Update on top critical mining projects in Ontario

The surging demand for electric vehicles (EVs) is breathing new life into Ontario’s mining industry. Several critical strategic mineral mines will produce the minerals required to manufacture EV batteries and renewable energy storage for the North American market.

The following are the top critical strategic minerals’ (CSM) mining projects in the development phase:

Canada Nickel: Crawford nickel sulphide project

Canada Nickel is a Toronto-based company that is advancing the next generation of net-zero carbon nickel-cobalt projects with plans to supply the critical mineral to Canada’s EV battery industry. The company’s Crawford nickel sulphide project is the second largest nickel resource and reserve globally, with 3.8 million tonnes of proven and probable nickel contained. The project is expected to be the third largest nickel sulphide operation globally with an annual production of 48,000 t/y nickel, 800 t/y cobalt, 1.6 million t/y iron, and 76,000 t/y chrome during its peak 27-year period, and a total of 1.6 million tonnes of nickel over the project’s 41-year lifespan.

Located in the Timmins Nickel District and covering 900 km2, the project will be a large scale, open pit, bulk tonnage, nickel sulphide operation with the potential for zero carbon production. Canada Nickel’s feasibility study (FS), completed in Nov. 2023, showed that the project has a $3.5 billion after-tax net present value (NPV) (8%), an internal rate of return (IRR) of 17%, increasing to $3.69 billion after-tax NPV (8%), an IRR of 18%, and an initial capital expenditure of $2.70 billion.

The FS also showed that over the project’s lifecycle, it is projected to generate more than $89 billion in revenue, $9.93 billion in federal and provincial income tax, and $3.69 billion in provincial mining taxes, from a total investment of $9.65 billion.

Canada Nickel received $4.38 million from the Critical Minerals Infrastructure Fund which will support pre-implementation studies for electrical infrastructure. The company also invested $35 million in 2024 to unlock the Timmins Nickel District and demonstrate its potential to be one of the world’s largest nickel sulphide districts. The company filed its environmental impact statement (EIS) in Nov. 2024 and expects to receive its permits in 2025 and to make a construction decision in 2025 leading to first production expected by year-end 2027.

Frontier Lithium: PAK lithium project

Frontier Lithium is a Canadian pre-production company positioning itself to become a strategic supplier of battery-grade lithium hydroxide.

The company is developing its PAK lithium project, which contains one of North America’s highest-grade, large-tonnage, hard-rock lithium resources in the form of a rare low-iron spodumene and ranks as the second largest lithium deposit in Ontario by size. In March 2024, Frontier Lithium announced a joint venture with Mitsubishi Corporation to develop a fully integrated lithium mining and processing operation.

Located in the Great Lakes Region and covering 270 km2, the PAK project will develop a fully integrated lithium mining and processing operation featuring two primary deposit areas: the PAK deposit and the Spark deposit. The proposed mine site will include two open pits, rock storage areas, a concentrator plant complex, and associated infrastructure. The project has a mine life of 24 years and an expected production of 23,174 t/y of lithium hydroxide monohydrate.

The project has received a total of $6.1 million from the Critical Minerals Infrastructure Fund for a mine access road and power transmission line infrastructure (two investments for two projects). The project has the potential to become North America’s lowest-cost lithium chemical production facility.

In 2023, Frontier Lithium conducted a pre-FS which showed that its PAK lithium project will deliver a post-tax NPV (8%) of $2.2 billion, a post-tax IRR of 24.1%, with a capital expenditure of $608 million for phase 1 (the mill and mine) and $749 million for phase 2 (the refinery).

All environmental baseline studies for the mine and mill were completed in Nov. 2024, with final reports expected over the next couple of months. The company continues exploration drilling, regional mapping, and technical de-risking of the integrated flowsheet.

International Lithium: Raleigh Lake lithium project

International Lithium Corp. (ILC) is a Canadian lithium exploration company that acquires and advances lithium properties and critical mineral projects.

