

Given the multitude of metal exposures and operating jurisdictions, there’s no single prescription for all Canadian executives to follow. However, several actions have emerged through our discussions with mining and metals executives:

1. Leverage government incentives: Understand what is available and worth taking. Get involved in discussions that are shaping programs directly affecting your business.

2. Take proactive actions on liquidity and debt: Develop clear scenarios for the duration of operational shutdown, metal prices, currencies and input costs to forecast cash levels and covenant compliance week-by-week to better determine the level of:

a. Management actions to take to reduce cash outflow (exploration, growth capex, working capital inventory levels, dividends and discretionary expenses).

b. Engagement of lenders in dialogue on covenant relief or refinancing and increasing working capital lines and consider creating or increasing stream financing.

c. Hedging actions to lock in low energy costs, currency rates and in some cases collars or another form of hedging metal prices if required to avoid distress.

d. Proactively put themselves in play or file Companies’ Creditors Arrangement Act (CCAA) to be prudent and keep control of what could rapidly become a downward spiralling situation.

3. Review portfolios: Identify assets that consume cash and management attention yet have limited long-term strategic value, and either sell or find the right partners to take them on. These could be exploration assets, but this also applies to prefeasibility or feasibility projects that no longer fit the owner’s profile or infrastructure that could be sold with a lower cost of capital.

4. Align on how to deploy excess capital: For some fortunate miners – such as select gold producers – the combination of record high gold prices in most local currencies, all-time low oil costs and cheap borrowing costs may create debate between stakeholders on how to deploy excess capital or balance sheet capacity. Companies need to proactively establish a set of priorities and criteria for capital deployment that balances capital required, potential return and risk. Having a strong alignment across the business and stakeholders can reduce angst and lead to more strategic long-term decisions.

While these considerations may not be applied directly by every business, they’re a good touchstone to maintain perspective when regrouping or prioritizing activities. A sharp eye and an agile mindset will be essential to working through these and coming out on top on the other side of COVID-19.

Jon Wojnicki is a partner and Canadian co-leader of the EY-Parthenon practice of Ernst & Young LLP. He’s based in Toronto. For more insights, visit ey.com/en_ca/covid-19.

Comments