Fundraising by junior, intermediate miners hit lowest since 2019: S&P

Funds raised by junior and intermediate mining companies dropped by 12% in 2024 to US$10.27 billion, its lowest in five years, according to data tracked by S&P Global. This is despite a 2% rise in the number of financings, which came in at 2,802 for the year.

On a month-to-month basis, the total value of fundraising is also trending down after setting a two-year high in October 2024. In December, funds raised by miners fell 21% to US$890 million, following a near 30% decrease in November.

The number of significant deals -- namely those valued at over US$2 million -- also decreased by nine to 66 in December.

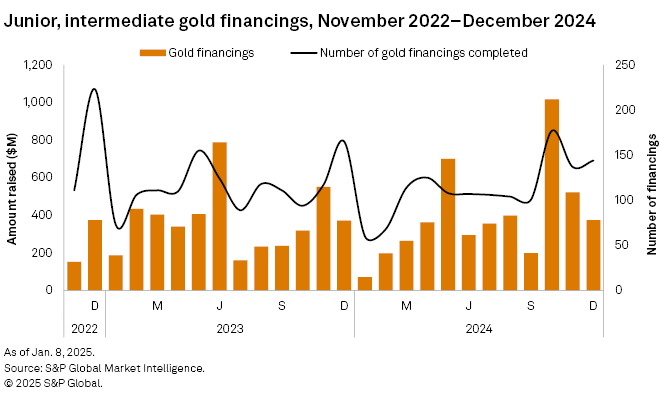

The back-to-back monthly decrease is largely reflected by gold juniors and intermediates raising less funds over that period.

In December, gold financings declined 28% to US$375 million, despite an uptick in the number of transactions (144 versus 137 in November), S&P data showed. This is because of a fewer number of significant deals (from 36 to 29), which dragged down the December totals.

The largest and only big financing (over US$50 million) was the A$220 million placement of ordinary shares by Spartan Resources for its Dalgaranga gold project in Western Australia. This was also the largest financing overall for the year.

Reduced funding for base and non-gold precious metals also contributed to the downtrend in financings.

Total fundraising in this group fell 45% in December to US$234 million due to lower financings in copper, nickel and silver, after reaching a seven-month high of US$428 million in November.

Like gold, there were fewer high-value financings, despite the number of transactions rising to a record high of 114 from 78 in November.

The sole big transaction, and the third-largest overall, was Osisko Metals' $72 million bought deal, part of a larger placement for gross proceeds of $107 million.

On the other hand, funds raised for specialty commodities jumped 63% to US$281 million in December, marking the highest total in eight months, S&P said.

Lithium financings increased for the third consecutive month to US$145 million, while funds raised for uranium increased for the fourth straight month to US$63 million. Graphite financings also rose significantly, reaching US$56 million.

The number of transactions grew to 88, up from 65 in November, and there were two big transactions valued at more than US$50 million in December, compared to none in November.

The largest transaction and the second-largest overall was the A$154 million follow-on equity offering by Vulcan Energy Resources. Proceeds are intended to fund the first phase of its Lionheart lithium project in Germany.

Comments