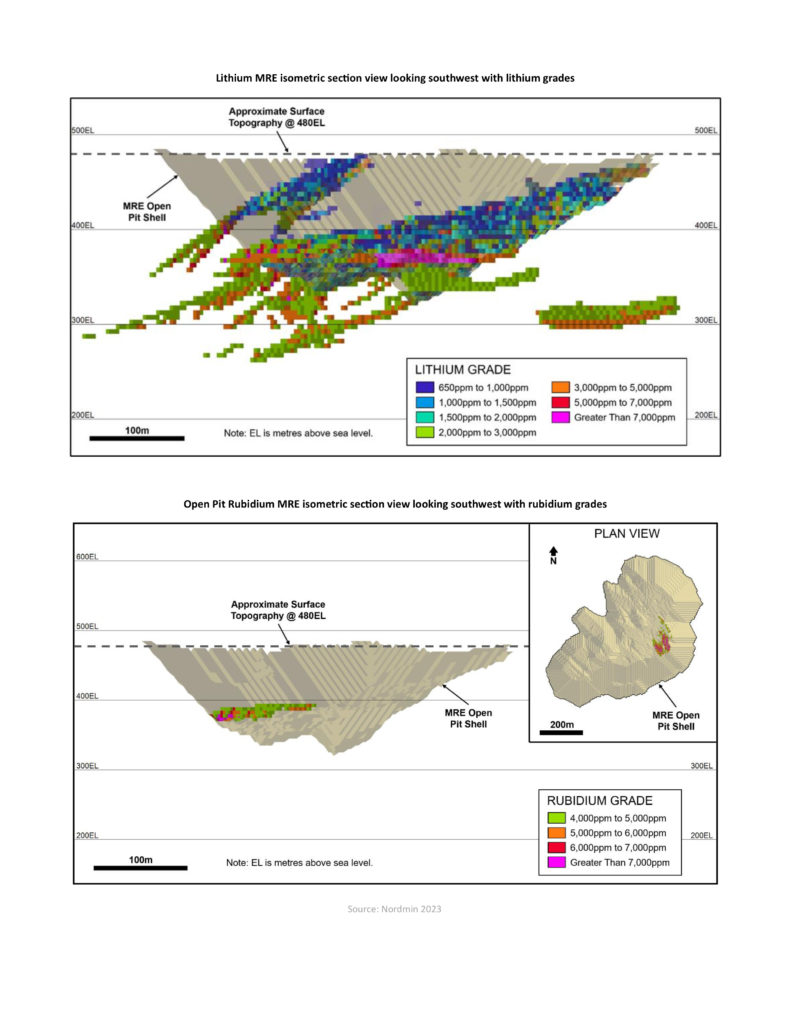

The company’s Raleigh Lake project is a relatively small lithium deposit consisting of spodumene. The project is unique in that it contains a significant and highly concentrated rubidium deposit within but separate from the lithium deposit in the mineral microcline. The resource estimate for the lithium in spodumene is approximately six million tonnes at 0.6% Li2O or 600,000 tonnes of spodumene concentrate.

Located 25 km west of Ignace, the project consists of a proposed open pit mining operation, with a mine life of nine years and an expected production rate of 56,000 t/y of spodumene concentrate. The mining of the spodumene will eventually unearth the self-contained rubidium deposit consisting of approximately 1,400 tonnes of Rb2O.

The results of the preliminary economic assessment (PEA) reported in Dec. 2023 that the project had a post-tax NPV (8%) of $342.9 million, a post-tax IRR of 44.3%, and a capital expenditure of $111.9 million. The PEA was based solely on the production of spodumene concentrate and does not consider the economics of the rubidium deposit.

Currently, ILC is moving forward with its FS. Phase 1 metallurgical test work proved lithium recoveries were above 81%. Phase 2 metallurgical test work will consist of collecting a bulk sample and optimizing the results as determined in Phase 1.

ILC says because there is no large capital investment required for infrastructure development for the project, much of the work generally required for an FS does not need to be conducted for this project. However, the company has made an application to convert its mining claims into mining leases, and it has begun the baseline environmental work required for the submission of a mining permit application.

According to ILC, the lithium market will factor in any decisions regarding production at the Raleigh Lake project. The project can be fast tracked to production owing to its location within existing infrastructure. Once a decision to proceed with production is made, the mine will take approximately two years to fully permit and construct. If a decision was made in 2025 to proceed, production would commence in 2027 or 2028.

Northern Graphite: Bissett Creek project

Northern Graphite is a Canadian junior mining company engaged in the production, exploration, and development of mineral resource properties. The company is focused on producing natural graphite and upgrading it into high-value products including anode material for lithium batteries and EVs, fuel cells, and graphene.

Northern Graphite’s goal is to become an integrated, mine-to-battery producer of graphite by expanding production at its existing mine, bringing a second mine onstream in 2026, and advancing two large scale projects towards development while also developing down-stream capacity to produce anode material for lithium batteries and EVs.

