Greenstone the great

Why Equinox’s flagship is flourishing

From the start, Equinox Gold’s goals were ambitious:

To be a diversified, Americas-focused gold producer with more than one-million-oz. of gold per year. Equinox president and CEO Greg Smith said Equinox wanted to “grow quickly and the only way to do that is through acquisition and developing assets as we go along.”

Is there a particular ratio of acquisition to asset development that Equinox aims at in balancing that approach? Not really, Equinox president and CEO Greg Smith replied. The key is to pay attention to your portfolio.

Smith said Equinox wanted to “grow quickly and the only way to do that is through acquisition and developing assets as we go along.”

With completion of four mine builds and a string of acquisitions since 2018, Equinox Gold’s production base is now eight mines across Canada, the United States, Mexico, and Brazil.

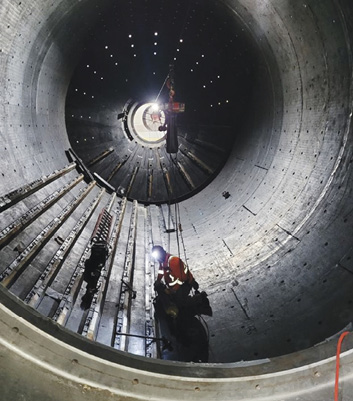

What might be called the crown jewel is the company’s Greenstone gold mine 275 km northeast of Thunder Bay, Ont. This is Equinox’s flagship asset and largest, lowest-cost gold producer. Equinox acquired a 60% interest in the project in April 2021, commenced construction in October 2021 in partnership with Orion Mine Finance, and in May 2024 acquired Orion’s 40% interest to consolidate 100% ownership of the mine into Equinox. In the same month, the Vancouver headquartered company poured first gold at the mine, with an inaugural pour of 1,800 oz of gold from the full recovery circuit.

Smith describes himself as “very, very pleased with the pace at which we were able to build one of the largest mines in Canada.” He attributes Greenstone’s successful development to “having permits, good community and Indigenous support and advanced engineering already in place. That helped immensely.”

Today, Greenstone is key to Equinox’s growth strategy, with the expectation of achieving 400,000 oz. of production per year once the mine is ramped up to capacity.

“Generally operating assets trade at a better valuation than developing assets. If you have too much in your portfolio in development and not enough in production, you’re going to trade at a lower valuation and have a higher capital cost which makes it more of a challenge to grow,” he said.

It was for this reason Smith admits “to kind of getting beat up a little bit by the market for a few years while we were building Greenstone.” There are lots of things that can beat you up, of course: schedule and budget overruns, price fluctuation, and capital constraints to mention only a few.

“You’re taking a bet on geology and that your ore deposit’s going to deliver what you think it will, and you’re right about price so that we’re not completely exposed to price changes,” said Smith.

Equinox managed to achieve production at Greenstone on budget and on schedule, and hopes to do the same thing during its expansion gold mining operations: Castle Mountain Phase 2 operations will complement the current operation in California, the company said, increasing production “to more than 200,000 oz. of gold per year.” The new Piaba underground and satellite open pit “will nearly double” the Aurizona mine life in Brazil. Constructing a carbon-in-leach plant to process higher grade ore “would extend the Mexican Los Filos mine life by four years and add more than 1 million oz. of gold production.”

So many reasons to build

Greenstone encompasses the former Hardrock, Macleod-Cockshutt, and Mosher underground mines which produced more than 2 million oz. between the late 1930s and 1970. Site rehabilitation began in the 1990s with Equinox eventually proposing a 15-year life of mine.

Today with proven and probable reserves of 5.5. million oz. at an average grade of 1.27 g/t, the first five years at Greenstone are expected to produce 400,000 oz. per year with an average of 360,000 oz. of gold per year for its initial 14-year mine life.

The property is replete with advantages, said Smith, not the least of which is the mine’s presence in northern Ontario “and one of the top mining jurisdictions in the world.”

“It was accessible to the TransCanada Highway, so it had very easy logistics and access to energy infrastructure, massively important permits in place, and a team that had been working on this project for a long time.” The property ticked off every box, Smith noted.

For all this, no one at Equinox expected entirely seamless progress towards mine completion. This was evident by the company’s 14% contingency budget which was much larger than had been anticipated in the project’s feasibility study. “It was based on the inflation data we were seeing and in part on a gut feel,” said Smith.

The gut feel materialized with the unexpected arrival of Covid and of inflation which had an immediate impact on the project’s supply chain. But Smith’s team was ready, he said. Pre-construction activities, long lead ordering, and detailed engineering “completed long before we had even started construction were incredibly helpful achieving the schedule and budget we eventually built the mine on.”

Smith reserves some of his highest praise for one particular addition to the Greenstone operation – the high-pressure grinding rolls (HPGR) as part of the crushing circuit. Studies show HPGRs “enhance fracturing of the material” which may allow for “improved solution penetration once it’s in the tanks,” said Smith.

In effect the HPGRs “take the place of a semi-autogenous grinding (SAG) mill. “But really the big benefit is our material is more amenable to going through the recovery circuit and the HPGRs draw a lot less power than a SAG mill on a much smaller footprint so it makes more economic sense.”

Too big, too fast?

One question surrounds both the size and development pace of one of Canada’s largest open pit gold mines.

Noted Smith, small mines often take as much managerial effort and focus as large mines. Another deciding factor is often the very short mine life of many gold operations. Hence the need for assets with scale, Smith said, plus sufficient mine life and exploration growth potential to weather the multiple phases the commodities cycle is subject to.

“As a public company a large portfolio and scale increases liquidity, increases the multiples that you trade at, and decreases your cost of capital going forward,” Smith said. “We are an industry that’s always hungry for capital, so having that scale gives you greater access to capital and attracts larger investors.”

Equinox hopes to reap an average 400,000 oz. annually for the first five years, and 360,000 oz. annually over the 14-year mine life. Smith says at Greenstone, Equinox expects “a little bit of a dip” in the grade profile of the deposit mid-mine life before picking up again.

Of particular interest to investors will be what’s underfoot at Greenstone. According to Equinox’s analysis the mine’s underground deposit hosts 9.8 million tonnes at 3.93 g/t gold (1.2 million oz. indicated) and 35.6 million tonnes at 3.87 g/t gold (3.1 million ox. inferred).

“We’re also looking at a large land package with satellite deposits that have existing resources on them.” This includes 700,000 oz. of gold potentially within trucking distance to the Greenstone plant, the Brookbank project with an undeveloped high-grade gold deposit, and a 396 km2 underexplored land package “with excellent potential for new discoveries.”

“We’re looking at ways those can feed into the mine life,” said Smith. “And the underground deposit already is north of 4 million oz. That can contribute to the mine life as well.”

Staying strategic

One thing Equinox does not suffer from, Smith said, is the boom and bust mindset some companies get caught up in, i.e. getting carried away with investments when business is looking good, slashing and burning when things go sideways.

Smith stressed a management team has prepared for the good times and bad times, “and built a company that navigates through both phases.”

“We built this company through acquisitions but we’ve always done them in a very targeted fashion. The market environment really didn’t play into our valuation of our acquisitions. It was much more strategic than that, he said.

In addition to striving to be a profitable, million-ounce-per-year producer, Smith added, we do it in a sociably responsible manner. That’s because along with growth comes social responsibilities. A case in point is the population centre in the town of Geraldton where environmental concerns and local economics are always top of mind.

Hence, the need for agreements and support from the local First Nation communities early on in Greenstone’s development. Those relationships eventually blossomed into 24 joint venture agreements with First Nations representing more than $180 million (e.g., 20% of the project’s contracted value).

Equinox’s local commitments were enough to persuade Doug Ford, Premier of Ontario, to visit the Greenstone mine in June to witness a gold pour. There, he outlined nearly $4 million that will be used to underwrite Equinox’s social commitments in the area including training and skills development to support local construction contracting.

With four mine builds and a string of acquisitions since 2018, Equinox Gold’s production base is now eight mines across Canada, the United States, Mexico, and Brazil.

David Godkin is a freelance writer.

Comments