Northern Graphite is the only significant producer of natural graphite in North America and its Bissett Creek graphite project is the only graphite project in the province. Graphite is the largest component of lithium batteries used in EVs. Once in production, Bissett Creek will be a main supplier of graphite to Northern Graphite’s planned battery anode material plant in Baie-Comeau, Que. The plant, located with easy access to North America’s gigafactory belt, will process graphite from the company’s mines into 200,000 t/y of battery anode material, enough to supply four 50 gigawatt gigafactories, and build 2.5 million lithium batteries.

Located between North Bay and Ottawa, the project will be built as a staged, two-phase development that is synced to market demand, and will have a mine life of 23 years. The project has 1.2 million tonnes of graphite in measured and implied resources, initial production will be 44,000 t/y in phase 1, with a capital expenditure of $155 million.

Northern Graphite completed its FS, and all permits are expected to be received, pending funding, in 2025. The company expects to make a construction decision sometime in 2025, with a construction start date of 2026 and first production anticipated in 2027.

Rock Tech Lithium: Georgia Lake lithium project

Rock Tech Lithium is another Canadian mining company that develops lithium properties. The company’s focus is to develop and optimize battery-grade lithium hydroxide monohydrate with a goal to create a closed-loop lithium production system.

The mining and processing operation of Rock Tech’s Georgia Lake lithium project will produce 6% lithium concentrate for a planned lithium hydroxide converter in Red Rock. The operation will use a combination of open pit and underground mining over five deposits, with mineral processing that involves crushing, dense media separation, and flotation.

The project is located 160 km northeast of Thunder Bay. The project covers 67.28 km2 and will include open pit mining, underground mining, a concentrator, a water treatment plant and a tailings storage facility. The project has a mine life of nine years and an expected production rate of one million t/y of lithium concentrate.

The results of Rock Tech’s pre-FS completed in Nov. 2022 demonstrated mineral reserves totaling 7.33 million tonnes at an average grade of 0.82% Li2O and a recovery rate of 80%, a post-tax NPV (8%) of $190 million, a post-tax IRR of 35.6%, and total capital expenditures of $378 million.

The project was awarded conditional approval of funding for up to $1.4 million under the Critical Minerals Infrastructure Fund for its Fairloch Lake access road project, which involves constructing a new 10-kilometre access route from the TransCanada Highway to Rock Tech’s Georgia Lake Mine.

Rock Tech has plans for a drilling program across its six deposits, including its newly discovered East Conway. The primary goal of this program is to expand the overall mineral resource, upgrade the resource classification to measured and indicated, and integrate the findings into a future definitive feasibility study (DFS).

The company is working on further engineering and permitting activities for this project which is required to progress to the next stage and prepare for eventual construction and operation.

Rock Tech expects to decide on this project by the end of 2025. If approved, construction of the project is expected to occur between 2025 and 2027, with first production anticipated in 2028, in line with its planned converter commissioning.

Tartisan Nickel: Kenbridge nickel project

One last Canadian exploration and development mining company in this report is Tartisan Nickel Corp., which is also focused on mining battery metals.

The company’s flagship project is its wholly owned Kenbridge nickel project. Totaling 42,73 km2, it is located in the Kenora Mining District in the northwestern corner of Ontario. The project is focused on nickel, copper, and cobalt.

The results of Tartisan’s PEA, dated July 2022, were based on an underground operation. With an initial nine year mine life and operating at 1,500 t/d, it would use conventional processes to produce a nickel/copper concentrate. The measured, indicated, and inferred mineral resource estimate to date, both potentially open pit and underground mining potential totals, are 146 million lb of nickel, 78 million lb of copper, and two million lb of cobalt. The expected capital expenditure is $134 million.

Tartisan’s 2025 drilling program expects to bring one million tonnes of inferred nickel at 1% into the indicated category as well as test significant geophysical anomalies indicated from the 2021-2022 drilling program results. The company also plans to drill deeper below the 900-metre level.

A magnetotellurics (MT) mobile airborne survey is scheduled to be flown over the Kenbridge nickel project in May 2025. The results of this survey should promote additional drilling targets and a better overall understanding of the newly acquired land. Tartisan anticipates a post-2025 drilling update to the mineral resource estimation (MRE) which should improve overall project economics and mine life. Environmental metallurgical work should be completed by spring 2025.

Diane L.M. Cook is a freelance mining writer.

Comments